As of August 2025, Tesla’s setup blends strong balance‑sheet resilience with cyclical pressure on growth and margins. Trailing‑12‑month revenue sits at $92.72B while the most recent quarter showed a -11.80% year‑over‑year revenue decline and profit margin of 6.34%, underscoring price competition and product mix headwinds. Liquidity remains a strength with $36.78B in cash against $13.13B in total debt and a 2.04 current ratio. The stock’s 52‑week change of 69.48% highlights a powerful rebound, yet volatility (beta 2.33) and headlines around autonomy, governance, and legal matters keep sentiment polarized. Shares recently traded near $349.60 (8/27/2025), roughly between the 50‑day ($322.97) and 200‑day ($329.73) moving averages. Over the next three years, the investment debate hinges on whether software and AI monetization can offset near‑term auto margin pressure and legal or regulatory risks tied to driver‑assistance systems.

Key Points as of August 2025

- Revenue: TTM revenue of $92.72B; quarterly revenue growth (yoy) at -11.80% indicates softer demand/pricing dynamics.

- Profit/Margins: Gross profit $16.21B; profit margin 6.34%; operating margin 4.10% – reflecting competitive pressures and investment in new programs.

- Earnings/CF: Net income $5.88B; diluted EPS 1.68; operating cash flow $15.77B; levered free cash flow $1.34B.

- Balance sheet: Total cash $36.78B vs total debt $13.13B; current ratio 2.04; debt/equity 16.82% supports ongoing capex and software bets.

- Share price/volatility: Recent close ~$349.60 (8/27/2025); 50‑DMA $322.97; 200‑DMA $329.73; 52‑week range $205.97–$488.54; beta 2.33.

- Ownership/short interest: Shares outstanding 3.23B; float 2.71B; institutions hold 50.95%; short interest 76.71M (2.73% of float); short ratio 0.87.

- Sales/Backlog: Reported yoy revenue decline and margin mix imply cautious delivery trends; backlog commentary not provided here.

- Analyst view: Sentiment remains divided – bulls emphasize autonomy/AI optionality; bears focus on margin compression and legal overhangs.

- Market/liquidity: High liquidity profile with 3‑month average volume of 99.23M and 10‑day average volume of 73.79M.

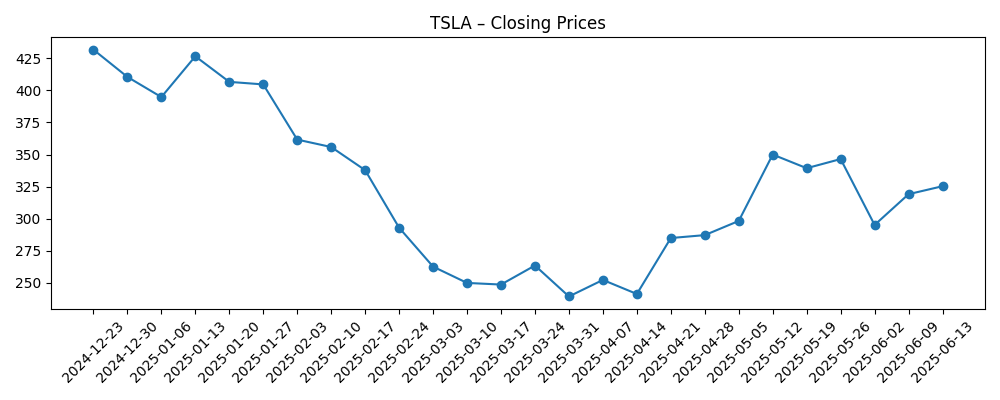

Share price evolution – last 12 months

Notable headlines

- Tesla Reportedly Shuts Down AI Project Weeks After Musk Called It “Spectacular” [Gizmodo]

- Tesla rejected $60 settlement in Autopilot case that ultimately cost it 4 times that amount [The Verge]

- The lawyer who beat Tesla is ready for ‘round two’ [The Verge]

- Tesla Will Use A Powerful New Weapon in AI Race [Gizmodo]

- Tesla proposes giving Elon Musk $29 billion so he stays CEO [The Verge]

- The viral video of a ‘deactivated’ Tesla Cybertruck is most likely fake [The Verge]

- A Viral Cybertruck Hoax Got So Big, Tesla Had to Break Its Silence [Gizmodo]

- Musk Moves to Bring Tesla Power to U.K. As Car Sales Stumble [Gizmodo]

Opinion

Investors should read the AI headlines in context: rapid iteration can look like volatility, but it is often how frontier software matures. Reports that an internal AI project was shut down weeks after being praised suggest an aggressive capital allocation cycle in which weaker bets are culled quickly while compute and teams are redeployed to higher‑conviction efforts. Combined with coverage that Tesla will use a new tool in the AI race, the near‑term takeaway is not binary success or failure but cadence: the company is likely to cycle through models, partners, and tooling frequently. For equity holders, the key is whether this churn produces sustained software attach rates or upgraded autonomy tiers that can stabilize margins when hardware prices remain under pressure.

