PepsiCo (PEP) enters September 2025 with a defensible snacks-and-beverages portfolio, a low beta profile, and a share price that has lagged the S&P 500 over the past year. The company delivers $91.75B in trailing revenue with 17.49% operating margin and continues to prioritize its dividend, offering a forward yield of 3.99% on a 5.69 annual rate. Near-term debates center on whether gross margin recovery can offset softer volumes and whether a near-100% payout ratio is sustainable while debt remains elevated. With quarterly revenue up 1.00% year over year but quarterly earnings down sharply, investors are weighing execution against resilience. This three-year outlook frames what could drive a rerating: pricing discipline, mix upgrades, productivity savings, balance-sheet repair, and the cadence of product innovation across zero-sugar sodas, energy, and global snacks.

Key Points as of September 2025

- Revenue and growth: Revenue (ttm) of $91.75B; quarterly revenue growth (yoy) at 1.00%.

- Profitability: Profit margin at 8.23%; operating margin at 17.49%; diluted EPS (ttm) of 5.49; quarterly earnings growth (yoy) at -59.00%.

- Sales/Backlog: Global consumer-staples sales mix; no formal backlog typical for beverages and snacks.

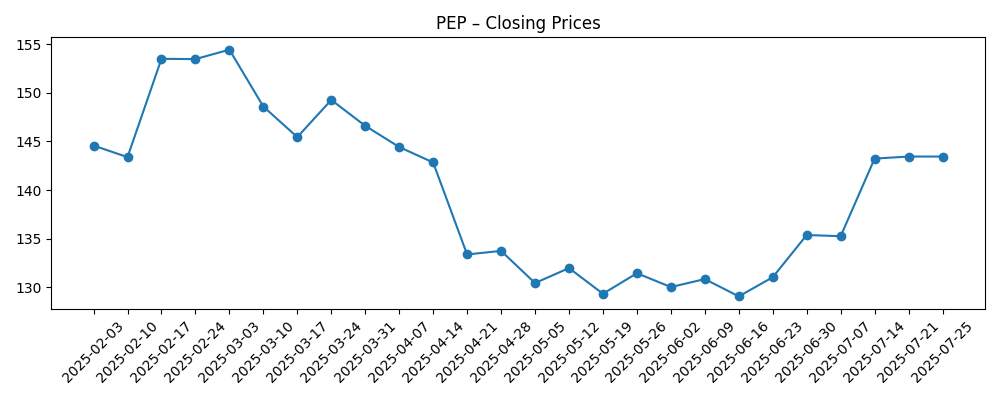

- Share price and trend: 52-week change at -19.51%; 52-week high 179.43 and low 127.60; beta (5Y) 0.47.

- Trading markers: 50-day moving average 143.22; 200-day moving average 144.28; average 3-month volume 9.64M; short interest 1.64% of float; short ratio 2.84.

- Cash flow: Operating cash flow (ttm) $12.19B; levered free cash flow (ttm) $7.59B.

- Balance sheet: Total debt $51.38B; total debt/equity 276.87%; current ratio 0.77; ROE 39.86%; ROA 8.51%.

- Dividend: Forward annual dividend rate 5.69; forward dividend yield 3.99%; payout ratio 99.95%; ex-dividend date 9/5/2025; next dividend date 9/30/2025.

- Market cap & ownership: Large-cap profile with 1.37B shares outstanding; institutional ownership 79.01%; insiders 0.19%.

Share price evolution – last 12 months

Notable headlines

- How Is PepsiCo’s Stock Performance Compared to Other Food & Beverage Stocks? [Barchart.com]

- Jim Cramer Points Out Mistakes PepsiCo, Inc. (PEP) Might Have Made [Yahoo Entertainment]

- PepsiCo, Inc. (PEP): A Bull Case Theory [Yahoo Entertainment]

Opinion

PEP’s defensive label has not insulated the stock from a reset: the shares are down over the past year and sit closer to their 52-week low than their high, while the 50-day and 200-day moving averages cluster in the mid-140s. A low beta suggests muted market sensitivity, but staples can still de-rate when earnings momentum cools. The current setup looks like a tug-of-war between stable cash generation and a slower growth tape. The relative performance discussion highlighted by Barchart resonates: peers with cleaner earnings trajectories have been rewarded, while laggards pay a valuation penalty. For PepsiCo, a credible path to re-accelerating earnings—via cost savings, improved mix, and moderating input costs—could be enough to stabilize sentiment, even without outsized top-line growth, particularly if management sustains operational discipline through holiday and emerging-market cycles.

