Apple heads into late 2025 with a fresh iPhone 17 cycle, mixed-but-stable early demand signals, and a steady services engine that continues to cushion hardware cyclicality. Trailing revenue of 408.62B and a 24.30% profit margin underscore robust unit economics even as investors debate the sustainability of premium device growth. What changed: sentiment reset after a volatile first half, then improved on reports of healthy lead times and steady preorders, albeit with differing analyst takes. Why it changed: a new product cycle coincided with on‑device AI marketing and renewed ecosystem pull from AirPods and services, while legal headlines reintroduced governance and regulatory questions. Why it matters: the stock narrative hinges on whether services monetization and an AI‑driven upgrade wave can offset a mature smartphone market and any regulatory friction. Sector context: across consumer tech, premium smartphone units are broadly mature, but ecosystem lock‑in and recurring services are expanding share of profit pools, setting up a “show‑me” few quarters for platform owners.

Key Points as of October 2025

- Revenue: trailing 12‑month revenue stands at 408.62B; quarterly revenue growth (yoy) is 9.60%.

- Profit/Margins: profit margin is 24.30% with a 29.99% operating margin (ttm), supporting strong cash generation.

- Sales/Backlog: Apple does not disclose backlog; third‑party checks show mixed iPhone 17 preorder tone (UBS) with stable lead times (JPMorgan).

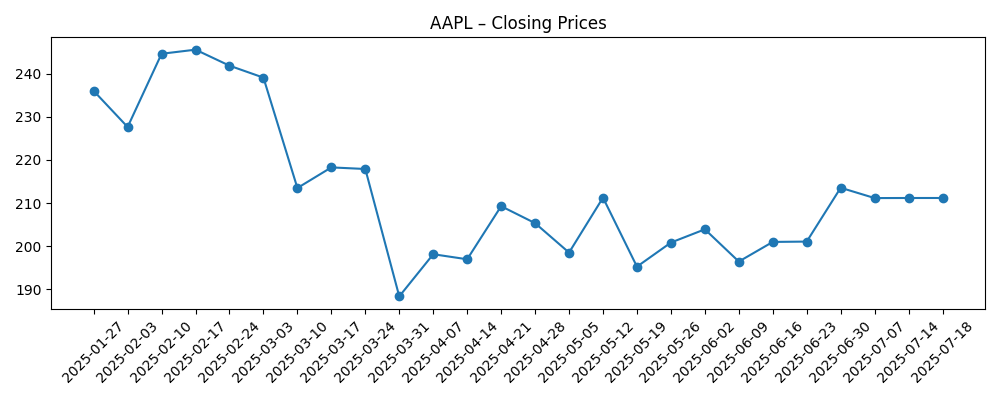

- Share price: 52‑week range is 169.21–260.10; recent close near 245.27 with 50‑ and 200‑day averages at 236.26 and 222.30.

- Analyst view: headlines split between cautious (“overly bullish” iPhone outlook) and constructive (stable lead times), indicating no consensus.

- Market cap: exact market value not disclosed here; shares outstanding are 14.84B.

- Ownership/positioning: short interest is low at 0.75% of float; institutions hold 63.60%.

- Dividend/Capital returns: forward dividend rate 1.04 (0.41% yield); payout ratio 15.33% leaves ample flexibility.

- Qualitative: ecosystem breadth (iPhone, AirPods, services) and brand strength underpin pricing power; legal actions and app‑store policy debates remain watch items.

Share price evolution – last 12 months

Notable headlines

- UBS Reiterates Neutral on Apple (AAPL), Sees Mixed iPhone 17 Preorder Demand

- JPMorgan Stays Bullish on Apple (AAPL) with Stable iPhone 17 Lead Times

- Analyst Says Apple’s (AAPL) Valuation Reflects “Overly Bullish” iPhone Outlook

- Apple (AAPL) Sees High Demand for Affordable iPhone 17

- Apple's new iPhone 17 is available. Will users upgrade devices?

