Allianz SE (ALV.DE) enters the next three years from a position of balance-sheet strength and steady profitability. On trailing revenue of 109.02B and net income of 10.07B, the group posts an 11.05% operating margin and 18.18% return on equity, supported by 36.77B in operating cash flow. Shares are up 23.86% over 52 weeks and recently changed hands near 351.4, below the 52-week high of 380.30, with beta at 0.98. Investors also weigh a forward dividend of 15.4 (4.38% yield) against a 59.05% payout ratio. With total cash of 132.17B versus 36.88B of debt and a 1.63 current ratio, Allianz retains ample flexibility through the cycle. This note outlines a three-year outlook to September 2028, focusing on earnings durability, dividend sustainability, and the share price path under different macro and underwriting scenarios.

Key Points as of September 2025

- Revenue: 109.02B (ttm); revenue per share 282.58; quarterly revenue growth 0.00% year over year.

- Profitability: Net income 10.07B (ttm), profit margin 9.36%, operating margin 11.05%; ROE 18.18%, ROA 0.99%.

- Cash, liquidity and leverage: Total cash 132.17B; current ratio 1.63; total debt 36.88B; debt/equity 60.95%.

- Cash flow and dividend: Operating cash flow 36.77B; levered free cash flow 4.99B; forward dividend 15.4 (4.38% yield); payout ratio 59.05%.

- Sales/backlog: No formal backlog metric for insurers; gross profit 24.98B; quarterly earnings growth 13.10% yoy.

- Share price: Last weekly close 351.4 (2025-09-05); 52-week range 280.80–380.30; 50-day MA 353.87; 200-day MA 336.46; beta 0.98.

- Market cap: About 135.5B, based on latest close and 385.55M shares outstanding.

- Investor focus: Dividend sustainability, underwriting discipline, investment income and asset-management flows; average 3-month volume 542.18k.

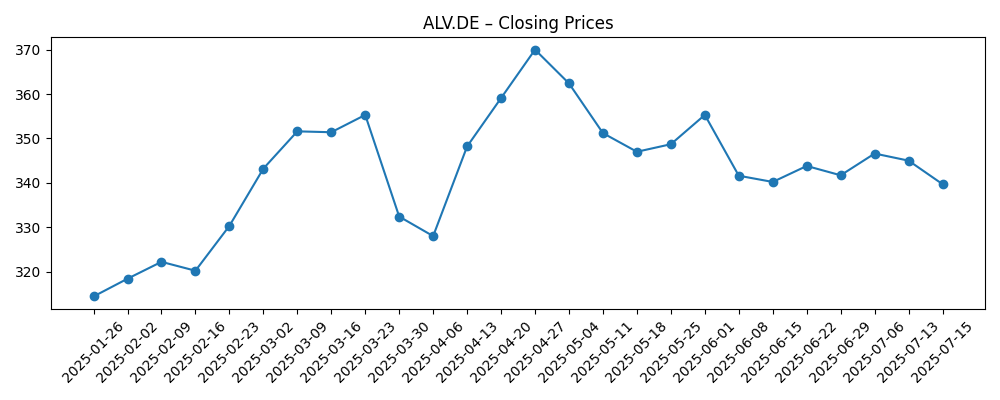

Share price evolution – last 12 months

Notable headlines

Opinion

Allianz’s near-term investment case rests on the interplay between underwriting stability and investment income, both of which have supported an 18.18% ROE and 11.05% operating margin on 109.02B of trailing revenue. With 132.17B in cash against 36.88B in debt and a 1.63 current ratio, the balance sheet provides cushion if catastrophe losses or reserve adjustments bite. The 4.38% forward dividend yield, backed by a 59.05% payout, offers a tangible return while earnings compound. After a 23.86% 52-week gain, the share now sits around 351.4, below the 380.30 high, leaving room for upside if margins hold and investment returns remain supportive. In our view, a benign claims environment and disciplined pricing could translate into steady earnings growth without stretching the capital base.

