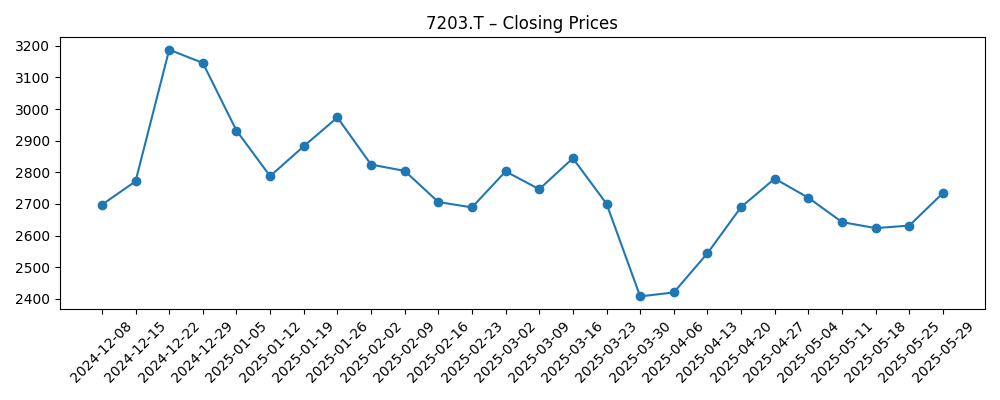

Toyota Motor (7203.T) enters late‑2025 balancing tariff headwinds with operational resilience. The automaker’s latest quarter showed pressure on earnings, and management cut its full‑year outlook amid U.S. tariff uncertainty, according to recent media reports. Yet the balance sheet remains deep, with ¥15.97T in cash, steady operating cash flow, and a forward dividend yield of 3.28% supported by a 27.68% payout ratio. Shares have been volatile this year—sliding to ¥2,407.5 in late March before recovering to ¥2,904.5 on August 27—while the 50‑day and 200‑day moving averages sit at ¥2,651.65 and ¥2,723.61, respectively. With TTM revenue of ¥48.45T, a profit margin of 8.82% and beta of 0.24, the stock’s three‑year setup hinges on policy outcomes, product mix execution (hybrid/EV), and capital allocation discipline.

Key Points as of August 2025

- Revenue: TTM revenue ¥48.45T; gross profit ¥8.5T; quarterly revenue growth (yoy) 3.5%.

- Profit/Margins: Profit margin 8.82%; operating margin 9.52%; net income ¥4.27T; EBITDA ¥6.87T; diluted EPS 325.21.

- Cash flow: Operating cash flow ¥4.89T; levered free cash flow ¥1.31T.

- Balance sheet: Cash ¥15.97T; total debt ¥38.44T; current ratio 1.27; total debt/equity 103.92%.

- Share price: Last close ¥2,904.5 (Aug 27, 2025); 52‑week range ¥2,226.5–¥3,220.0; 50‑day MA ¥2,651.65; 200‑day MA ¥2,723.61; beta 0.24.

- Market cap: Approx. ¥37.8T (¥2,904.5 × 13.03B shares outstanding).

- Dividend: Forward annual dividend ¥95; yield 3.28%; payout ratio 27.68%; next ex‑div date 9/29/2025.

- Ownership & liquidity: Shares outstanding 13.03B; float 9.76B; insiders 15.21%, institutions 26.01%; avg 3‑month volume 29.42M.

- Outlook watch: Quarterly earnings growth (yoy) −36.90%; tariff‑driven guidance cuts highlighted in recent reporting.

Share price evolution – last 12 months

Notable headlines

- Toyota slashes outlook on tariff concerns as profit plunges 37% [Fortune]

- Trump tariffs shock: Toyota cuts full-year earnings forecast, Q1 net profit drops 37% [Livemint]

Opinion

The headline risk around tariffs has clearly become the main driver of Toyota’s near‑term narrative. A lowered full‑year outlook following a steep year‑on‑year earnings decline places more weight on management’s cost and pricing actions in North America. With a beta of 0.24, the stock tends to move less than the broader market, but policy shocks can still compress valuation if investors anticipate prolonged margin pressure. The share price path since March suggests the market is willing to look past the trough—recovering from ¥2,407.5 to ¥2,904.5—yet conviction will likely track clarity on import duties, localization plans, and any pass‑through of higher costs. In this context, Toyota’s scale, brand strength and flexible powertrain mix offer buffers while the company recalibrates guidance.

