Unilever (ULVR.L) enters the next three years with a reset in expectations: the shares have lagged in the past year as topline momentum cooled and management leaned into brand support, productivity and portfolio focus. Reported revenue stands at 59.77B, but quarterly growth has softened as last year’s price increases annualize and volumes remain patchy across categories and geographies. The stock’s roughly 8% decline underscores an investor shift from pure price-led expansion to the harder work of reigniting volume, protecting shelf space and converting efficiency gains into cash. In consumer staples, where trading down and private label typically intensify when real incomes are squeezed, the narrative tends to hinge on repeatability of growth and resilience of cash returns. For Unilever that means balancing reinvestment with deleveraging and defending its dividend while cost inflation normalizes and foreign exchange stays volatile. The three-year outlook therefore depends less on headline pricing and more on the quality of execution: mix, innovation cadence, retailer negotiations, and the speed at which productivity programs drop through to free cash flow.

Key Points as of October 2025

- Revenue and growth: Revenue (ttm) is 59.77B; quarterly revenue growth (yoy) is -3.20%, reflecting normalization after price-led gains and mixed volumes.

- Profitability: Profit margin is 9.29% and operating margin is 18.85%; EBITDA totals 11.83B and net income is 5.55B, indicating resilient profitability amid slower growth.

- Sales/Backlog: Backlog is not applicable to fast-moving consumer goods; near-term demand visibility depends on sell-through and retailer inventory (data not disclosed).

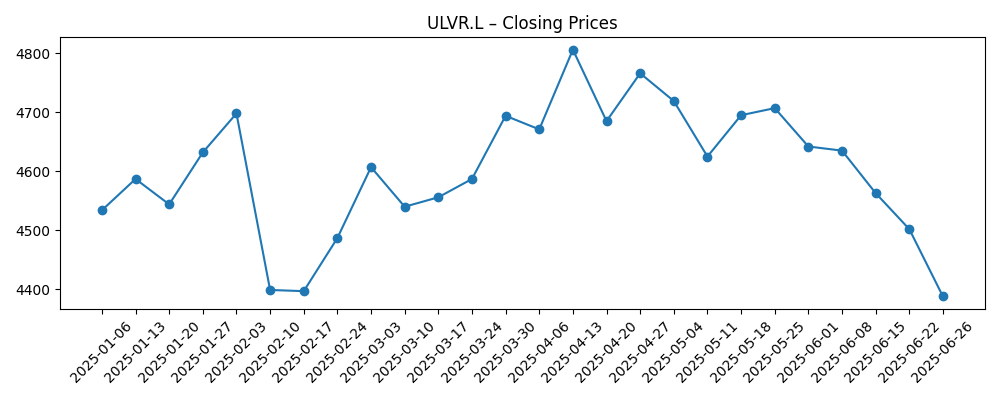

- Share price and trading: Last weekly close was 4,485; 52‑week range 4,311–4,910 with a 52‑week change of -8.01%. The 50‑day and 200‑day moving averages are 4,545.60 and 4,575.19.

- Valuation snapshot: Trailing P/E 22.48; forward P/E 15.24; PEG 1.67; EV/EBITDA 13.00; Price/Sales 2.10; Price/Book 6.94.

- Scale and risk: Market cap 107.69B; shares outstanding 2.45B; beta 0.25, indicating lower volatility relative to the market.

- Balance sheet: Total cash 5.37B; total debt 32.02B; debt/equity 160.68%; current ratio 0.76—execution on deleveraging and liquidity remains in focus.

- Cash and returns: Operating cash flow 8.44B; levered free cash flow 5.47B; forward dividend yield 3.45% with payout ratio 80.12% (ex‑div 8/14/2025).

- Qualitative: Competitive intensity from private label and retailer negotiations remains elevated; FX translation and input-cost moves are key external variables.

Share price evolution – last 12 months

Notable headlines

Opinion

Top-line softness is the first signal in the current setup. Quarterly revenue growth at -3.20% year over year, paired with quarterly earnings growth at -5.10%, points to a fading price-led contribution as last year’s increases annualize and promotions normalize. Unilever’s revenue base of 59.77B (ttm) remains substantial, but the quality of growth matters more than its absolute size now. The mix between price and volume is the swing factor: if volumes stabilize in core categories while maintaining price discipline, the company can defend shelf space without excessive promotion. Foreign exchange can still dilute reported growth, and retailer inventory management may add quarter-to-quarter noise. Against that backdrop, investors are watching how much of the recent productivity efforts translate into operating leverage rather than being fully recycled into marketing and innovation—essential spending that nonetheless can mask near-term margin progress.