Earnings dynamics look balanced. Quarterly revenue growth is flat at 0.00% year over year, but quarterly earnings growth of 13.10% suggests mix and margin tailwinds, helped by underwriting and investment results. Operating cash flow of 36.77B and levered free cash flow of 4.99B indicate capacity to fund dividends and selective reinvestment while maintaining financial flexibility. Gross profit of 24.98B and EBITDA of 16.59B underpin resilience across cycles. If rates stay supportive and reinsurance markets remain rational, Allianz should be able to defend margins near current levels. Conversely, a turn in the loss cycle, tighter reinsurance, or lower reinvestment yields would pressure spreads, making cost discipline and portfolio optimization more important to keep ROE near today’s level.

Technically, the stock trades above its 200-day moving average of 336.46 and near the 50-day at 353.87, consolidating after touching the 52-week high of 380.30. Average trading volume (542.18k over three months; 469.64k over ten days) and a 0.98 beta point to near-market volatility, which can help income-focused investors reinvest dividends on pullbacks. Recent weekly closes show bouts of momentum (late April to mid-May and early August) followed by consolidation, typical for large-cap financials. Provided fundamentals hold, a gradual stair-step pattern is plausible, with setbacks likely around ex-dividend dates and macro risk events. If fundamentals weaken, those same levels could fail, and the share might revert closer to longer-term averages.

The dividend remains a central pillar. With a 15.4 forward rate and 59.05% payout, distribution sustainability appears reasonable against 26.07 in trailing EPS and robust operating cash generation. We would expect Allianz to prioritize dividend continuity through the cycle, with any incremental capital deployment calibrated to underwriting conditions and asset-management flows. Institutional ownership of 40.88% adds to the base of long-term holders seeking yield and stability. Key watchpoints into the next three years include large-loss seasonality, reserve development, and the interest-rate path, all of which feed directly into earnings and capital strength. On balance, the combination of stable operations, cash, and yield supports a constructive medium-term stance, tempered by the inherent cyclicality of insurance.

What could happen in three years? (horizon September 2025+3)

| Scenario | Implications |

|---|---|

| Best case | Benign catastrophe activity and disciplined pricing keep margins firm; investment income stays supportive; operating cash flow remains strong, enabling continued dividend growth while preserving a conservative balance sheet. |

| Base case | Normal loss years and steady markets; earnings grow modestly from a 109.02B revenue base; dividend remains the primary return lever with a disciplined payout policy; share price tracks fundamentals with bouts of consolidation. |

| Worse case | Severe catastrophe seasons and softer markets pressure margins and capital; reinvestment yields compress; management emphasizes risk reduction and reinsurance costs; dividend policy prioritizes sustainability over growth until conditions normalize. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Catastrophe losses and reinsurance pricing, affecting underwriting margins and capital.

- Interest-rate path and credit spreads, driving investment income and asset valuations.

- Regulatory and reserve developments, including capital requirements and audit reviews.

- Asset-management net flows and fee margins across market cycles.

- Currency movements between operating and reporting jurisdictions.

- Execution on cost discipline and technology investment to sustain efficiency.

Conclusion

Allianz begins the next phase with scale (109.02B in revenue), solid profitability (11.05% operating margin, 18.18% ROE), and abundant liquidity (132.17B cash). The stock’s 23.86% 52-week advance, current level near 351.4, and position above the 200-day moving average suggest investors already recognize the company’s resilience, yet uncertainty around catastrophes and rates remains. The forward dividend of 15.4 (4.38% yield) and a 59.05% payout ratio provide a durable income anchor, supported by 36.77B in operating cash flow and 4.99B in levered free cash flow. Over three years, we see a base case of steady operations, with dividends contributing a substantial portion of total return and price action likely to track fundamentals. Upside hinges on benign losses and firm pricing; downside risks center on large events and market stress, where Allianz’s balance sheet should help cushion impacts.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.