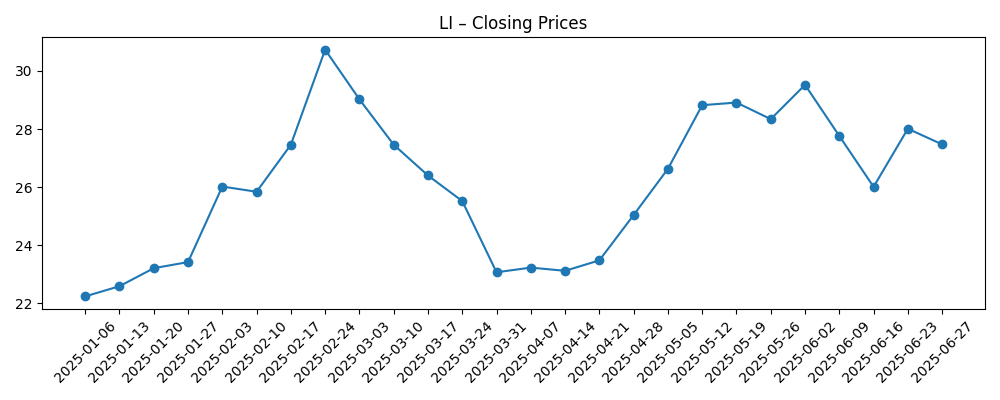

Li Auto’s stock has retraced from midsummer highs as China’s EV price war intensifies and investors reassess the path from range‑extended hybrids to pure battery models. The shares recently closed at 22.80, down from a late‑July peak near 31.80, reflecting concerns that discounting could dilute margins just as the company ramps R&D and charging investments. Macro news is mixed: travel and consumption recovered during Golden Week, yet auto makers continue to cut prices to defend share, and policy discussions around critical materials add uncertainty to component costs. For the sector, this phase marks a shift from hyper‑growth to disciplined scale, where product cadence, software differentiation and cost control separate winners from laggards. For investors in Chinese EVs, the question is less about demand in aggregate and more about who can sustain unit economics while navigating regulation and supply chains. Over the next few years, narrative will hinge on execution of new model launches and the durability of pricing power in a crowded domestic market.

Key Points as of October 2025

- Revenue: data not disclosed in the snapshot; focus remains on scaling China premium family SUVs dominated by range‑extended hybrids while preparing a broader BEV lineup.

- Profit/Margins: data not disclosed; domestic price cuts and promotions are pressuring margins, partially offset by vertical integration and software feature bundling.

- Sales/Backlog: no backlog disclosed; demand visibility hinges on new model cadence, competitive pricing, and the pace of BEV infrastructure build‑out.

- Share price: recent weekly close at 22.80 (2025‑10‑10); trading range since July has oscillated around mid‑20s–low‑30s amid delivery headlines and price‑war news flow.

- Analyst view: mixed to cautious as competition intensifies; investors are focused on execution of BEV launches and the monetization of driver‑assist and in‑car software.

- Market cap: not disclosed in this dataset; liquidity remains supported by active trading in U.S. ADRs.

- Competitive position: strong brand recognition in China’s family SUV niche; cross‑shopped with BYD, NIO, and Tesla; pricing power being tested by industry‑wide discounting.

- Regulation/FX/Inputs: evolving rules around critical minerals and rare earths could influence motor and battery supply chains and cost trajectories.

- Product/tech: ADAS and cockpit software continue to differentiate; charging partnerships and service network depth will matter as BEV mix rises.

Share price evolution – last 12 months

Notable headlines

- China’s Golden Week travel boom masks a bruising price war

- World Bank raises China growth forecast to 4.8% despite U.S. trade tensions

- Chinese EV giant BYD sees UK sales soar by 880%

- Electric vehicle sales surge across EU as overall car market stalls

- China tightens export rules for crucial rare earths

Opinion

The share move tells a straightforward story: sentiment has faded as investors price in a longer, tougher slog on profitability during an industry‑wide price war. With company‑specific revenue and margin figures undisclosed here, trading appears driven by headlines and the market’s shifting view on the quality of growth. Discounts help sustain volume but often at the cost of gross margin, especially for players still investing in BEV platforms, charging partnerships, and software stacks. Against that backdrop, the retreat from late‑July highs likely reflects a market preference for immediate margin clarity over top‑line expansion. Put simply: the debate has moved from “how fast can they grow?” to “what does each unit contribute after promotions and incentives?”

