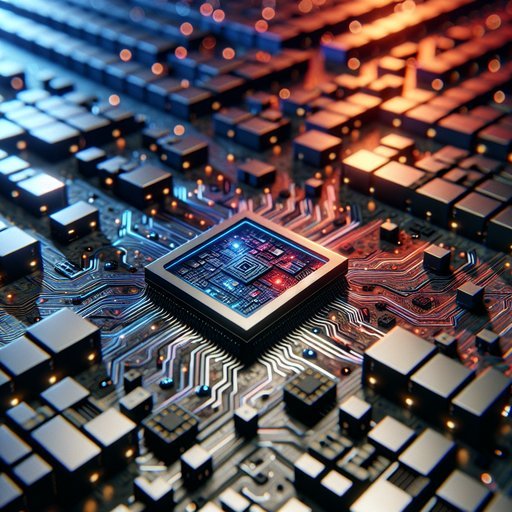

On June 17, 2025, several interlinked developments marked a turning point in the semiconductor industry, highlighting the impact of geopolitical tensions and technological innovations. As the U.S. tightened export controls on chip design software to China, Beijing stalled the Synopsys-Ansys merger worth $35 billion, further exacerbating tensions between the two nations [1][6]. Meanwhile, China's pivot to artificial intelligence (AI) for processor design marks a significant step in maintaining its semiconductor ambitions amid these restrictions [5]. This shifting landscape is mirrored by significant strides in other regions, such as Singapore's enhancements in data centers fueled by AI advancements [2].

The U.S.-China trade struggle has had profound implications for the semiconductor supply chain. Escalated by recent U.S. export restrictions on chip design software, China's decision to delay the Synopsys-Ansys deal underscores its increasing move towards technological self-sufficiency [1][2]. Both countries reached a partial consensus during a trade meeting in London, but the underlying tensions remain evident [1].

These developments signal a more complex relationship as both parties navigate their national interests. In response to U.S. sanctions, China has embraced AI to advance processor design, a clear attempt to sustain innovation in the face of restricted access to crucial design tools from U.S. companies [3].

This pivot to AI not only aims to bypass U.S. controls but also leverages the continuous advancement in AI technologies, which can expedite design processes and reduce reliance on foreign technologies [3]. As traditional avenues close, China's progression to AI-driven innovations may reshape future technological capabilities. Challenges also extend to other technology companies, such as Huawei, which faces restrictions on its AI chip production.

U.S. government caps on Huawei's Ascend-series AI chips at 200,000 units in 2025 illustrate the tangible influence of these regulations on production capacities [4]. This quota reflects broader efforts by the U.S. to limit China's technological growth, creating a more fragmented global semiconductor market.

Amidst these challenges, other nations like Singapore are seizing opportunities to strengthen their technological infrastructure. Singapore is enhancing its data centers and AI capabilities amidst intensifying global competition, positioning itself as a future-ready player in the digital economy [5]. Meanwhile, firms like InCore Semiconductors are pushing the envelope in chip design automation through their innovative SoC Generator platform, further illustrating global strides in design efficiency and capability [6]. These advancements underscore the rapid evolution of semiconductor design and manufacturing in a rapidly shifting geopolitical landscape.

Sources

- China delays Synopsys–Ansys deal amid heightened US tech export curbs (Digitimes, 2025-06-17)

- China Just Froze a $35 Billion U.S. Merger -- And Investors Should Pay Attention (Yahoo Entertainment, 2025-06-13)

- China turns to AI to design processors thanks to recent U.S. sanctions (PhoneArena, 2025-06-14)

- Huawei hits a ceiling? US caps Huawei's 2025 AI chip output at 200,000 units (Digitimes, 2025-06-16)

- Singapore sharpens sovereign AI edge as global competition intensifies (Digitimes, 2025-06-17)

- InCore Semiconductors unveils SoC Generator platform, achieves silicon validation of auto-generated chipset (BusinessLine, 2025-06-16)