Income investors anchor the bull case. A forward yield of 3.99% is compelling for a consumer staple, but a 99.95% payout ratio compresses flexibility. Coverage by operating and free cash flow is still present, yet leverage (total debt of $51.38B, debt/equity 276.87%) and a 0.77 current ratio argue for caution. The ex-dividend and record dates show an uninterrupted cadence, but extending the streak over the next three years probably requires margin repair and careful capital allocation. Dividend growth may trail history until earnings growth normalizes. Clarity on capex discipline, working-capital management, and the pace of debt reduction will shape confidence in both the payout and any buyback capacity. Investors should look for explicit cash-prioritization frameworks in upcoming quarters.

Strategically, PepsiCo retains enviable breadth: global snacks, core colas, zero-sugar variants, and energy adjacency. The Yahoo “bull case” lens is plausible if execution lifts throughput and mix, particularly where zero-sugar and premium snacks can expand gross profit dollars without straining volumes. Conversely, the critique flagged by Jim Cramer underscores how missteps in pricing, innovation cadence, or marketing effectiveness can sap operating leverage. With quarterly revenue growth at 1.00% and earnings volatility elevated, even incremental improvements in cost-to-serve, logistics, and packaging can matter. A steady pipeline of brand renovation, tight price-pack architecture, and disciplined in-store activation would help defend shelf space while nudging margins higher, especially as commodities and transportation costs trend more benignly than in the prior surge.

Technical and positioning factors should not be ignored. Short interest is modest at 1.64% of float, and average liquidity around 9.64M shares per day supports institutional participation. The convergence of 50- and 200-day moving averages near recent trading levels suggests the potential for a base-building phase if fundamentals stop deteriorating. A series of in-line or better quarters—helped by productivity savings and steadier input costs—could shift the narrative from defense to repair. Conversely, another leg down in earnings or guidance would likely keep the shares rangebound, with the dividend providing a floor but not a catalyst. Over a three-year horizon, the balance of probabilities still leans on execution: reliable delivery against modest expectations can be enough for multiple stability in a staple.

What could happen in three years? (horizon September 2025+3)

| Scenario | 2028 outlook |

|---|---|

| Best | Pricing discipline and mix upgrades sustain modest revenue growth while productivity programs lift margins. Cash generation supports a reliable dividend and gradual deleveraging, improving balance-sheet flexibility and investor confidence. |

| Base | Organic growth remains steady but unspectacular. Margins normalize from recent lows, funding a maintained dividend with measured increases. Leverage trends sideways as operating cash flow covers reinvestment and shareholder returns. |

| Worse | Persistent volume softness and cost pressures cap margin recovery. Dividend coverage tightens, forcing slower growth in payouts. Limited balance-sheet progress and uneven execution keep the shares subdued relative to staples peers. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Margin trajectory vs. input-cost trends and productivity savings execution.

- Dividend sustainability and cash allocation amid a high payout ratio.

- Leverage management and liquidity (debt load, current ratio) affecting financial flexibility.

- Innovation cadence and pricing architecture across zero-sugar beverages, energy, and snacks.

- Retail execution and international demand resilience, especially in emerging markets.

Conclusion

PepsiCo remains a high-quality staple with durable brands and broad distribution, yet the equity story hinges on margin repair and disciplined capital allocation. The data show a company with meaningful scale—$91.75B in trailing revenue and strong operating capabilities—but facing slower growth and elevated earnings volatility. A forward yield of 3.99% supports total-return math, though a near-100% payout ratio limits room for error until earnings and cash flow trend higher. Over the next three years, modest top-line progress paired with steady productivity gains could be sufficient to stabilize sentiment and restore a premium relative to lagging peers. Watch for incremental improvements in gross margin, explicit deleveraging plans, and consistent execution on innovation and in-store activation. If PepsiCo can convert its portfolio breadth into dependable earnings growth, the shares have scope to re-rate; if not, the dividend likely remains the primary anchor of returns.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.