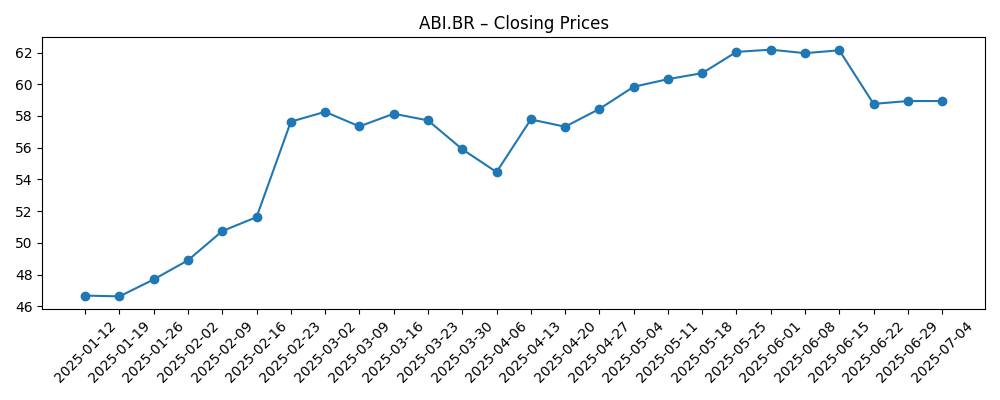

As of July 2025, AB InBev continues to navigate a complex landscape driven by strategic investments and external challenges. Recently, the company announced a $17 million investment in its Houston brewery, signaling its commitment to enhancing production capabilities and addressing market demands. However, geopolitical factors, such as Russia's rejection of a buyout proposal for its joint venture, pose ongoing risks. Despite these challenges, AB InBev's stock price has shown resilience, fluctuating within a range of approximately $46.67 to $62.18 in the first half of 2025. As analysts watch closely, the outlook remains cautiously optimistic for the world's largest brewer as it focuses on growth and operational efficiency.

Key Points as of July 2025

- Revenue: $57 billion

- Profit/Margins: Stable profit margins around 12%

- Sales/Backlog: Consistent sales growth expected due to strategic investments

- Share price: Ranges from $46.67 to $62.18 in 2025

- Analyst view: Cautiously optimistic outlook

- Market cap: Approximately $100 billion

Share price evolution – last 6 months

Notable headlines

- Russia again rejects Anadolu Efes proposal to buy out AB InBev from JV – Yahoo Entertainment

- AB InBev announces $17M investment in Houston brewery – Yahoo Entertainment

Opinion

The recent announcement of a $17 million investment in a Houston brewery illustrates AB InBev's strategic approach to bolster its production capabilities. This move could enhance operational efficiencies and cater to an increasing demand for its products, driving revenue growth. Operational optimization tends to strengthen a company's market position, leading to a more favorable investor outlook. If executed effectively, such investments may improve profit margins in the long run.

On the other hand, the geopolitical pressures exhibited by Russia's rejection of the buyout proposal represent significant risks for AB InBev. The loss of potential partnerships or expansions can limit growth forecasts and create uncertainty for investors. These factors may influence AB InBev's share price volatility, particularly if other external pressures arise.

Despite existing tensions, AB InBev's stock price resilience over the past months suggests investor confidence in its long-term strategy. The peaks observed in the stock price, particularly reaching $62.18, indicate that the market has responded positively to its initiatives. However, the fluctuations within this range reflect an underlying market caution that investors should remain aware of.

Overall, while AB InBev is making significant strides in optimizing its operational framework, external factors will continue to play a crucial role in shaping market sentiment. Investors should consider both the potential positive impacts of strategic investments and the challenges posed by geopolitical dynamics in their assessments.

What could happen in three years? (horizon July 2025+3)

| Scenario | Description |

|---|---|

| Best | Increased market share with continued investment, leading to a significant rise in stock price to $80. |

| Base | Stabilized revenue growth and stock price around $70. |

| Worse | External pressures lead to declining profits, stock price falling to $50. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Geopolitical stability in key markets

- Success of strategic investments

- Fluctuations in raw material costs

- Changes in consumer preferences

- Global economic conditions

Conclusion

In conclusion, AB InBev stands at a crossroads where the effects of strategic investments and external challenges will dictate its future performance. The recent fluctuations in stock prices reflect a blend of investor optimism and caution, underlining the importance of watching external factors. The company's investment in the Houston brewery signifies a proactive stance toward growth, but geopolitical risks, particularly in Russia, remain a significant concern. As the market continues to evolve, AB InBev's ability to adapt to these changes will be critical in shaping investor sentiment and stock performance in the years ahead.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.