Quality of any future beats or misses will hinge on mix and monetization. Range‑extended hybrids can cushion charging‑infrastructure gaps and support scale, but they also anchor the brand’s cost structure and may limit eligibility for certain policy tailwinds relative to pure BEVs. If Li Auto can lean into software‑driven features—advanced driver assistance, infotainment, and connected services—it may defend average selling prices without relying solely on hardware upsizing. Conversely, if promotions dominate the sales narrative, revenue growth could become less meaningful for equity holders because the incremental dollar would arrive with diminishing contribution. Sustainability, therefore, will depend on execution discipline: targeted incentives, tight bill‑of‑materials management, and clear differentiation at each price point.

Industry dynamics are doing much of the work. BYD’s scale, aggressive pricing, and increasingly global reach raise the bar for all domestic peers, while global brands continue to recalibrate plans in China. Sector data point to robust EV uptake, but share shifts fast toward models with the most compelling price‑to‑spec packages. Policy risk sits in the background: export controls on key minerals and shifting subsidy frameworks can alter costs and demand at short notice. For Li Auto, that means two imperatives—make the cost curve more resilient and ensure that BEV launches arrive with adequate charging and service support. Players that marry rapid product iteration with controlled cash burn tend to earn a more durable multiple in this environment.

Valuation in China EVs is increasingly narrative‑driven: the market pays up when delivery momentum aligns with improving unit economics and compresses multiples when pricing pressure dominates. Over the next three years, the multiple investors assign to Li Auto will likely track proof points on three axes: (1) BEV ramp quality and charging ecosystem partnerships; (2) margin stability despite promotions; and (3) software attach rates that expand lifetime value per vehicle. Any signs of global channel experiments need framing through policy and logistics risk, given rising trade frictions. In short, the stock will respond less to big promises and more to execution milestones that reduce uncertainty about margins and cash needs, even if top‑line trajectories remain healthy.

What could happen in three years? (horizon October 2025+3)

| Best case | Price competition stabilizes as supply normalizes and weaker brands retrench. Li Auto launches competitive BEVs on time, sustains healthy order intake without heavy promotions, and expands software features that lift per‑vehicle economics. The market rewards clearer margin visibility and steadier free‑cash dynamics, improving sentiment and liquidity. |

| Base case | Price pressure persists but becomes more surgical. Hybrids remain a volume pillar while BEVs scale gradually, supported by partnerships for charging and service. Margins fluctuate within a manageable band as the company balances promotions with cost reductions, and the equity narrative focuses on execution consistency rather than hyper‑growth. |

| Worse case | Price war re‑accelerates on new model waves; BEV launches slip or require deep discounts to move volume. Input‑cost volatility tied to batteries and rare earth policies compresses gross margin, while competitive feature cycles erode differentiation. The stock de‑rates as investors prioritize balance‑sheet resilience and near‑term cash preservation across the group. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Execution of new BEV launches and the pace of charging/service partnerships supporting real‑world adoption.

- Intensity and duration of China’s EV price war, including competitor actions from large incumbents.

- Regulatory changes affecting subsidies, data/ADAS rules, and export controls on batteries and rare earths.

- Supply‑chain costs for batteries, motors, and semiconductors, including FX and input‑price swings.

- Consumer demand resilience amid China macro trends and any shifts in household confidence.

- Software monetization and feature differentiation that can defend pricing without heavy promotions.

Conclusion

Li Auto enters the next phase of China’s EV cycle with solid brand equity but a tougher profitability backdrop. The share price has drifted from midsummer levels as investors handicap a longer period of promotions while the company transitions toward BEVs and steps up software investment. Sector currents are mixed—demand is healthy, yet competition is intense and policy remains a swing factor for costs. In this setting, the narrative that drives the multiple is less about raw delivery growth and more about quality of growth: pricing discipline, cost control, and distinctive features that support willingness to pay. Watch next 1–2 quarters: BEV launch cadence and charging partnerships; promotional intensity versus order intake; software attach and take‑rate signals; any policy changes that affect battery and rare‑earth inputs. Clear progress on these fronts would simplify the equity story by improving visibility on margins and cash needs, while setbacks would keep the stock trading on headline risk and broader sector sentiment.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.