Infineon Technologies (IFX.DE) enters the next three years with a steadier top line and a busier roadmap. Trailing‑twelve‑month revenue stands at 14.64B with profit margins under pressure, and quarterly revenue growth barely positive at 0.10%. Against this backdrop, management moved to deepen its automotive stack by agreeing to acquire Marvell’s automotive Ethernet unit for $2.5B, a bolt‑on that targets in‑vehicle networking alongside Infineon’s power and microcontroller strengths. The shares have been volatile, trading between a 52‑week high of 39.43 and low of 23.17, and most recently closing near 31.27. Brokers highlighted a “Strong Buy” stance in August, while the balance sheet shows moderate leverage and solid liquidity. This note outlines how execution, margins, and auto demand could shape IFX.DE’s share price through September 2028.

Key Points as of September 2025

- Revenue: TTM revenue is 14.64B; quarterly revenue growth (yoy) sits at 0.10%.

- Profit/Margins: Profit margin 4.78%; operating margin 11.45%; gross profit 6.0B; EBITDA 4.36B.

- Earnings: Net income (TTM) 1.12B; diluted EPS 0.95; quarterly earnings growth (yoy) −24.30%.

- Cash & Leverage: Total cash 1.54B; total debt 5.37B; current ratio 1.77; debt/equity 32.14%.

- Sales/Backlog: Revenue per share 11.27; backlog not disclosed here, with exposure centered on auto and industrial semis.

- Share price: Last close (Sep 4, 2025) ~31.27; 52‑week high 39.43, low 23.17; 50‑DMA 36.06; 200‑DMA 33.75; beta 1.60.

- Analyst view: Brokerages cited a “Strong Buy” rating in August 2025 (ETF Daily News).

- Dividend & ownership: Forward dividend 0.35 (1.11% yield); payout ratio 36.84%; ex‑dividend 2/21/2025; institutions hold 54.80% of float.

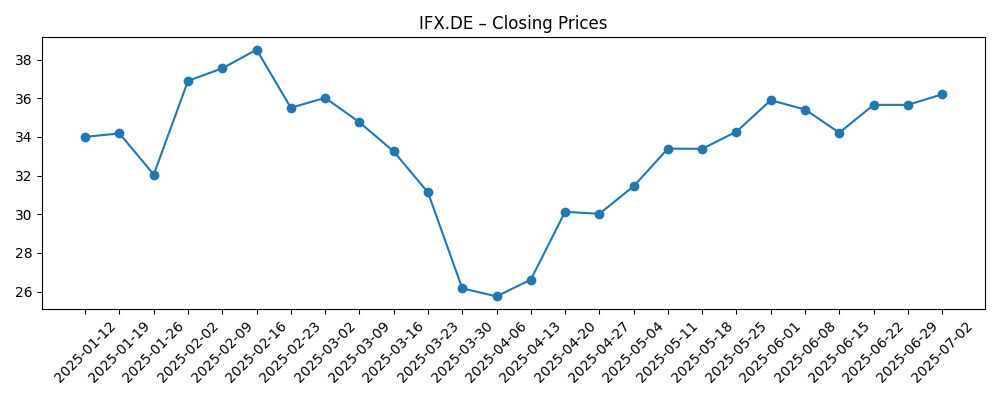

Share price evolution – last 12 months

Notable headlines

- Infineon buys Marvell's auto ethernet unit for $2.5B

- Infineon Technologies AG (OTCMKTS:IFNNY) Given Consensus Rating of “Strong Buy” by Brokerages

- Current Sensor Market Company Evaluation Report 2025: Infineon Technologies highlighted for R&D and strategic moves

Opinion

The announced plan to acquire Marvell’s automotive Ethernet unit for $2.5B is strategically consistent: Infineon already leads in power semiconductors and automotive microcontrollers, and in‑vehicle networking is the connective tissue that ties sensors, zonal controllers, and power domains together. If closed and integrated well, the assets could enhance platform stickiness across AURIX‑based systems and expand content per vehicle. The risk is execution: integrating new product lines while sustaining qualification cycles with major OEMs and Tier‑1s can stretch R&D and sales bandwidth. Near term, the transaction can weigh on free cash flow as integration and alignment costs are absorbed. Longer term, success would likely support pricing power and mix uplift—drivers that matter more in a volume‑sluggish auto cycle. Watch for product roadmap disclosures, cross‑selling milestones, and customer wins as leading indicators of synergy capture.

