SAP SE enters the next three years with accelerating earnings and a cloud-first strategy that is starting to scale. The last reported quarter showed earnings growth of about 91.10% year over year, supported by operating discipline and a richer cloud software mix, while trailing twelve-month revenue stands at 35.89B. Shares rallied into early 2025 before settling into a tighter range, reflecting a broader rotation within software and a wait-and-see stance on enterprise IT budgets. What changed is not just the pace of results, but the quality: more recurring revenue, stronger cash conversion, and clearer product roadmaps around AI-enabled applications. It changed because SAP’s migration programs and partnerships are converting installed-base demand, and cost structures are normalizing after prior restructuring. It matters because the three-year debate now hinges on durability—whether margin gains and cloud momentum persist as macro tailwinds fade. Sector-wide, enterprise software is moving deeper into subscription and AI, rewarding platforms with sticky workloads and credible expansion paths.

Key Points as of October 2025

- Revenue: Trailing revenue at 35.89B with quarterly revenue growth of 8.90% year over year, evidencing steady expansion in core applications and cloud.

- Profit/Margins: Profit margin at 18.23% and operating margin at 28.46%; gross profit of 26.48B underscores scalable software economics.

- Sales/Backlog: Backlog data not disclosed in the provided figures; headlines and company commentary point to robust cloud demand and migrations.

- Balance sheet/liquidity: Total cash 10.18B vs. total debt 8.75B; current ratio 1.03 and debt/equity 21.13% provide financial flexibility.

- Cash flow: Operating cash flow 7.19B and levered free cash flow 7.37B support continued investment and dividends.

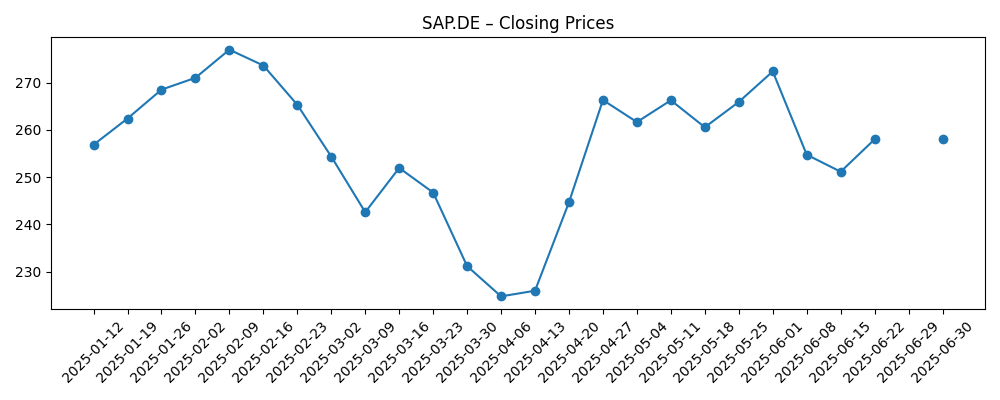

- Share price: 52-week range 208.70–283.50; 50-day moving average 232.15 vs. 200-day 249.87; 52-week change 8.98%; beta 0.90.

- Dividend: Forward annual dividend yield 1.02% with a payout ratio of 42.27%; ex-dividend date was 5/14/2025.

- Analyst/sentiment: Reuters noted SAP beat earnings estimates in June 2025 on robust cloud performance; trading liquidity healthy (avg 3M volume 1.35M).

- Market cap/ownership: Market cap not disclosed here; shares outstanding 1.16B, float 963.12M; institutions hold 40.58%, insiders 11.31%.

- Qualitative position: ERP installed base, RISE with SAP, and ecosystem deals (e.g., Siemens IoT) strengthen competitive footing; regulatory clearance activity noted.

Share price evolution – last 12 months

Notable headlines

- SAP SE Announces Third Quarter 2025 Results

- SAP SE outlines 2025 innovation roadmap at annual conference

- SAP appoints new Chief Sustainability Officer

- German regulator approves SAP's acquisition of IT service firm

- SAP SE beats earnings estimates with robust cloud performance

- SAP SE signs multi-year partnership with Siemens for IoT solutions

Opinion

Results suggest SAP’s mix shift is doing the heavy lifting. Strong quarterly earnings growth against high-20s operating margins indicates that subscription revenue is scaling and cost discipline is holding. The absence of disclosed backlog figures in our dataset limits visibility, but beats reported by external outlets align with healthy demand for core ERP and surrounding cloud services. Cash generation looks durable, with free cash flow exceeding operating cash flow in the trailing period—an indication of working-capital tailwinds and lower cash restructuring outflows. Together, these pieces support the view that SAP’s earnings power is becoming more recurring, less cyclical.

