Meta Platforms (META) enters September 2025 with momentum and scrutiny. The stock is up 49.60% over the past year, outpacing the S&P 500’s 17.26%, and trades near its 52‑week high of 796.25 after a recent close around 751.98. Financially, the company posts $178.8B in trailing‑12‑month revenue, $71.51B in net income, and robust margins (profit 39.99%; operating 43.02%), backed by $102.3B in operating cash flow and $31.99B in free cash flow. Management is investing heavily in AI and wearable platforms while navigating safety concerns around chatbots and VR. With $47.07B in cash against $49.56B of debt, a 1.97 current ratio, and a new dividend yielding 0.27% (7.44% payout), Meta has flexibility to refine strategy. This note outlines a balanced three‑year outlook under multiple scenarios.

Key Points as of September 2025

- Revenue: Trailing 12‑month revenue is $178.8B; quarterly revenue growth (yoy) is 21.60%.

- Profit/Margins: Profit margin 39.99% and operating margin 43.02%; TTM net income $71.51B; diluted EPS 27.57.

- Sales/Backlog: Ad and commerce demand underpin cash generation (operating cash flow $102.3B; levered free cash flow $31.99B); no formal backlog disclosed.

- Share price: Last weekly close ~751.98; 52‑week range 479.80–796.25; 50‑DMA 739.68; 200‑DMA 652.89; beta 1.24.

- Performance: 52‑week change +49.60% vs S&P 500 +17.26%.

- Analyst view proxies: Institutional ownership 79.79%; short interest 1.28% of float; short ratio 2.16; dividend yield 0.27% with 7.44% payout.

- Market cap: Approximately $1.89T based on implied shares 2.51B and a recent price near 751.98.

- Balance sheet: Cash $47.07B; total debt $49.56B; current ratio 1.97; debt/equity 25.41%.

- Liquidity: Average 3‑month volume 11.69M; 10‑day average 9.47M.

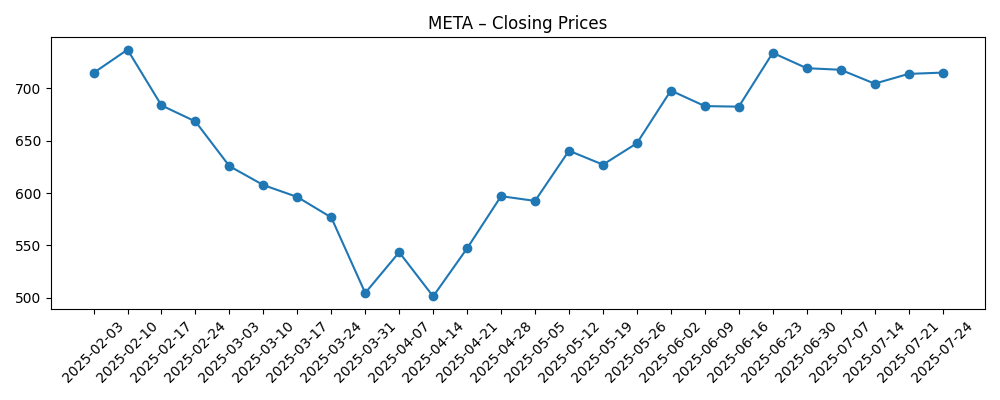

Share price evolution – last 12 months

Notable headlines

- Mark Zuckerberg Halts AI Hiring After Million-Dollar Talent Poaching Sparks Investor Backlash Amid Meta's 'Superintelligence Efforts:' Report

- Meta Has Already Won the Smart Glasses Race

- Meta is struggling to rein in its AI chatbots

- Meta curbed research about VR safety risks to kids, whistleblowers say

- Meta is going to stuff Midjourney AI images into your feed

- Meta Whistleblowers Allege Company Buried Info on Child Safety

- Meta’s AI translation tool can dub your Instagram videos

Opinion

Investors’ immediate question is whether the reported halt in AI hiring reflects discipline or constraint. Pausing recruitment following backlash over million‑dollar offers signals responsiveness to shareholder concerns and may temper operating expense growth, helping preserve a 43.02% operating margin. It also gives management room to prioritize model performance, infrastructure efficiency, and monetizable experiences across Facebook, Instagram, and WhatsApp without escalating dilution from stock‑based compensation. The risk is execution latency: AI talent is scarce, and delays in bringing teams in‑house could slow the pace at which Meta rolls out differentiated assistants, creative tools, and recommendation improvements. Near term, the company’s $102.3B in operating cash flow and $47.07B cash position help sustain training and inference spending even with slower headcount growth, but the competitive clock ticks quickly in AI.