The legal drumbeat around Autopilot remains a core overhang for the multiple. Reports of a rejected small settlement that later proved costlier, and a plaintiff attorney signaling “round two,” underscore that litigation expenses, potential adverse judgments, and reputational impacts may persist. While none of these headlines alone determine the three‑year path, they influence regulator posture and consumer perception, both critical to rolling out more advanced driver‑assistance. If legal risk grows, Tesla may throttle feature rollout, bundle differently, or reprice software to balance uptake with liability exposure. That scenario tempers upside from autonomy while emphasizing the value of Tesla’s strong cash position to absorb episodic legal costs.

Governance narratives, including the proposal to grant Elon Musk a substantial pay package to retain him as CEO, feed directly into the bull case on AI and robotics optionality. Supporters argue that leadership continuity and founder‑driven urgency are essential to deliver the software roadmap, while skeptics worry about key‑man risk and potential dilution of focus across ventures. Over a three‑year horizon, clarity on leadership incentives and strategic prioritization could compress or expand the valuation multiple independently of unit growth. If governance stabilizes with clear milestones and disclosures, investors may be more willing to underwrite long‑dated software value even as near‑term auto margins remain modest.

On the product side, the Cybertruck hoax episode and subsequent company response highlight the noise‑to‑signal ratio in Tesla’s media cycle, but they also demonstrate the need for disciplined communications when narratives can sway demand. Meanwhile, energy expansion ambitions, including moves to bring Tesla Power to the U.K., provide a potential second growth pillar that is less exposed to EV price wars. If energy storage, grid services, and software begin to scale alongside autonomy offerings, Tesla could re‑rate as a broader energy‑tech platform. Conversely, if EV competition intensifies and software monetization lags, the equity could revert to tracking auto‑cycle dynamics, where valuation depends more on cost control than on optionality.

What could happen in three years? (horizon August 2025+3)

| Scenario | Narrative | Signals to watch |

|---|---|---|

| Best | Autonomy and energy scale into meaningful profit contributors, offsetting auto margin pressure. Legal overhangs are contained, governance stabilizes, and software take‑rates rise, supporting a stronger multiple. | Faster feature rollouts with positive safety data; improving sentiment after legal milestones; evidence of rising software/energy mix in updates. |

| Base | EV margins remain mixed amid competition, but incremental software and energy growth stabilize profitability. Litigation remains manageable, and leadership focus is clear, keeping valuation range‑bound versus long‑term averages. | Delivery cadence steady but price‑sensitive; periodic AI/tooling updates; measured expansion in storage and services. |

| Worse | Legal or regulatory outcomes constrain driver‑assistance features; competitive pricing compresses margins; AI initiatives fail to translate to monetization, leading to prolonged multiple compression. | Adverse verdicts or stricter rules; continued discounting; slower software adoption and muted energy deployments. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Regulatory and legal outcomes tied to Autopilot/driver‑assistance capabilities and related disclosures.

- Trajectory of unit demand and pricing in core EV models amid intensifying global competition.

- Pace and credibility of AI/autonomy feature releases and evidence of durable software monetization.

- Execution in energy storage and grid services as a second growth engine to diversify revenue.

- Governance clarity, including leadership incentives and capital allocation toward AI, robotics, and manufacturing.

- Macro factors affecting risk appetite and rates, given the stock’s high beta and growth profile.

Conclusion

Tesla enters the next three years with contrasting signals: solid liquidity and scale on one hand, and cyclical pressure on growth and margins on the other. The numbers show a company capable of funding bold bets – $36.78B in cash, positive operating cash flow, and manageable leverage – yet also one contending with a -11.80% yoy revenue slide and mid‑single‑digit profit margins. From here, the stock’s path will likely be set by non‑auto levers: autonomy progress, energy expansion, and the company’s ability to translate rapid AI iteration into monetizable features. Legal and governance headlines may add valuation volatility, but they also act as catalysts if resolved constructively. For long‑term investors, the risk‑reward balances on whether software and services can steadily raise the profit and cash mix while EV pricing remains competitive.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.