Profitability and cash conversion are the counterweights to slower growth. Operating margin at 18.85% and profit margin at 9.29% indicate underlying resilience, supported by an 11.83B EBITDA base. Cash generation remains a relative strength, with 8.44B in operating cash flow and 5.47B in levered free cash flow. The capital structure, however, puts the spotlight on discipline: total debt of 32.02B and a current ratio of 0.76 argue for steady deleveraging and vigilant working-capital control. The forward dividend yield of 3.45% and payout ratio of 80.12% imply less headroom if earnings softness persists, so consistency in free cash flow will be critical to underpinting distributions. With beta at 0.25, the shares behave defensively, but that stability is best preserved by sustaining margins while avoiding a sharp uptick in promotion that would erode price architecture.

Within global consumer staples, the competitive dynamic is defined by trading down, private-label advances, and retailer pushback when inflation cools. Unilever’s valuation mix—trailing P/E of 22.48 versus a forward P/E of 15.24 and EV/EBITDA of 13.00—suggests the market expects earnings to recover as cost inflation normalizes and productivity programs take hold. Delivery will hinge on mix (premium formats and innovation), credible brand support that drives repeat purchase, and steady supply-chain execution. FX and country risk can still blur the read-through from operational improvements to reported results. In this environment, even modest volume recovery can have an outsized impact on narrative and, by extension, on the multiple investors are willing to assign to steadier cash flows.

Over a three-year horizon, the story likely shifts from price normalization toward volume-led growth, if execution lands. Success would show up in stable to improving margins with healthier contribution from mix and innovation, while cash conversion funds both reinvestment and debt reduction. If pricing must roll back to defend share, near-term margin pressure could follow, raising questions about dividend flexibility and the pace of deleveraging. The setup is therefore a balance: the company has scale, brand reach, and cash generation; the test is to convert those into durable volume momentum without sacrificing price architecture. That balance will shape the narrative investors apply to the shares and whether today’s forward-looking valuation compresses, holds, or expands.

What could happen in three years? (horizon October 2025+3)

| Scenario | Narrative (to Oct 2028) |

|---|---|

| Best | Volumes recover as innovation and premium mix gain traction; productivity savings drop through to margins; FX headwinds ease; steady deleveraging supports a sustainable dividend and room for selective portfolio moves. |

| Base | Volumes stabilize with modest growth; pricing normalizes without major giveback; margins hold broadly steady as reinvestment continues; cash generation funds disciplined debt reduction and a maintained dividend profile. |

| Worse | Consumer trading down accelerates and private label gains share; Unilever increases promotion to defend shelf space, pressuring margins; input costs or FX turn adverse; dividend flexibility narrows and deleveraging slows. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Volume trajectory and pricing elasticity as prior price increases fully annualize.

- Commodity, packaging and freight costs versus ongoing productivity savings.

- Foreign-exchange translation and country mix effects on reported results.

- Execution on marketing and innovation ROI while protecting operating margin.

- Portfolio actions, deleveraging progress, and dividend sustainability.

- Retailer negotiations and private-label competition across key markets.

Conclusion

Unilever’s setup blends resilient profitability with a growth reset. The data indicate slowing quarterly growth and solid margins, with cash generation supporting dividends even as leverage and liquidity warrant attention. In a sector where defensiveness is valued but not overpaid, the next leg depends on volume stabilization, credible brand support, and the degree to which productivity gains flow to the bottom line rather than being fully recycled. Valuation already embeds some improvement—forward earnings expectations are higher than the trailing print—so delivery will need to be consistent across categories and geographies to sustain the current multiple. Watch next 1–2 quarters: volume trends; pricing discipline and promotion intensity; input-cost and FX moves; marketing ROI; free-cash-flow conversion; progress on leverage and any portfolio updates. Together these will determine whether the narrative evolves from price normalization to durable, volume-led growth that can support a stable dividend and gradually improving balance sheet.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.