Suntory Beverage & Food Limited (2587.T) enters August 2025 with resilient margins and a share price that has trailed the market. Trailing‑twelve‑month revenue stands at ¥1.69T, with operating margin of 10.14% and profit margin of 5.23%. Cash generation remains solid (operating cash flow ¥189.14B; levered free cash flow ¥74.56B), supported by a conservative balance sheet (cash ¥145.88B vs debt ¥48.18B; current ratio 1.23). Still, top‑line momentum softened, with quarterly revenue down 1.10% year over year and quarterly earnings down 2.00%. The stock is down 10.95% over 12 months, trades near ¥4,672, and offers a forward dividend yield of 2.56% with a 43.82% payout ratio. With a very low 5‑year beta of 0.01, the name has behaved defensively as management navigates pricing, mix and cost inflation.

Key Points as of August 2025

- Revenue: TTM revenue ¥1.69T; most recent quarterly revenue growth −1.10% year over year.

- Profit/Margins: Operating margin 10.14%; profit margin 5.23%; ROE 8.37%; ROA 4.77%.

- Sales/Backlog: No formal backlog metric in beverages; quarterly earnings growth −2.00% year over year.

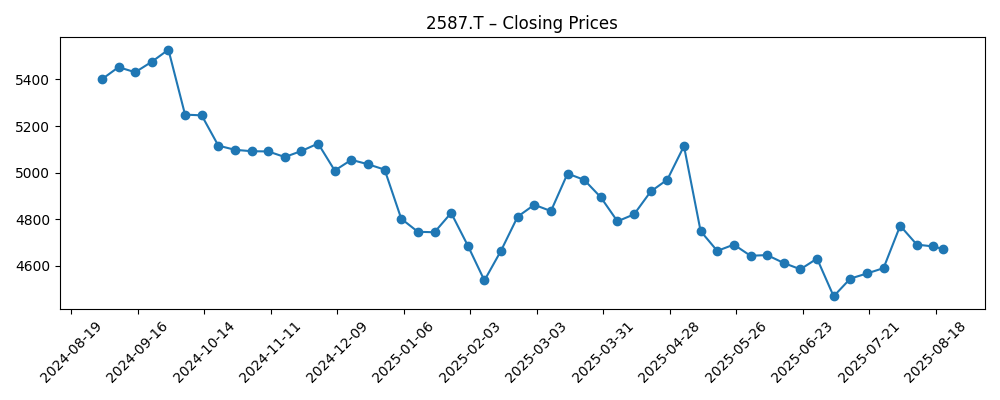

- Share price: Last close ~¥4,672; 52‑week change −10.95%; 52‑week high ¥5,602, low ¥4,442; 50‑day MA ¥4,605.40; 200‑day MA ¥4,810.19; beta 0.01.

- Dividend: Forward dividend ¥120 (yield 2.56%); payout ratio 43.82%; next ex‑dividend date 12/29/2025.

- Balance sheet: Cash ¥145.88B; debt ¥48.18B; debt/equity 3.65%; current ratio 1.23.

- Cash flow: EBITDA ¥223.25B; operating cash flow ¥189.14B; levered free cash flow ¥74.56B.

- Market cap: Approximately ¥1.44T, based on ~309M shares outstanding and a ~¥4,672 share price.

- Ownership/liquidity: Insiders hold 59.70%; institutions 20.61%; float 123.52M; average 3‑month volume ~641k shares.

Share price evolution – last 12 months

Notable headlines

Opinion

The share price path over the past six months suggests a market reassessing growth versus defensiveness. After sliding from early May into a July low near the ¥4,469 area, the stock partially recovered in early August before settling around ¥4,672 as of August 21. Against that backdrop, fundamentals look steady rather than spectacular: revenue is essentially flat to slightly lower year over year, while margins remain respectable. With a 52‑week change of −10.95% and a very low beta, the equity has behaved more like a steady consumer staple than a growth vehicle. In our view, absent fresh catalysts, the market is waiting to see sustained pricing power and volume stability before rewarding the shares with a higher multiple.

