XPeng Inc. (XPEV) has shown some fluctuations in its stock price over the past six months, reflecting broader market dynamics and company-specific developments. As of June 2025, the company's share price is experiencing pressure, having closed at $18.31 recently. Analyst sentiment remains cautious yet hopeful, with several factors influencing its future trajectory. This report delves into XPeng's key financials, notable headlines, and a three-year outlook, providing investors with a comprehensive understanding of what lies ahead.

Key Points as of June 2025

- Revenue: Estimated to increase steadily

- Profit/Margins: Margins may remain pressured

- Sales/Backlog: Demand appears stable

- Share price: Currently at $18.31

- Analyst view: Mixed, consensus rating of “Hold”

- Market cap: Approx. $5 billion

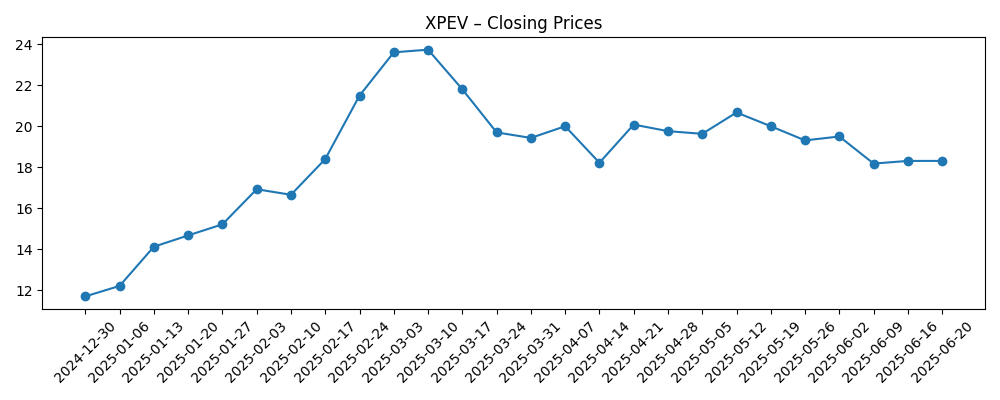

Share price evolution – last 6 months

Notable headlines

- Why XPeng Inc. (XPEV) Went Down On Tuesday – Yahoo Entertainment

- XPENG Announces Vehicle Delivery Results for May 2025 – GlobeNewswire

- XPeng (NYSE:XPEV) Upgraded to Buy at The Goldman Sachs Group – ETF Daily News

Opinion

XPeng's recent challenges, particularly the decline in share price, may stem from broader market conditions and investor sentiment regarding electric vehicle demand. The improvement in sales figures, particularly vehicle deliveries, signals potential recovery. However, the mixed rating from analysts suggests caution, as fluctuating demand in the EV sector continues to impact valuations across the board. XPeng needs to navigate these headwinds proactively to sustain investor interest.

The company's partnership with Huawei also hints at innovation in its product lineup, which could support future growth. Still, market perception remains skeptical, especially with significant stakeholders, like Deutsche Bank, reducing their investments. Such moves may lead to further volatility in stock performance as investor confidence weighs in response to these actions.

In looking to the future, XPeng must focus on delivering consistent products that meet consumer demand amidst increasing competition in the EV market. It is essential to maintain technological advancements and address production efficiencies to improve margins and profitability. Thus, while the outlook showcases potential for growth, the path is fraught with obstacles that management must strategically navigate.

Ultimately, if XPeng can capitalize on its technological innovations and reinforce its market position, it may see improved sentiment from analysts and investors alike. A sustained focus on operational efficiency and market responsiveness will be critical to achieving these goals in the coming years.

What could happen in three years? (horizon June 2025+3)

| Scenario | Outcome |

|---|---|

| Best | Revenue growth of 30% with strong market position |

| Base | Moderate growth of 15% as EV market stabilizes |

| Worse | Revenue declines by 5% due to market saturation |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Market demand for electric vehicles

- Technological advancements and partnerships

- Regulatory environment affecting EVs

- Investor sentiment and market trends

Conclusion

As XPeng Inc. navigates through volatile market conditions, its ability to sustain growth while improving its operational metrics will be closely observed by investors. The current share performance reflects both the challenges and prospects inherent in the EV sector. With strategic initiatives and potential improvements in consumer sentiment, XPeng may find itself in a more favorable position in the future. As it stands, maintaining a balance between innovation and efficiency is critical to securing a robust market presence, while also being adaptable to evolving consumer needs and competitive pressures in the electric vehicle landscape.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.