As of

Key Points as of September 2025

- Revenue: Trailing-12-month revenue of $693.15B; revenue per share $86.49; gross profit $172.67B; EBITDA $42.88B.

- Profit/Margins: Profit margin 3.08%; operating margin 4.39%; diluted EPS (ttm) 2.65; quarterly earnings growth (yoy) 56.10%.

- Sales/Backlog: Quarterly revenue growth (yoy) 4.80%; ongoing fulfillment and automation initiatives; operating cash flow $38.44B supports reinvestment.

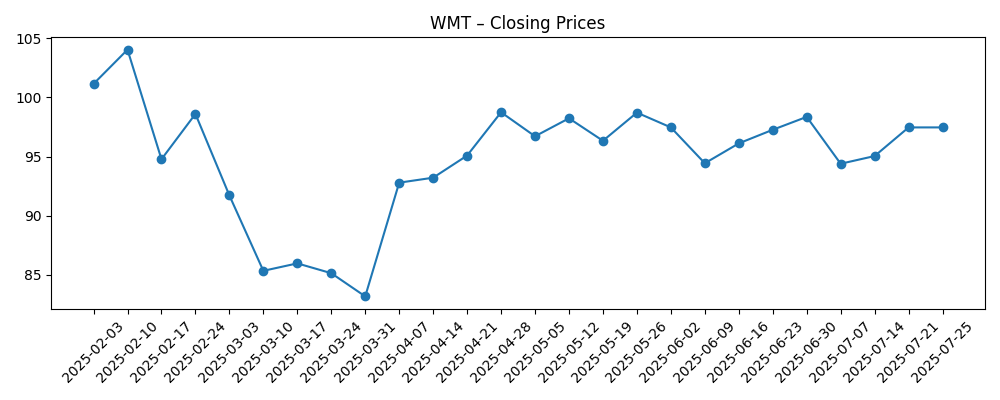

- Share price: Latest weekly close near $100.41; 52-week range $77.49–$105.30; 50-day MA 98.49; 200-day MA 95.21; beta 0.65; 52-week change 29.74% vs S&P 17.26%.

- Analyst view: Multiple firms (Citi, Guggenheim, Tigress) cite momentum, e-commerce traction and share gains; debate over tariff messaging surfaced.

- Market cap/Float: ~7.97B shares outstanding and 4.35B float imply market value around $800B at recent prices; short interest 0.49%; short ratio 2.88; average 3‑month volume 16.36M.

- Balance sheet: Total debt $66.56B; cash $9.43B; current ratio 0.79; debt/equity 68.72%.

- Dividends & corporate actions: Forward dividend $0.94 (0.92% yield); payout ratio 33.40%; ex‑dividend 12/12/2025; last split 3:1 on 2/26/2024.

Share price evolution – last 12 months

Notable headlines

- Tigress Financial Lifts Walmart (WMT) Price Target After Strong Q2 Results

- Walmart Inc. (WMT) Is Experiencing A Weird Tariff Perception, Says Jim Cramer

- Jim Cramer Says Walmart Inc. (WMT) Made A Mistake When Discussing Tariffs

- Citi Reaffirms Buy on Walmart (WMT) on Growth Momentum and E-Commerce Push

- No Change In Walmart's Strong Momentum, Analysts Confirm

- Walmart Partners With Ranpak To Automate Packaging In Fulfillment Centers

- Target customers may soon flee to Walmart due to alarming change

- Guggenheim Shrugs Amazon Threat, Lifts Walmart (WMT) Price Target

- Should You Buy the Post-Earnings Drop in Walmart Stock?

Opinion

Walmart’s three‑year setup is shaped by two countervailing forces seen in recent headlines: constructive analyst sentiment and the tariff narrative risk. On the positive side, multiple firms have reiterated or lifted views, citing e‑commerce momentum and share gains, which fits the company’s reported 4.80% quarterly revenue growth and strong earnings acceleration. The Ranpak automation partnership also speaks to a playbook of incremental efficiency improvements that can protect margins in a price-sensitive environment. On the other hand, commentary missteps around tariffs, as highlighted by Jim Cramer, show how quickly policy perception can sway sentiment for a mass‑merchant with exposure to global supply chains. Navigating that communication risk will matter, but the stock’s low beta of 0.65, consistent cash generation, and disciplined payout suggest the franchise has the resilience to withstand episodic headlines while continuing to compound scale advantages.