Wearables are Meta’s wild card. The view that Meta has “already won the smart glasses race” matters because it points to a path beyond ads toward recurring device‑plus‑service ecosystems. If glasses become the preferred interface for lightweight capture, translation, and heads‑up assistance, Meta can deepen engagement, improve advertising attribution, and eventually layer premium features. Success would also validate the broader Reality Labs thesis after years of investment. Yet hardware cycles are unforgiving: returns depend on supply chain execution, utility‑driven software, and developer enthusiasm. Any stumble could reignite scrutiny of spending priorities. Still, pairing on‑device AI with social graphs is a credible differentiator, and the core businesses’ margin profile and 0.27% dividend create room to iterate without jeopardizing financial resilience.

Safety and compliance are the counterweights. Reports that chatbots are hard to rein in and whistleblower claims about youth safety in VR raise regulatory and reputational risks. Even if allegations are contested, remediation typically means more content moderation, product gating, and policy enforcement—activities that add cost and can cap experimentation speed. The trade‑off is clearest in generative partnerships, such as licensed image integrations, where quality, rights management, and user controls must be visibly robust. For Meta, getting this right is not optional: regulators, advertisers, and parents are closely watching. The silver lining is that operationalizing safety at Meta’s scale can become a moat if done well, but timelines are unpredictable and headlines can keep a ceiling on the multiple during periods of heightened scrutiny.

Technically, the stock’s recovery from a March–April swoon to levels near its 52‑week high, with price above the 50‑ and 200‑day moving averages, indicates renewed confidence in earnings durability. With a 49.60% 12‑month gain and low short interest (1.28% of float), positioning is favorable but can amplify drawdowns on negative news. Institutional ownership of 79.79% suggests a patient holder base, and the dividend (7.44% payout) adds a small return component. Over three years, performance hinges on translating AI research into engagement and monetization, scaling smart glasses beyond enthusiasts, and navigating safety obligations without impairing growth. The base case is steady ad growth plus selective new revenue streams; upside depends on device adoption and AI assistant utility; downside centers on regulation, competition, and ROI on long‑cycle bets.

What could happen in three years? (horizon September 2025+3)

| Case | Narrative | Implications |

|---|---|---|

| Best | AI assistants and creator tools become fixtures across apps; smart glasses mature into a mainstream accessory with strong engagement. Safety systems scale effectively, easing regulatory pressure. | Durable revenue acceleration with stable 40%+ margins; multiple expansion toward the top of large‑cap tech; increased dividend capacity while funding growth. |

| Base | Ad businesses grow steadily as AI improves targeting and Reels monetization; glasses and VR/AR contribute but remain secondary. Compliance costs are manageable. | Margins remain healthy around current levels; total returns track earnings growth with modest yield support; valuation stays in line with megacap peers. |

| Worse | Heightened safety actions constrain product velocity; hardware adoption stalls; rivals out‑iterate on AI. Macro softens ad demand. | Growth slows and margins compress due to higher trust & safety spend; multiple contracts toward market average; investment plans are reprioritized. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Regulatory and legal outcomes tied to youth safety, chatbot behavior, and platform governance.

- Pace and quality of AI feature deployment and monetization across Facebook, Instagram, and WhatsApp.

- Ad demand sensitivity to macro conditions and competitive dynamics in short‑form video.

- Execution in smart glasses and broader XR hardware, including developer ecosystem traction.

- Capital allocation (dividends, buybacks) versus investment in AI infrastructure and Reality Labs.

Conclusion

Meta’s investment case into 2028 rests on balancing ambition with discipline. Financially, the company carries strong profitability (39.99% profit margin; 43.02% operating margin) and cash generation ($102.3B operating cash flow) that can fund AI training, inference, and device roadmaps while supporting a modest dividend. Strategically, pairing social scale with on‑device and cloud AI could deepen engagement and create new surfaces for commerce and advertising; smart glasses offer a credible path to a post‑phone interface. The risks are equally clear: regulatory scrutiny around youth safety and generative AI, execution complexity in hardware, and competitive pressure for top AI talent. With shares near the 52‑week high and sentiment improved, expectations are elevated. Delivery against safety commitments and steady product cadence are likely to decide whether Meta compounds from here or pauses as it absorbs its recent gains.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.