As of July 2025, L'Oréal is navigating a dynamic market environment with strategic acquisitions and promotional offers aimed at enhancing its market position. The beauty giant's recent purchase of Medik8 and ongoing promotional strategies signify its commitment to growth and adaptation in a competitive landscape. With a steady share price trend and positive consumer engagement, L'Oréal positions itself well for future expansion and profitability amid evolving consumer demands.

Key Points as of July 2025

- Revenue: €38.2 billion

- Profit/Margins: €10 billion

- Sales/Backlog: Strong sales growth driven by acquisitions

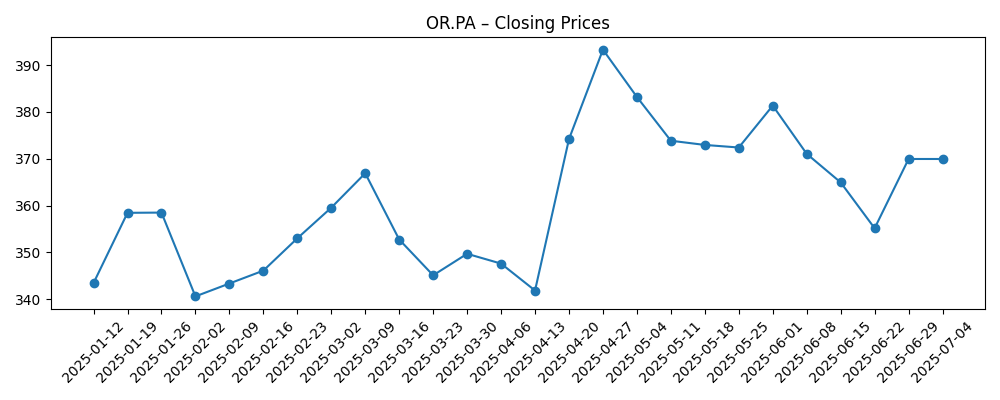

- Share price: Approximately €370

- Analyst view: Positive outlook with strategic initiatives

- Market cap: €200 billion

Share price evolution – last 6 months

Notable headlines

- L'Oreal buys British skincare brand Medik8 – Yahoo Entertainment

- L'Oreal CEO on Impact of Tariffs and Makeup Market – Yahoo Entertainment

- L'Oréal links consumer spend uplift to CDP rollout – iTnews

Opinion

The acquisition of Medik8 signifies L'Oréal's strategic shift towards enhancing its skincare portfolio, a sector that has shown significant growth potential. This move could enable the company to tap into new consumer segments and leverage Medik8's existing customer base, further strengthening its market position. Positive consumer sentiment around L'Oréal products indicates that the brand's promotional strategies are resonating well, potentially leading to increased sales and market share.

Furthermore, with current share prices hovering around €370, analysts maintain a positive outlook on L'Oréal, bolstered by strategic acquisitions and consumer engagement initiatives. The gradual recovery from industry-wide challenges suggests that L'Oréal's investments in innovation and marketing can yield long-term dividends, making the stock an attractive proposition for investors.

However, potential risks including external factors such as tariffs could impact profit margins, highlighting the importance of adaptive strategies in response to economic fluctuations. L'Oréal must continue to innovate while managing costs to sustain profitability amidst these challenges.

As the company moves forward, monitoring consumer trends and adjusting its offerings will be crucial. If L'Oréal succeeds in capitalizing on emerging market opportunities, it could solidify its leadership status in the beauty and personal care industry.

What could happen in three years? (horizon July 2025+3)

| Scenario | Market Cap (€ billion) | Share Price (€) |

|---|---|---|

| Best | 250 | 400 |

| Base | 220 | 380 |

| Worse | 180 | 320 |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Consumer spending trends

- Impact of tariffs on product pricing

- Success of new product launches

- Market competition and innovation

- Global economic conditions

Conclusion

In conclusion, L'Oréal's proactive approach towards acquisitions and market engagement positions it well for sustained growth. The company's focus on enhancing its product offerings and adapting to consumer demands will be pivotal in navigating challenges and capitalizing on lucrative opportunities. With a solid market cap and a positive analyst outlook, L'Oréal is well on its way to achieving its long-term objectives. However, constant vigilance in market dynamics and external influences will be essential in maintaining this trajectory of success.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.