JPMorgan Chase enters the next three years with solid profitability and an elevated share price backdrop. As of September 2025, the bank reports trailing-12-month revenue of $163.75B and net income to common of $55.15B, with profit and operating margins of 34.52% and 43.75% respectively. Shares have climbed 43.73% over the past year, outpacing the S&P 500’s 17.26%, and recently traded near $300.54—close to the 52‑week high of $305.15. Liquidity remains deep (total cash $1.54T) alongside $1.17T of total debt typical of a universal bank balance sheet. The dividend profile is steady, with a forward annual rate of $5.60 and yield of 1.88% on a 27.18% payout ratio. Strategic signals include fresh hiring in M&A, participation in large-scale financing tied to data infrastructure, and supportive analyst commentary following strong Q2 results.

Key Points as of September 2025

- Revenue: TTM revenue of $163.75B; latest quarterly revenue growth (yoy) at -10.60%.

- Profit/Margins: Profit margin 34.52%; operating margin 43.75%; ROE 16.21%; ROA 1.30%.

- Sales/Backlog: Strategic activity includes hiring technologists to bolster M&A and involvement in a potential $22B data-hub financing.

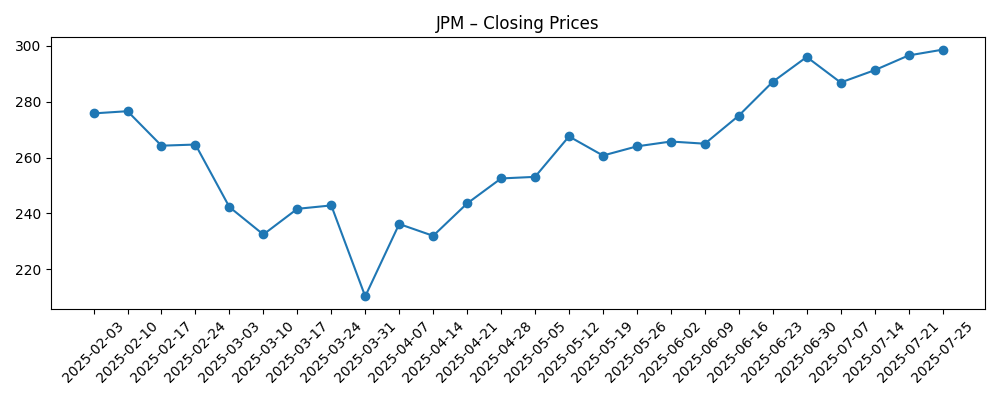

- Share price: Recent close near $300.54; 52‑week change 43.73% vs S&P 500 at 17.26%; 52‑week range 201.83–305.15.

- Analyst view: Price target lifted by at least one broker after strong Q2 earnings; sentiment supported by outperformance coverage.

- Market cap: About $826B based on recent price and 2.75B shares outstanding; institutional ownership 74.49%.

- Liquidity/Leverage: Total cash $1.54T and total debt $1.17T; operating cash flow (ttm) -$148.62B.

- Dividend: Forward annual dividend rate $5.60 (yield 1.88%); payout ratio 27.18%; last dividend date 7/31/2025.

- Trading profile: Beta 1.13; 50‑day MA 293.08; 200‑day MA 262.61; average 3‑month volume 8.34M; short interest 0.88% (ratio 2.95).

Share price evolution – last 12 months

Notable headlines

- JPMorgan Chase (JPM) Rose on Renewed Investor Optimism

- JPMorgan Chase & Co (JPM) Hires More Tech Experts to Strengthen M&A Business

- JPMorgan (JPM) and MUFG Eye $22B Loan for Texas AI-Driven Data Hub

- Freedom Broker Lifts JPMorgan Chase (JPM) Price Target After Strong Q2 Earnings

- Is JPMorgan Chase Stock Outperforming the S&P 500?

- JPMorgan (JPM) Announces Dividends for Preferred Stock

- JP Morgan, Commerzbank and ING to Back European Defense Bank

Opinion

JPMorgan’s share-price leadership over the last year reflects both bank-specific execution and macro tailwinds. The firm’s 52‑week change of 43.73% versus the S&P 500’s 17.26% signals expanding confidence that core earnings power is durable even as reported quarterly revenue growth has cooled (-10.60% yoy). The margin profile remains a differentiator, with a 43.75% operating margin and 16.21% ROE anchoring the case for premium valuation. In our view, the mix of capital markets normalization and steady consumer/wholesale banking provides multiple ways to win. The broker price-target lift following strong Q2 results, paired with headlines about renewed investor optimism, confirms that the buy-side narrative has shifted from defense to offense. At roughly $300 per share, near a 52‑week high, the bar for upside is higher—yet the bank’s scale, liquidity, and franchise breadth continue to argue for resilience on any cyclical setback.

