As of

Key Points as of September 2025

- Revenue: TTM revenue 408.62B; quarterly revenue growth (yoy) 9.60%; gross profit 190.74B.

- Profit/Margins: Profit margin 24.30%; operating margin 29.99%; diluted EPS (ttm) 6.59; ROE 149.81%; ROA 24.55%.

- Sales/Backlog: No formal backlog disclosed; demand visibility tied to iPhone cycle and installed base; quarterly earnings growth (yoy) 9.30%.

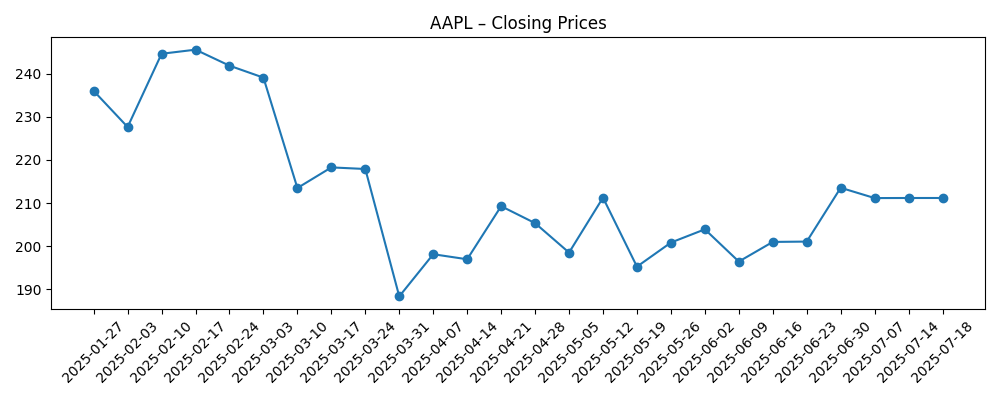

- Share price: Recent weekly close 239.69 on 2025‑09‑01; 52‑week high 260.10, low 169.21; 50‑day MA 218.41; 200‑day MA 221.40; beta 1.11; 52‑week change 8.50% vs S&P 18.47%.

- Analyst view: Recent coverage signals support ahead of the iPhone launch and sees growth momentum despite antitrust headwinds.

- Market cap: Approximately $3.56T (239.69 × 14.84B shares outstanding); float 14.81B.

- Balance sheet/cash flows: Total cash 55.37B; total debt 101.7B; current ratio 0.87; operating cash flow 108.56B; levered free cash flow 94.87B.

- Capital returns: Forward dividend yield 0.43% on a 1.04 rate; payout ratio 15.33%; ex‑div 2025‑08‑11; dividend date 2025‑08‑14; last split 4:1 on 2020‑08‑31.

- Ownership/short interest: Institutions 63.67%; insiders 1.97%; shares short 127.08M (2025‑08‑15); short ratio 2.08; short % of float 0.86%.

Share price evolution – last 12 months

Notable headlines

- Masimo Sues U.S. Customs and Border Patrol Over Apple Watch Blood Oxygen Ruling (Bloomberg Law)

- Warren Buffett’s Berkshire Hathaway offloads more AAPL shares (9to5Mac)

- Apple’s (AAPL) Growth Momentum Intact Despite Antitrust Headwinds (Yahoo)

- Apple Stock (AAPL) Backed by Analysts Ahead of iPhone Launch Event (Yahoo)

- Jim Cramer Says Reports Of Apple Inc. (AAPL)’s “Death” Are Overblown (Yahoo)

Opinion

Investor positioning is front and center after Berkshire Hathaway trimmed its AAPL stake. While high‑profile selling can weigh on sentiment, Apple’s low short interest (0.86% of float) and substantial free cash flow provide a backstop via ongoing buybacks and dividends. The 52‑week performance (+8.50%) trails the S&P 500, yet the stock’s regain above the 50– and 200–day moving averages suggests improving trend resilience into the product cycle. In our view, the Berkshire reduction is more a portfolio and tax‑management signal than a verdict on Apple’s core franchise. With institutions holding 63.67% and insiders at 1.97%, the shareholder base remains stable. The key for the next leg will be whether upcoming devices can re‑accelerate unit demand and spur services attach, which together could support multiple stability, if not modest expansion, from current levels.

