TotalEnergies continues to demonstrate resilience in a volatile energy market through strategic acquisitions and operational adjustments. The company has recently swapped its Gato do Mato stake for the Lapa oil field, a move expected to enhance its production capabilities. Additionally, TotalEnergies has secured interests in several offshore blocks in Malaysia, Indonesia, and Suriname, positioning itself favorably for future growth. Despite facing challenges from competing majors and fluctuating oil prices, TotalEnergies received a favorable rating upgrade from Bernstein, reflecting analyst confidence in its long-term potential. The company’s advancements in technology, including a partnership with AI startup Mistral, are anticipated to further bolster its operational efficiencies and market position.

Key Points as of July 2025

- Revenue: Multibillion-dollar growth trajectory

- Profit/Margins: Stable, with potential for improvement

- Sales/Backlog: Positive trends in new acquisitions

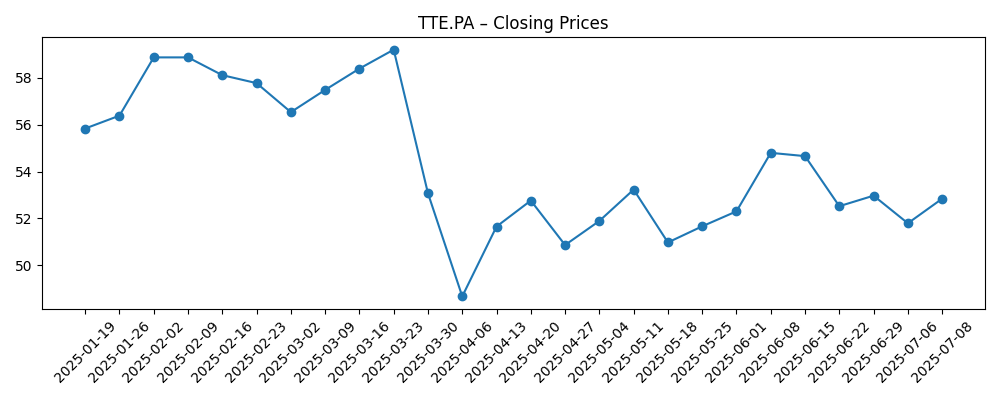

- Share price: Average of $52.84 in early July 2025

- Analyst view: Upgraded by Bernstein, reflecting confidence

- Market cap: Strong, with growth prospects in emerging markets

Share price evolution – last 6 months

Notable headlines

- TotalEnergies (TTE) Swaps Gato do Mato Stake for Lapa Oil Field to Boost Production – Yahoo Entertainment

- Bernstein Upgrades TotalEnergies SE (TTE) Stock, Reduces PT – Yahoo Entertainment

- TotalEnergies acquires blocks in Malaysia and Indonesia – Yahoo Entertainment

- TotalEnergies acquires 25% interest in Block 53 offshore Suriname – Offshore Technology

- TotalEnergies forms AI partnership with French startup Mistral – Yahoo Entertainment

Opinion

The recent upgrades and acquisitions by TotalEnergies highlight a strategic shift that may position the company for significant growth despite market volatility. With oil prices fluctuating, the company’s diverse portfolio and focus on emerging technologies could mitigate risks and enhance profitability. Investors are particularly interested in the impact of its new AI initiatives on operational efficiencies, which may provide a competitive edge in the long term.

Moreover, TotalEnergies' ability to secure stakes in key offshore blocks suggests a commitment to expanding its influence in high-potential markets. This proactive strategy may lead to increased production capacity, positively impacting revenue streams. Analysts appear to share this optimism, as reflected in the recent upgrade from Bernstein, bolstering investor confidence.

However, the competitive landscape remains challenging, especially as Western majors vie for exploration rights in regions like Libya. TotalEnergies must navigate these dynamics effectively while optimizing its asset portfolio to maintain resilience against external pressures. The company's established reputation and commitment to sustainability could also enhance its appeal to socially-conscious investors, creating additional avenues for growth.

In conclusion, TotalEnergies is well-positioned to capitalize on its strategic opportunities in the evolving energy sector. Continued focus on innovation, coupled with its robust acquisition strategy, is likely to drive future growth and enhance shareholder value in the coming years.

What could happen in three years? (horizon July 2025+3)

| Scenario | Projected Outcomes |

|---|---|

| Best | Strong global energy demand; significant production growth; share price increases to $75. |

| Base | Steady market conditions; moderate growth; share price stabilizes around $60. |

| Worse | Market downturn; increased competition; share price falls to $45. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Global oil demand fluctuations

- Regulatory changes impacting the energy sector

- Technological advancements in energy production

- Competitive landscape and market share

- Investor sentiment and market trends

Conclusion

In summary, TotalEnergies is navigating a critical phase of its development, marked by strategic acquisitions and a commitment to innovation. The company's diverse portfolio and proactive approach may serve as key drivers of growth, bolstering its performance amidst fluctuating market conditions. As TotalEnergies expands its footprint in emerging markets and invests in new technologies, the potential for enhanced profitability and shareholder value becomes increasingly apparent. With supportive analyst ratings and a solid market presence, the company is well-positioned to adapt to the changing energy landscape, providing optimism for investors looking at the long-term prospects.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.