As of June 2025, Tesla, Inc. is navigating through a challenging landscape marked by declining EV sales in Europe and the anticipation of its upcoming robotaxi service launch. The electric vehicle giant has witnessed a significant drop in quarterly earnings, with a notable year-over-year revenue decline. Despite maintaining a strong market presence, analysts remain cautious, evaluating Tesla's response to increased competition and evolving market conditions. The company's strategic decisions in the coming months will be crucial as it seeks to stabilize its performance and regain investor confidence.

Key Points as of June 2025

- Revenue: $95.72B

- Profit Margin: 6.38%

- Quarterly Revenue Growth (YoY): -9.20%

- Share Price: $325.31

- Analyst View: Mixed, with various ratings

- Market Cap: Approx. $1.05T

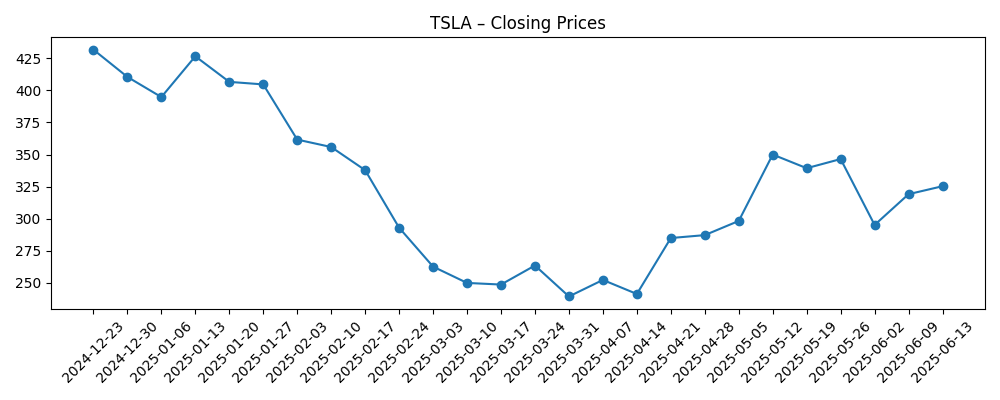

Share price evolution – last 6 months

Notable headlines

- Tesla facing new challenge as its EV sales decline in Europe – Yahoo Entertainment

- TD Cowen Maintains Buy Rating on Tesla (TSLA) – Yahoo Entertainment

- Tesla, Inc. (TSLA) Set to Launch Robotaxi Service in Austin on June 12 – Yahoo Entertainment

- Elon Musk says he’ll still lead Tesla in 5 years: ‘Unless I die’ – Quartz India

Opinion

The decline in Tesla's EV sales in Europe poses a significant challenge for the company as it grapples with evolving competition and market saturation. Analysts have pointed to the necessity of strategic adjustments, particularly as new entrants, like Xiaomi's SUV, begin to capture market share in the EV space. This competitive pressure may influence not only sales but also investor sentiment, which is critical given Tesla's volatile stock performance over the past six months. The launch of the robotaxi service in Austin represents a potential turning point for Tesla, providing an opportunity to showcase its technological advancements and regain momentum in a competitive market.

Furthermore, the broader economic context, including interest rate fluctuations and potential regulatory changes, could impact consumer demand for electric vehicles. The mixed ratings from analysts suggest a divided outlook on Tesla's capacity to navigate these waters effectively. If the company can leverage its innovations while addressing shortcomings in production and sales strategies, it stands a chance to stabilize its revenue and profit margins over the coming quarters. However, failure to adapt may lead to further declines, emphasizing the urgency of decisive action.

Investors should closely monitor key developments, including the performance of the newly launched robotaxi service and Tesla's response to changing consumer preferences. As competition intensifies, the need for differentiation and sustainability in product offerings becomes increasingly paramount. This period of transition may reveal whether Tesla can maintain its leading position in the EV market or cede ground to rivals. The outcome of these strategic initiatives could significantly influence Tesla's share price trajectory in the next three years.

In the short term, volatility around Tesla's stock could continue as the market recalibrates its expectations based on upcoming quarterly results and strategic announcements. The company's ability to communicate a clear vision for overcoming current challenges will be crucial in shaping its narrative and restoring investor confidence. Ultimately, the interplay of innovation, market dynamics, and management efficacy will define Tesla's path forward amidst rising uncertainties.

What could happen in three years? (horizon June 2025+3)

| Scenario | Outcome |

|---|---|

| Best | Share price rises to $500 as EV adoption increases and robotaxi service succeeds. |

| Base | Share price stabilizes around $400 with moderate sales growth and improved margins. |

| Worse | Share price drops to $200 if sales decline persist and competition intensifies. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Consumer demand for EVs

- Competition from new market entrants

- Success of the robotaxi service

- Global economic conditions

- Regulatory changes affecting EVs

Conclusion

In summary, Tesla, Inc. faces a multifaceted set of challenges and opportunities as it progresses through 2025. The decline in sales, particularly in key markets like Europe, underscores the urgent need for the company to innovate and adapt. The potential success of new initiatives, such as the robotaxi service, could provide a much-needed boost to both sales and investor sentiment. Analysts hold a cautious yet optimistic view, reflecting a belief in Tesla's long-term prospects, although concerns about competition and economic pressures persist. As stakeholders evaluate Tesla's trajectory, the coming months will be critical in determining how well the company can leverage its brand and technological advantages amidst a rapidly changing landscape.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.