UniCredit (UCG.MI) enters the next three years from a position of strength: revenue of 24.82B (ttm), profit margin 42.71%, and ROE 16.34% underline robust profitability, while the share price has surged 77.35% over 12 months, nearing its 52-week high. Management has been active on portfolio moves, completing the merger with Alpha Bank Romania and lifting its Commerzbank stake to 26%, even as both sides play down takeover prospects. With a forward dividend yield of 3.70% and payout ratio of 36.36%, capital returns look supported by earnings momentum (quarterly revenue growth 10.20% and earnings growth 24.90% yoy). Against an evolving European rate cycle, investors will watch whether margins and volumes can hold, and how regulators react to UniCredit’s growing strategic footprint in Germany and Southeast Europe.

Key Points as of September 2025

- Revenue: 24.82B (ttm); quarterly revenue growth (yoy) 10.20%.

- Profit/Margins: profit margin 42.71%; operating margin 71.61%; EPS (ttm) 6.61; ROE 16.34%.

- Sales/Backlog: earnings momentum strong with quarterly earnings growth (yoy) 24.90%; rate sensitivity remains a core driver of volumes and fees.

- Share price: last close 64.92 (2025-09-05); 52-week high 69.82; 52-week low 35.45; 50-day MA 62.92; 200-day MA 52.00; 52-week change 77.35%; beta 1.27.

- Analyst view: Citi resumed coverage with a Buy; forward dividend yield 3.70%; payout ratio 36.36%.

- Market cap/ownership: large-cap profile; shares outstanding 1.53B; float 1.49B; institutions hold 50.65%.

- Capital & liquidity: total cash 172.98B; total debt 216.86B; book value per share 43.66; operating cash flow (ttm) -1.15B.

- Corporate actions: Commerzbank stake raised to 26%; Commerzbank leadership signals takeover unlikely; Alpha Bank Romania merger completed.

- Trading liquidity: average volume (3M) 5.1M; (10D) 4.93M.

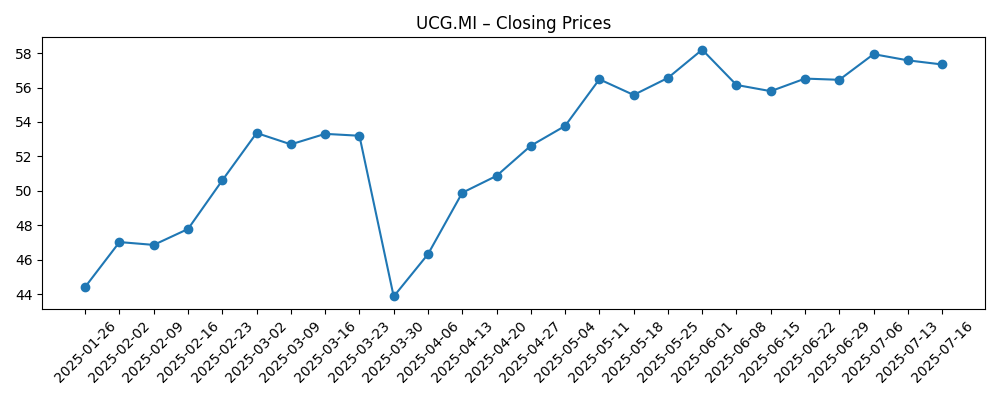

Share price evolution – last 12 months

Notable headlines

- UniCredit completes merger with Alpha Bank Romania

- UniCredit’s Commerzbank takeover unlikely, says German bank CEO

- UniCredit increases Commerzbank stake to 26%

- UniCredit resumed with a Buy at Citi

- UniCredit S.p.A. Unsponsored ADR short interest update (UNCRY)

Opinion

UniCredit’s move to 26% in Commerzbank is the most consequential strategic development for its three-year outlook. The increased stake boosts optionality: it can seek commercial partnerships, influence strategic direction, and potentially capture cross-border synergies in transaction banking, payments, and corporate lending—without committing to a full takeover. Public messaging from German leadership that a takeover is unlikely tempers expectations and reduces immediate political friction. For investors, the stake can still create value if it opens revenue-sharing or cost-efficiency initiatives, but it also raises governance complexity and regulatory scrutiny. In the near term, clarity on intentions and any formal cooperation agreements will help narrow the scenario spread for earnings and capital planning. A disciplined, partnership-first stance could let UniCredit benefit from strategic proximity while preserving balance-sheet flexibility.

