Unilever’s share price has lagged this year as the post‑inflation pricing cycle fades and volumes prove harder to reignite, while brand governance noise adds distraction. The company still generates steady cash and owns defensible household names, but investors are recalibrating expectations toward slower, more promotional growth. That reset is visible in a forward P/E of 15.31 and a dividend yield of 3.53%. The core question for the next few years is whether mix and innovation can replace price‑led gains without eroding margins. In European consumer staples, disinflation and retailer pushback are shifting bargaining power back toward private labels, demanding sharper execution at the shelf. For Unilever, stabilizing volumes, defending gross margin, and tidying portfolio controversies—such as recent tensions around Ben & Jerry’s—will likely shape the narrative more than any single quarter. The stock’s low beta and income support can buffer volatility, but operational proof points, not sentiment, should determine whether the multiple re‑rates.

Key Points as of October 2025

- Revenue – trailing 12 months: 59.77B; quarterly revenue growth (yoy): -3.20% (volume/mix detail not disclosed).

- Profit/Margins – profit margin: 9.29%; operating margin: 18.85%; gross profit (ttm): 26.38B indicates solid pricing/mix and cost control.

- Sales/Backlog – backlog not applicable in consumer staples; quarterly earnings growth (yoy): -5.10% underscores the shift from price‑led to volume‑led growth.

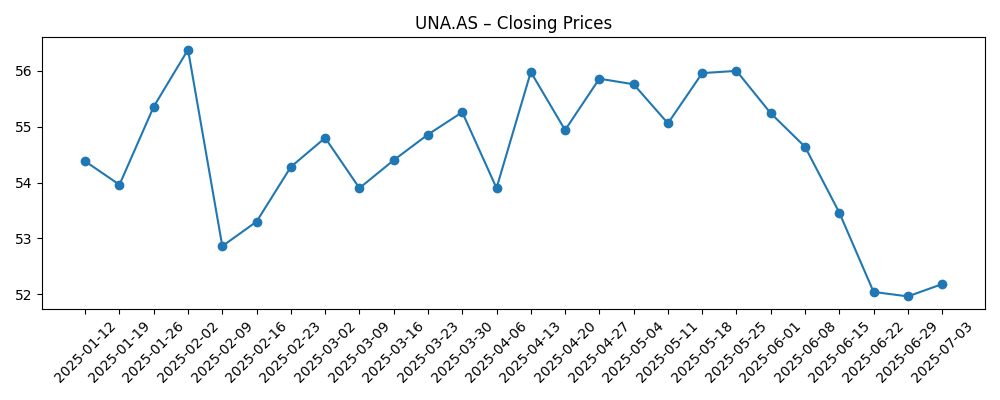

- Share price – 52‑week change: -11.09%; range: 49.87–58.66; 50‑day/200‑day moving averages: 52.49/53.81; low beta (0.25) dampens volatility.

- Analyst/Market view – forward P/E (price‑to‑earnings) 15.31 and PEG 1.68 imply expectations for moderate, quality‑of‑earnings growth rather than a rapid rebound.

- Market cap & valuation – market cap: 123.49B; EV/EBITDA: 13.00; EV/Revenue: 2.45; Price/Sales: 2.11; Price/Book: 6.97.

- Balance sheet & cash – total debt: 32.02B; debt/equity: 160.68%; current ratio: 0.76; operating cash flow (ttm): 8.44B; levered free cash flow: 5.47B; payout ratio: 79.68%.

- Qualitative – broad brand portfolio in Beauty & Personal Care, Home Care, and Foods; retailer negotiations tightening amid disinflation; FX exposure to emerging markets can swing results; Ben & Jerry’s governance controversy poses reputational risk.

Share price evolution – last 12 months

Notable headlines

- Ben & Jerry's co-founder quits over social activism row [BBC News]

- The Jerry from Ben & Jerry's has quit — and is criticizing parent company Unilever on his way out [Business Insider]

- Ben & Jerry’s cofounder leaves firm amid dispute with Unilever over Gaza [Al Jazeera English]

- Ben van Ben & Jerry’s wil het ijsbedrijf terug: ‘Unilever probeert ons de mond te snoeren’ [Het Financieele Dagblad]

Opinion

Top‑line softness and a dip in earnings growth suggest the price‑led upcycle is fading. Quarterly revenue growth at -3.20% year over year and quarterly earnings growth at -5.10% indicate volumes are not yet compensating for slower pricing. Even so, Unilever’s 18.85% operating margin and 9.29% profit margin show that mix and cost discipline continue to protect profitability. Cash generation remains a strength: operating cash flow of 8.44B and levered free cash flow of 5.47B support a forward dividend yield of 3.53% and a 79.68% payout ratio. The trade‑off is balance‑sheet flexibility, with 32.02B of debt and a 0.76 current ratio signaling the need for careful capital allocation while navigating a slower demand backdrop.