That said, the pace of earnings expansion is unlikely to remain near recent levels as comparisons toughen and sales cycles reflect macro uncertainty. The key debate is margin sustainability as cloud infrastructure costs, AI investments, and services delivery scale up. If SAP continues to convert its installed base through RISE with SAP and expands attach into analytics, supply-chain, and sustainability modules, mix can support gross margin resilience. Conversely, heavier services mix or elongated migrations could cap near-term operating leverage. Monitoring cloud gross margin and services utilization will be essential to gauge the quality of growth.

Within enterprise software, SAP’s moat rests on mission-critical ERP workflows that are expensive to rip and replace. That confers pricing power, especially as customers modernize to S/4HANA and embed AI-driven automation. Partnerships like the Siemens IoT tie-up can thicken value propositions in manufacturing and asset-heavy industries, while a clearer sustainability agenda may help in Europe’s regulatory environment. Competitive pressure from hyperscalers and suite rivals remains real, but SAP’s differentiated domain model and process depth can offset multi-product bundling from peers if integration stays tight.

For the equity narrative, a more predictable cloud base typically commands a higher and steadier multiple. If investors gain confidence in backlog conversion, churn discipline, and margin durability, the story could re-rate toward “quality compounder” rather than “turnaround.” However, if macro softness in Europe or currency swings hit new bookings, the multiple can compress given already solid performance in the last year. Dividend support (with a 1.02% forward yield) and a moderate beta provide some downside ballast, but multiple trajectory will track execution on AI features, partner-led sales, and time-to-value for RISE projects.

What could happen in three years? (horizon October 2025+3)

| Case | Narrative |

|---|---|

| Best | Installed-base migrations accelerate as customers standardize on RISE with SAP, AI-infused modules drive upsell, and services delivery becomes more productized. Cloud gross margins expand on scale efficiencies, and partnerships (e.g., IoT and industry clouds) unlock new logos. Earnings quality improves with lower volatility, sustaining a premium narrative. |

| Base | Migrations progress steadily but unevenly across regions. AI features support higher engagement without materially changing win rates. Margins hold near current levels as efficiency gains offset investment. The stock tracks fundamentals with periodic macro-driven swings, anchored by predictable cash generation and a stable dividend framework. |

| Worse | Enterprise spending slows, elongating sales cycles and delaying migrations. Higher delivery costs and a larger services mix pressure margins, while competition intensifies in analytics and middleware. Currency headwinds and regulatory friction add noise, leading to a de-rating until execution and demand visibility improve. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Pace of S/4HANA and RISE with SAP migrations (backlog conversion, churn, and attach of adjacent modules).

- Cloud gross margin trajectory versus AI and infrastructure investment needs.

- Enterprise IT spending cycle in Europe and the U.S., including timing of large ERP modernization projects.

- Foreign exchange movements affecting reported growth and profitability.

- Integration and execution on partnerships and approved acquisitions, including regulatory and data residency requirements.

- Competitive actions from suite and hyperscaler rivals, including pricing and bundling strategies.

Conclusion

SAP’s setup into the next three years is defined by a healthier earnings mix, solid margins, and a credible roadmap to deepen wallet share across its vast ERP base. Trailing revenue and profitability metrics suggest scale and operating discipline, while recent beats point to demand resilience. The balance sheet and cash generation provide flexibility to invest in AI features, industry clouds, and partner ecosystems without overleveraging. The question for the equity story is durability: can SAP maintain margin quality as migrations broaden and services scale, and can it translate AI into tangible adoption rather than pilot fatigue? The answer will likely drive the multiple more than near-term swings in bookings. Watch next 1–2 quarters: backlog conversion trends; cloud gross margin and services mix; RISE deal velocity; cash flow seasonality; competitive pricing. If execution stays consistent and macro headwinds remain manageable, the narrative should continue to shift from cyclical to compounding, with valuation anchored by recurring revenue and disciplined capital allocation.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.