Strategically, Toyota can mitigate tariff friction by accelerating regionalization of supply and production, deepening North American sourcing, and optimizing its hybrid‑led bridge to full electrification. The company’s breadth—from hybrids and plug‑ins to fuel‑cell and software features—allows it to pursue margins over pure volume. Success will depend on prioritizing high‑contribution models, pacing EV rollouts to match demand and charging infrastructure, and extracting cost from batteries and electronics. Management’s capital allocation—balancing growth capex with shareholder returns—will be read as a signal of confidence. Execution that stabilizes operating margin while preserving product cadence could reset consensus over the next several quarters, even without a rapid macro tailwind.

Financially, Toyota enters this phase with meaningful liquidity and internal cash generation. Cash of ¥15.97T, operating cash flow of ¥4.89T and positive levered free cash flow provide latitude to invest through the cycle while maintaining a forward dividend yield of 3.28% on a 27.68% payout ratio. That income support, combined with the stock’s trading above its 50‑day and 200‑day moving averages, should help limit downside if policy noise persists. Still, quarterly earnings growth of −36.90% year‑on‑year underscores that near‑term comps are difficult. The next ex‑dividend date (9/29/2025) is a near‑term catalyst for income‑focused holders, but longer‑term multiple expansion will likely require evidence that pricing, mix and cost cuts can offset tariff friction.

Looking three years out, scenarios hinge on geopolitics and execution. If tariff pressures ease or are offset by deeper localization, Toyota’s diversified lineup could sustain steady revenue and margin recovery, with hybrids anchoring earnings while EV economics improve. In a middling case, tariffs linger but stabilizing supply chains and selective price actions contain damage, keeping cash flows adequate for investment and dividends. The bear case would be extended tariff escalation and slower demand in key markets, forcing tougher trade‑offs between market share and profitability. Against that backdrop, Toyota’s lower beta and scale argue for resilience, but investors should expect a path defined by policy milestones, model launch cadence, and cost‑down progress in batteries and software.

What could happen in three years? (horizon August 2025+3)

| Scenario | Narrative | Implications |

|---|---|---|

| Best | Tariff pressures fade or are neutralized by localization; hybrid leadership funds EV scale‑up; cost reductions stabilize margins. | Valuation re‑rates as confidence in earnings durability returns; share price sentiment improves toward prior cycle highs. |

| Base | Tariffs persist but are manageable; pricing, mix and efficiency offset most headwinds; product cadence remains steady. | Range‑bound trading with a constructive bias; dividend continues to anchor total return while modest growth resumes. |

| Worse | Tariffs escalate and demand softens in key markets; higher input costs and pricing caps compress margins. | De‑rating risk; focus shifts to capital preservation, deeper cost actions and portfolio prioritization. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Trade policy outcomes and tariff timelines in the U.S. and other major markets.

- Product mix execution across hybrids/EVs and the pace of cost reductions in batteries and electronics.

- Currency moves and input‑cost volatility affecting pricing power and margins.

- Supply chain resilience, localization progress and any production disruptions.

- Capital allocation signals, including dividends, buybacks and investment pacing.

Conclusion

Toyota’s three‑year outlook is defined less by demand for cars than by the cost of selling them into tariff‑sensitive markets. Recent guidance cuts reflect that reality, but the financial profile—strong liquidity, positive free cash flow and a covered dividend—gives management room to adapt without sacrificing strategic initiatives. The share price recovery from March lows toward current levels above key moving averages suggests investors see a pathway to stabilization, provided pricing and cost actions hold. In our view, the base case is gradual normalization as localization offsets policy drag and hybrids bridge the margin gap while EV economics improve. Upside could come from a friendlier policy backdrop or faster cost‑downs; downside stems from prolonged tariffs or weaker end‑markets. For now, expect a patience trade supported by income, with catalysts tied to policy milestones and execution on mix, cost and software.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.