Strategically, JPMorgan is leaning into advisory and technology-heavy deal-making by hiring more technologists for its M&A business. We see two potential benefits: sharper origination in software and data infrastructure, and better diligence capabilities amid a market where AI and cloud architectures reshape client priorities. The bank’s prospective role in a $22B AI-driven data-hub financing would exemplify this pivot, linking corporate banking with thematic growth areas. Such transactions can deepen client relationships while adding fee and interest income streams. That said, underwriting and concentration risk must be managed carefully as data-center projects carry long-dated cash-flow assumptions. The firm’s strong liquidity ($1.54T total cash) and diversified funding base position it to underwrite selectively, but project timing and syndication depth will matter for capital efficiency. In aggregate, the initiative supports a higher-quality advisory pipeline if M&A volumes continue to repair into 2026–2027.

Income investors will note the forward annual dividend rate of $5.60 (1.88% yield) on a 27.18% payout ratio, suggesting room to balance distributions with organic growth. Preferred dividend actions reinforce a consistent capital-return framework. With shares outstanding at 2.75B and institutional ownership of 74.49%, the investor base is deep, and short interest remains modest at 0.88% (short ratio 2.95). These dynamics reduce technical overhang but also imply that future performance may hinge more on earnings trajectory than positioning squeezes. While operating cash flow (ttm) prints at -$148.62B—common in bank statements given securities and funding flows—headline liquidity and capital-stack management remain credible supports. Should macro volatility reappear, JPMorgan’s scale historically enables gain-of-share in deposits and talent, cushioning revenue variability. The 50‑ and 200‑day moving averages (293.08 and 262.61) offer technical reference points if momentum stalls.

Looking out three years, the central debate is whether today’s profitability can persist as rates normalize and credit costs gradually rise. A base case features mid-cycle spreads with steadier investment-banking fees and selective growth in data infrastructure financing. A better case would marry benign credit with a cyclical M&A upturn, allowing margins to sustain at attractive levels and supporting the dividend trajectory. A tougher case involves sharper NIM compression and heavier provisioning, which would test valuation near the 52‑week high range. Across paths, JPMorgan’s breadth—consumer, card, wholesale payments, markets, and advisory—provides buffers that many peers lack. Execution on technology-led origination and risk discipline around large syndicated financings will likely decide whether the bank keeps compounding at a premium or reverts closer to sector averages.

What could happen in three years? (horizon September 2028)

| Case | Revenue/Mix | Profitability & Returns | Capital & Payout | Stock Implications |

|---|---|---|---|---|

| Best | Investment banking and payments lead; data infrastructure financing scales prudently. | Margins hold near current profile; ROE remains strong. | Dividend grows within a conservative payout policy. | Premium multiple sustained as leadership narrative endures. |

| Base | Balanced mix; gradual recovery in advisory; stable consumer trends. | Margins normalize modestly; returns remain above industry average. | Steady dividend progression; active capital management. | Range‑bound to moderate upside, tracking earnings cadence. |

| Worse | Rate headwinds and slower fees; cautious underwriting on large projects. | Margin compression and higher credit costs weigh on returns. | Dividend maintained but growth slows to preserve flexibility. | Multiple compresses toward sector, sensitivity to macro spikes. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Interest-rate path and net interest margin trends across retail and wholesale banking.

- Credit costs and consumer/wholesale asset quality through the cycle.

- Capital markets activity (M&A, ECM/DCM, trading) and JPMorgan’s advisory pipeline.

- Regulatory capital requirements and any shifts in liquidity or stress-test outcomes.

- Execution on large syndicated financings tied to AI/data infrastructure and related risk controls.

- Dividend policy and broader capital allocation signals that shape investor sentiment.

Conclusion

JPMorgan’s three-year setup combines scale advantages with a healthy profitability base and an active strategic agenda. The stock’s sustained outperformance and proximity to a 52‑week high reflect confidence in execution, but they also compress the margin for error if growth slows. The firm’s TTM revenue of $163.75B and net income of $55.15B, alongside high margins and a 16.21% ROE, underpin the investment case, while liquidity of $1.54T supports flexibility to originate selectively and invest through cycles. Initiatives in technology-centric M&A and potential participation in large data-infrastructure financings broaden fee and lending opportunities. Risks include normalization of spreads, higher credit costs, and regulatory constraints. For long-term investors, the dividend framework (forward rate $5.60; 1.88% yield) and diversified earnings engines offer resilience. The next leg of returns likely tracks earnings momentum and discipline in capital deployment as macro conditions evolve.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.