Shares have traced a volatile path over the past six months, rallying into mid‑February (weekly close ~38.51 on Feb 16), sliding to a late‑March trough (~26.17 on Mar 30), recovering toward mid‑July highs (~38.12 on Jul 13), and easing back to ~31.27 by Sep 4. The 50‑day moving average at 36.06 sits above the 200‑day at 33.75, but momentum has softened as price dipped below the 50‑DMA. In our view, the 30–33 zone is a tactical area to test buyers, while 36–39 marks resistance until earnings revisions stabilize. Beta at 1.60 implies outsized swings versus indices, so macro risk and sector rotations will amplify moves. Technically, a sustained reclaim of the 50‑DMA with rising volume would signal accumulation; conversely, repeated failures near the 200‑DMA would keep a retest of the high‑20s in play.

Fundamentals show stabilization, not acceleration. TTM revenue is 14.64B, but quarterly earnings growth (yoy) is −24.30%, reflecting cyclical pressure and mix. Profit margin of 4.78% alongside operating margin of 11.45% leaves limited room for shocks, yet the EBITDA base (4.36B) and gross profit (6.0B) indicate operating scale once utilization normalizes. Cash of 1.54B and debt of 5.37B are manageable with a 1.77 current ratio and 32.14% debt/equity, while operating cash flow of 2.91B and levered free cash flow of 966.25M support investment and a measured return to shareholders. The forward dividend of 0.35 (1.11% yield) with a 36.84% payout provides flexibility; sustained dividend growth will require firmer margins. EPS of 0.95 and net income of 1.12B set a low base from which operating leverage can re‑emerge if auto and industrial demand thaw through 2026–2027.

Our base case sees steady demand in automotive power, microcontrollers, and sensing offsetting softness in consumer and portions of industrial, with the Marvell auto Ethernet assets, if closed, adding optionality rather than wholesale growth in year one. The institutional ownership base (54.80%) should provide some sponsorship if execution hits milestones, but estimate momentum will likely drive valuation. Key proof points: cadence of design‑ins tied to zonal architectures, silicon carbide adoption curves, and evidence that gross margin can firm as factory loadings improve. Balance sheet metrics—especially current ratio and leverage—offer resilience to invest in R&D and capacity without straining returns. Over three years, we think a credible path to mix uplift and normalized margins can re‑rate the shares; failure to integrate or a prolonged auto downcycle would keep the stock range‑bound with a yield‑only profile.

What could happen in three years? (horizon September 2025+3)

| Scenario | Strategic execution | Revenue/mix | Margins | Balance sheet & cash | Valuation drivers |

|---|---|---|---|---|---|

| Best | Auto Ethernet integration completes smoothly; cross‑selling across power, MCU, and networking wins major platforms. | Auto content per vehicle rises; industrial stabilizes; mix skews toward higher‑value platforms. | Gross and operating margins expand on utilization and pricing; earnings growth re‑accelerates. | Solid operating cash flow funds R&D and selective capacity; dividend growth resumes. | Multiple re‑rates as visibility improves; stock breaks out of the 36–39 ceiling. |

| Base | Integration is orderly but gradual; design‑in momentum steady with a 12–24 month revenue lag. | Balanced growth in auto and industrial offsets weaker consumer; incremental mix improvement. | Margins normalize modestly with cost discipline; earnings track sector average. | Cash generation covers investment and dividend; leverage stable. | Valuation tracks peers; shares oscillate around long‑term averages. |

| Worse | Integration delays or customer churn; slower uptake of new networking products. | Auto demand softens; industrial destocking persists; mix shifts to lower‑margin products. | Margins compress on pricing and loadings; earnings revisions drift lower. | Lower free cash flow constrains investment pace; dividend growth pauses. | Multiple compresses; shares revisit prior lows and remain range‑bound. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Regulatory and closing timeline for the Marvell automotive Ethernet acquisition, plus integration milestones.

- Automotive demand trajectory (EV, ADAS, and zonal architectures) and Infineon’s design‑win cadence.

- Margin progression as factory utilization and pricing normalize across power, MCU, and sensing lines.

- Capital allocation balance between R&D, capacity, M&A, and dividends amid cash and leverage constraints.

- Macro and sector rotations affecting high‑beta semis, including rate moves and China/EU industrial cycles.

Conclusion

Infineon enters this three‑year window with stable revenue but mixed earnings momentum, a volatile share price, and a strategically coherent push deeper into the car’s electronics fabric. The planned addition of automotive Ethernet capabilities, if executed well, can strengthen Infineon’s position as a systems supplier spanning power, compute, and connectivity. Financially, margins need to re‑normalize for the investment case to broaden beyond cyclic exposure; the existing EBITDA and gross profit base suggest that operating leverage can reappear as utilization and mix improve. Liquidity and leverage look manageable, supporting continued R&D and measured shareholder returns. Near term, the stock is likely to trade on revisions and deal updates; medium term, proof of cross‑selling and design‑in momentum could justify a higher multiple. Investors should watch technical levels (50‑ and 200‑DMA), integration progress, and margin inflection as the key signals into September 2028.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.