Margins are the near‑term fulcrum. A 10.14% operating margin and 5.23% profit margin indicate effective cost control and disciplined pricing. Input costs for packaging and ingredients can be volatile, and consumer elasticity varies by channel and region, so incremental mix improvements matter. Cash generation (¥189.14B operating cash flow; ¥74.56B levered free cash flow) provides a buffer to support brand investment, route‑to‑market efficiency, and selective capacity upgrades. If management can hold gross profit near current levels while nudging top‑line growth back to positive territory, incremental operating leverage should support earnings even without aggressive volume expansion.

Capital allocation is supportive. Net cash position remains comfortable with ¥145.88B in cash versus ¥48.18B in debt, and balance sheet ratios (current ratio 1.23; debt/equity 3.65%) suggest capacity to fund growth projects while maintaining a progressive dividend. The forward yield of 2.56% and a 43.82% payout ratio leave room for measured increases if earnings stabilize. While no explicit buyback or acquisition plans are provided in the data, the combination of low beta, insider ownership of 59.70%, and consistent free cash flow should help dampen downside and provide optionality for portfolio simplification or targeted innovation spending.

What could re‑rate the shares? First, a return to positive revenue growth on a sustained basis, reversing the −1.10% quarterly decline. Second, maintenance of double‑digit operating margins despite input and logistics pressure. Third, evidence of pricing power without material volume attrition. Finally, clear communication around capital deployment and dividend trajectory could improve investor confidence. Conversely, a prolonged period of flat sales and rising costs would likely keep the shares range‑bound. Given the defensive profile (beta 0.01), we expect the stock to remain relatively insulated from market volatility, with returns driven by execution, cost discipline, and the dividend rather than multiple expansion.

What could happen in three years? (horizon August 2025+3)

| Scenario | Narrative | Implications for shares |

|---|---|---|

| Best | Top‑line trends turn positive as pricing holds and volumes stabilize, supported by steady brand investment and improved route‑to‑market efficiency. Margins remain healthy with disciplined cost control and mix improvement. Dividend grows within a conservative payout framework. | Share performance improves, with reduced drawdowns and gradual multiple expansion reflecting confidence in durable cash flows; total return led by both price appreciation and dividends. |

| Base | Revenue is broadly stable with modest fluctuations, while operating discipline sustains margins near current levels. Cash generation comfortably funds capex and a steady dividend policy. | Shares track fundamentals with limited volatility; returns are primarily dividend‑led with modest price changes, consistent with the stock’s low beta characteristics. |

| Worse | Consumer demand softens and cost inflation persists, pressuring volumes and margins. FX or input‑cost swings are not fully offset by pricing or mix, and growth investments face delays. | Shares lag as earnings compress; valuation remains subdued until visibility improves. Dividend remains a support but offers limited offset to capital losses. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Input‑cost and packaging trends affecting gross margin resilience and pricing actions.

- Currency movements and translation effects on reported revenue and earnings.

- Volume elasticity in key channels amid pricing/mix initiatives and competitive activity.

- Execution on brand investment, innovation cadence, and route‑to‑market efficiency.

- Regulatory or fiscal changes affecting sweeteners, plastics, or beverage taxation.

- Capital allocation posture, including dividend trajectory and balance‑sheet discipline.

Conclusion

Suntory Beverage & Food appears positioned for stability rather than acceleration over the next three years. The business generates consistent cash, sustains double‑digit operating margins, and carries modest leverage, all of which underpin the dividend and provide flexibility for measured investment. The principal challenge is reigniting growth: quarterly revenue and earnings both dipped year over year, and the shares have underperformed over 12 months. In our base case, steady execution and cost control keep earnings broadly stable, with total returns driven largely by dividends. Upside hinges on sustained improvement in sales trends and visible margin durability; downside stems from prolonged input‑cost pressure or demand softness. With a very low beta, the stock may continue to offer defensive characteristics within portfolios, while catalysts such as firmer top‑line momentum and disciplined capital deployment could support a gradual re‑rating.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.