The quality of earnings looks defensible but levered. Return on equity at 28.70% is flattered by a 160.68% debt‑to‑equity ratio; return on assets of 8.66% and EV/EBITDA of 13.00 point to a business with healthy but not exceptional incremental returns absent volume recovery. The forward P/E of 15.31 implies the market is willing to underwrite moderate improvement, contingent on volume stabilization and margin preservation. With a low beta of 0.25, the shares may track like a bond‑proxy, but any sustained re‑rating likely hinges on proof that volume and share can grow without sacrificing pricing discipline.

Industry dynamics are turning less forgiving. As disinflation takes hold, retailers are pushing for sharper pricing and higher trade support, while private labels regain shelf momentum. In this environment, pricing power accrues to brands that can demonstrate distinctiveness and deliver innovation at accessible price points. FX volatility—especially in emerging markets—remains a swing factor for translation and transaction effects, and promotional intensity is likely to rise. Against that backdrop, Unilever’s breadth across categories is an asset, but execution at the shelf and in digital channels will matter more than portfolio breadth alone.

Reputational and governance noise around Ben & Jerry’s adds complexity. While the direct financial impact is not disclosed, the headlines can distract management and risk brand equity if not managed consistently across markets. Over the next three years, the narrative is likely to pivot on three levers: demonstrable volume lift from innovation and distribution, sustained gross margin through productivity and mix, and tidier brand governance to reduce headline risk. If Unilever can show progress on these fronts, the valuation multiple could migrate toward peers; if not, the current discount and income support may persist without a catalyst for re‑rating.

What could happen in three years? (horizon October 2028)

| Scenario | Narrative |

|---|---|

| Best | Volumes recover as innovation, value‑tier offerings, and better in‑store execution lift share across key categories. Input costs stay stable, productivity funds brand investment, and governance noise subsides. Margins hold, cash conversion stays robust, and the market rewards steadier growth with a higher multiple. |

| Base | Volumes stabilize but grow modestly; pricing normalizes, and promotions increase. Margins are broadly steady as cost savings offset mix pressure. Headline risk around brand governance fades but does not disappear. Valuation and share price track fundamentals without major re‑rating. |

| Worse | Retailer pushback and private‑label gains drive sustained volume and mix pressure. FX turns adverse, input costs re‑accelerate, and promotions compress margins. Governance controversies persist, distracting management. Cash returns are maintained but at the expense of strategic flexibility, and the multiple de‑rates. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Volume trajectory versus pricing and promotion intensity in core categories (sell‑through and market share data; volume details currently not disclosed).

- Retailer negotiations and trade terms as disinflation shifts bargaining power toward private labels.

- FX movements in key emerging markets impacting both translation and input costs.

- Input cost trends and productivity savings affecting gross and operating margins.

- Portfolio and governance headlines (e.g., Ben & Jerry’s) that may influence brand equity and management focus.

- Capital allocation balance between dividends, debt metrics, and any portfolio actions, given leverage and payout levels.

Conclusion

Unilever enters the next phase of the staples cycle with resilient margins, reliable cash generation, and a valuation that reflects tempered growth expectations. Recent revenue and earnings declines on a year‑over‑year basis underscore that the easy, price‑led gains of the inflation surge are behind us; what matters now is volume, mix, and brand distinctiveness at accessible price points. Balance‑sheet leverage and a high payout constrain optionality, making execution in the core engine more important than financial engineering. Governance noise around Ben & Jerry’s adds a headline overhang but is manageable if consistency and clarity are restored. Watch next 1–2 quarters: volume stabilization in key categories; pricing and promotion cadence with major retailers; margin resilience as input costs and FX move; cash conversion versus dividend commitments; and any steps to de‑risk brand governance. Absent clear progress, the shares may continue to act defensively; with it, a steadier growth profile could justify a healthier multiple over time.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.