Operationally, UniCredit’s profitability metrics are a support for the equity story: operating margin of 71.61% and ROE of 16.34% indicate a well-tuned cost base and pricing power. The challenge through the next leg of the cycle is sustaining those levels as the European Central Bank calibrates policy. If rates drift lower, net interest income could moderate, making fee income, cost discipline, and risk costs the swing factors for earnings. The bank’s quarterly revenue growth of 10.20% and earnings growth of 24.90% yoy set a high bar for comps; a gentle deceleration would still be compatible with a solid investment case provided asset quality remains stable. With book value per share at 43.66, the market appears to be underwriting continued profitability and controlled risk, especially given the stock’s strong 52-week performance.

Portfolio actions add another layer. Completing the merger with Alpha Bank Romania signals focus on scalable, adjacent markets where UniCredit can leverage technology and product depth. Execution will matter: customer retention, IT integration, and cross-selling will determine whether the combination lifts returns. Meanwhile, the Commerzbank position could function as a strategic platform rather than a prelude to consolidation, aligning with public statements that downplay a takeover. This “optionality without obligation” approach keeps political risk contained and preserves capital for organic growth and shareholder distributions. It also provides levers to pivot if the macro backdrop shifts—tightening collaboration in good times or simply maintaining a financial investment if conditions sour.

From a market standpoint, the share price trades above moving averages (50-day 62.92; 200-day 52.00), reflecting improved sentiment and strong delivery. The forward dividend yield of 3.70% and a payout ratio of 36.36% suggest room for continued cash returns while retaining earnings for growth and buffers. Liquidity metrics—average volumes near 5M—should support institutional participation, while beta of 1.27 indicates moderate cyclicality relative to broader indices. Over three years, the equity story likely pivots on three drivers: policy rates and deposit dynamics, regulatory posture toward cross-border influence in Germany, and the ability to deepen fee franchises. If UniCredit can execute on integration and partnership gains while keeping costs and risk contained, the current premium to book value appears defensible.

What could happen in three years? (horizon September 2025+3)

| Best | Regulators accept a partnership-led approach with Commerzbank; operating efficiency holds; fee income expands; integration in Romania delivers cross-sell gains; dividend growth continues alongside disciplined balance-sheet management; valuation supported by sustained profitability. |

| Base | Rate normalization trims net interest income, offset by stable fees and cost control; Commerzbank stake remains a financial holding with selective commercial cooperation; Romania integration on track; dividends maintained in line with earnings. |

| Worse | Macro slowdown and faster deposit repricing compress margins; regulatory pushback limits strategic benefits from the Commerzbank stake; integration hiccups in Southeast Europe; higher credit costs hit earnings and investor confidence. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- ECB policy path and deposit pricing dynamics affecting net interest income and margins.

- Regulatory and political stance in Germany regarding UniCredit’s 26% Commerzbank stake.

- Execution on Alpha Bank Romania integration, including customer retention and IT migration.

- Asset quality trends and credit costs across core corporate and retail portfolios.

- Capital return policy versus growth investments, considering payout sustainability.

- European macro conditions, market volatility, and sector risk sentiment (beta 1.27).

Conclusion

UniCredit’s investment case over the next three years leans on robust starting fundamentals and prudent strategic optionality. Elevated profitability (profit margin 42.71%; ROE 16.34%) and solid top-line momentum provide room to navigate a softer rate environment, while the forward dividend yield of 3.70% and a measured payout ratio offer income support without sacrificing resilience. The completed merger in Romania and the 26% Commerzbank stake expand UniCredit’s strategic radius, yet public signals that a takeover is unlikely help limit near-term political and execution risk. Key watchpoints include the pace of ECB policy normalization, deposit behavior, integration milestones in Southeast Europe, and any formalization of cooperation with Commerzbank. With the stock up 77.35% over the past year and trading above key moving averages, expectations are not low. Continued delivery on costs, fees, and risk control will be critical to sustain the current equity narrative.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.