Legal and regulatory headlines complicate the narrative, particularly the Watch‑related dispute highlighted by the Masimo action against U.S. Customs. For a company with 408.62B in TTM revenue and a 24.30% profit margin, product‑feature constraints are unlikely to be existential, but they can erode convenience, slow adoption in affected markets, and absorb management time. Beyond the Watch, antitrust attention to platform rules and payments continues to simmer, as reflected in recent coverage. The most probable near‑term outcome is iterative compliance changes rather than a sweeping model overhaul. Still, even modest concessions can dilute services monetization at the margin. We expect Apple to defend ecosystem cohesion while tailoring remedies region by region, aiming to preserve user experience and developer economics without inviting broader structural remedies.

On fundamentals, Apple’s 29.99% operating margin, 108.56B in operating cash flow, and 94.87B in levered free cash flow create ample room to invest through the cycle. Management can lean on silicon, AI‑enabled features, and tighter services integration to differentiate devices during a more selective consumer spend backdrop. The balance sheet—55.37B in cash versus 101.7B in debt and a 0.87 current ratio—encourages disciplined capital returns while prioritizing supply chain and product investments. We see incremental upside if new devices spark higher replacement rates and if services growth remains resilient despite policy shifts. Equally, a slower unit cadence would likely keep the multiple in check, putting more pressure on cost discipline to defend EPS growth.

Valuation framing is inevitably comparative: the stock has lagged the broader index over the past year but sits within range of its 52‑week high (260.10). Analyst commentary ahead of the iPhone launch is supportive, and sentiment has brightened as the price reclaimed key moving averages (50‑day 218.41; 200‑day 221.40). To break out decisively, investors will want evidence that device demand, services attachment, and on‑device intelligence features can add to both top line and margin. Conversely, renewed regulatory setbacks or a soft holiday cycle could re‑test support. Net‑net, we think the set‑up into the next several quarters is balanced: downside buffered by cash generation and capital returns, upside contingent on product‑led surprises and a manageable regulatory tape.

What could happen in three years? (horizon September 2025+3)

| Case | What it looks like by September 2028 | Share‑price tone | Key drivers |

|---|---|---|---|

| Best | Strong device refresh cycle anchored by compelling AI‑first features, resilient services momentum, and contained legal remedies that preserve ecosystem economics. | Outperforms the market; sustained new highs with a firmer multiple. | High user satisfaction, stable take‑rates, favorable court or settlement outcomes, efficient capital returns. |

| Base | Steady demand with mixed regional trends; services growth offsets modest device variability; regulatory changes are incremental and absorbed operationally. | Range‑bound to modestly positive; performance roughly in line with the market. | Execution on product roadmaps, selective price/promo, ongoing buybacks and dividends. |

| Worse | Muted device upgrades and tighter platform rules that pressure services monetization; prolonged product feature restrictions in wearables. | Underperforms; tests prior support levels with a compressed multiple. | Softer consumer spending, adverse legal rulings, heightened competitive intensity. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Product cycle strength: adoption of new iPhone and related devices, and the stickiness of AI‑enabled features across the ecosystem.

- Regulatory and legal outcomes: Watch‑related rulings and broader antitrust remedies that may alter platform rules or fees.

- Services durability: developer and policy shifts that affect App Store, payments, and content distribution economics.

- Capital allocation: pace of buybacks and dividend growth versus balance‑sheet flexibility (cash 55.37B; debt 101.7B).

- Macro and FX: consumer spending, regional demand, and supply chain stability impacting margins and cash flow.

Conclusion

Apple’s three‑year outlook balances proven cash generation with non‑trivial legal and competitive variables. The company’s 408.62B in TTM revenue, 99.28B in net income, and robust free cash flow (94.87B) give management several levers to defend and extend the franchise—through silicon leadership, AI‑forward software features, and deeper integration of devices and services. Recent headlines reinforce that sentiment can swing quickly: Berkshire’s trimming, supportive analyst notes, and regulatory noise pulled in opposite directions, yet the stock’s recovery above key moving averages suggests investors are giving the next product cycle the benefit of the doubt. We expect execution, not narrative, to decide the path from here. If upcoming launches lift unit demand and services attachment while legal outcomes remain manageable, upside is plausible. If demand cools or rules shift unfavorably, Apple’s capital returns are likely to cushion—but not eliminate—downside.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.