- Apple Inc. (AAPL) Sued Over Workplace Discrimination

- AirPods Pro 3 earn spot on TIME’s Best Inventions of 2025 list

Opinion

The latest numbers show a company still leaning on enviable economics. Revenue growth in the high single digits and margins near 30% at the operating line suggest pricing discipline, efficient cost control, and mix support from services. The quality of the growth matters: services are generally higher‑margin than hardware, which helps protect profitability even if device units are choppy across regions. That mix, paired with low short interest, frames a market that expects resilience and is primed to debate the magnitude—not the existence—of cash generation through the cycle.

Near term, the iPhone 17 cycle is the central swing factor. Third‑party checks are not unanimous, with some calling preorders mixed and others flagging stable lead times. That split likely reflects model mix and geography rather than a simple up‑or‑down story. If on‑device AI features and ecosystem tie‑ins (e.g., accessories, services) are compelling enough to drive upgrades, revenue growth can stay supported; if not, investors will scrutinize elasticity and promotional intensity for clues about sustainability.

Over three years, Apple’s narrative in the hardware‑plus‑services stack will be shaped by how convincingly it converts device users into recurring services customers while refreshing flagship devices with tangible AI benefits. In a mature premium smartphone market, share gains are harder to win, so the battleground shifts to retention, average revenue per user, and attach rates for wearables and audio—areas where brand and platform consistency are advantages. Recognition for AirPods Pro underscores how accessories can amplify ecosystem pull.

Regulation and legal exposure remain the wildcards. Policy shifts around app distribution and payments could alter take‑rates or compliance costs, while employment‑related litigation adds governance scrutiny. Supply chain resilience and component cost trends will also influence gross margin optics. Together, these factors will inform how investors value Apple’s cash flows: a durable services narrative and credible AI road map could sustain a premium multiple; any signs of slowdown in upgrades or policy‑driven take‑rate pressure could compress it toward broader large‑cap tech averages.

What could happen in three years? (horizon October 2025+3)

| Scenario | Narrative |

|---|---|

| Best | On‑device AI features drive a multi‑year upgrade wave, services penetration deepens across the base, and accessories sustain halo effects. Regulatory changes are manageable, preserving platform economics. Margin structure stays healthy as supply chain efficiencies offset component inflation. |

| Base | Upgrade activity is steady but uneven across regions; services grow steadily with occasional policy headwinds. Hardware margins normalize but remain solid. The stock tracks fundamentals with intermittent volatility around product cycles and regulatory headlines. |

| Worse | Upgrade intent underwhelms, requiring heavier promotions; services growth slows due to policy changes. Legal or regulatory outcomes increase costs. Input cost pressures and competition erode margins, leading to a narrative reset and a lower valuation multiple. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Execution of the iPhone 17 cycle and the pace of upgrades to AI‑enabled devices.

- Services monetization trends and any changes to app‑store policies or take‑rates.

- Component costs, supply chain stability, and foreign‑exchange impacts on margins.

- Competitive intensity from Android flagships and wearables, including promotional activity.

- Regulatory and legal developments, including employment and consumer cases.

- Investor sentiment shifts tied to analyst checks on demand and lead times.

Conclusion

Apple’s three‑year setup rests on a familiar equation: defend premium hardware economics while expanding high‑margin services and leaning into an AI‑enabled upgrade story. Current metrics point to resilience—growth in the high single digits, healthy margins, and low short interest—yet the debate is about durability versus expectation. Mixed preorder commentary suggests the early innings of the iPhone 17 cycle are nuanced, with model mix and geography likely determining sell‑through quality. Regulatory and legal headlines add noise but do not, by themselves, redefine the thesis unless they translate into sustained take‑rate or cost changes. The multiple over the next few quarters will track evidence that Apple can turn AI marketing into tangible user benefits and higher attach across services and accessories. Watch next 1–2 quarters: iPhone 17 sell‑through vs. lead‑time checks; services engagement and policy updates; gross‑margin cadence as component costs and promotions evolve.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.