Price action over the last six months shows that sentiment swings can be sharp even amid strong fundamentals. After rallying to a weekly close above $104.04 in mid‑February 2025, shares retreated into late March around $83.19 before recovering toward $100.41 by early September. That round‑trip illustrates how expectations around guidance, macro data, and messaging (including tariff talk) can dominate near‑term moves. Importantly, the subsequent recovery came alongside evidence of ongoing revenue growth and sharply higher year‑over‑year earnings, reinforcing the view that pullbacks have been more sentiment‑driven than structural. For long‑term investors assessing a three‑year horizon, this behavior argues for focusing on execution markers—unit economics in fulfillment, adoption in pickup and delivery, and cost per order—rather than short‑term tape action. With a 29.74% 52‑week gain and a 0.92% forward yield, Walmart offers a blend of defensiveness and steady compounding.

Strategically, incremental automation such as the Ranpak collaboration should help trim handling costs, improve packaging density, and reduce damage rates—small levers that compound across Walmart’s scale. When paired with merchandising breadth and everyday‑low‑price positioning, these operational upgrades can support stable operating margin performance (4.39% ttm) despite an environment where consumers remain price‑sensitive. Competitive dynamics remain intense, but the analyst thesis that Walmart can shrug off specific threats—such as Amazon’s encroachment in certain categories—rests on omnichannel convenience and proximity. The reported earnings growth (56.10% yoy for the recent quarter) provides room to keep investing in digital, supply chain, and customer experience without compromising discipline. If management sustains clear messaging on tariffs and pricing while demonstrating tangible service improvements, the company is positioned to defend traffic and basket size even in a slower macro tape.

A potential share shift from rivals adds a further tailwind. Reports that Target customers may migrate toward Walmart underscore the advantage of price leadership when household budgets are tight. Walmart’s 52‑week outperformance over the S&P 500 (29.74% vs 17.26%) hints that investors are already rewarding this positioning. In the next three years, watch for sustained low volatility (beta 0.65), healthy cash generation ($38.44B OCF ttm), and disciplined capital returns (payout ratio 33.40%) to anchor the story, while enhancements in e‑commerce fulfillment and in‑store digitization contribute to steady sales growth. Short interest remains minimal (0.49% of shares), suggesting limited pressure from bearish positioning. Against that backdrop, any renewed anxiety around tariffs, wage inflation, or competitive pricing could create temporary dislocations—potentially opportunities—provided the company continues to show progress on efficiency and customer value.

What could happen in three years? (horizon September 2025+3)

| Scenario | Outcome by September 2028 |

|---|---|

| Best | Walmart sustains steady revenue growth with continued gains in e‑commerce and efficient fulfillment. Automation projects reduce unit costs, helping maintain or gently expand margins. Positive analyst stance persists, sentiment remains constructive, and the stock benefits from defensive demand and consistent dividends. |

| Base | Sales trends remain stable with modest growth as consumers stay value‑oriented. Margin profile is broadly unchanged as productivity gains offset price investments. The shares track fundamentals with typical volatility, supported by ongoing cash generation and a predictable dividend cadence. |

| Worse | Tariff or cost shocks collide with heightened price competition, pressuring traffic or mix. Messaging missteps weigh on sentiment, while wage and supply chain costs limit efficiency gains. Growth slows and the market assigns a more cautious view until execution re‑accelerates. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Trade and tariff policy developments affecting imported goods costs and pricing strategy.

- Execution in e‑commerce fulfillment and automation, including benefits from packaging and logistics initiatives.

- Competitive actions from large peers in grocery and general merchandise, especially pricing and delivery speed.

- Consumer spending trends and mix shifts between essentials and discretionary categories.

- Labor costs, shrink, and supply chain efficiency influencing margins and cash flow.

- Communication tone and guidance credibility, given recent attention to tariff commentary.

Conclusion

Walmart enters the next three years with a sturdy foundation: scale, cash generation, and a defensible value proposition. The company’s recent numbers—$693.15B in trailing revenue, 4.80% quarterly revenue growth, and notably stronger earnings momentum—indicate that efficiency and omnichannel investments are bearing fruit. Shares have also demonstrated resilience, outperforming the broader market with lower volatility, while a 0.92% forward yield and a 33.40% payout ratio reflect a balanced capital return profile. Key watch items include tariff policy, wage and logistics costs, and the pace of automation benefits. Analyst support tied to e‑commerce gains and operational execution remains a constructive backdrop, but investor expectations are high, implying that clear communication and steady delivery are essential. On balance, the outlook skews toward continued, measured progress rather than dramatic change, with long‑term value compounding driven by consistency, scale, and disciplined reinvestment.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.