Reliance Industries Ltd (RELIANCE.NS) enters September 2025 with diversified cash flows across energy, digital and retail, modest topline momentum, and active balance-sheet management. Trailing-twelve-month revenue stands at 9.77T with EBITDA of 1.71T and net income of 815.04B, implying margins of 11.93% at the operating level and 8.35% net. Liquidity remains solid with 2.25T in cash against 3.7T in total debt and a low-beta profile of 0.22. Quarterly revenue growth has picked up to 5.10% year-on-year while diluted EPS is 60.20. The stock closed the week at 1,379.00, sits near its 50-day moving average of 1,391.50, and below the 52-week high of 1,551.00. A modest dividend yield of 0.40% with an 8.30% payout ratio underscores capacity to fund growth alongside distributions.

Key Points as of September 2025

- Revenue: TTM revenue 9.77T; revenue per share 721.63; diversified across energy, digital and retail.

- Profit/Margins: Gross profit 3.48T; EBITDA 1.71T; operating margin 11.93%; net margin 8.35%; diluted EPS 60.20.

- Sales/Backlog: Quarterly revenue growth (yoy) 5.10%; no backlog data disclosed in the provided figures.

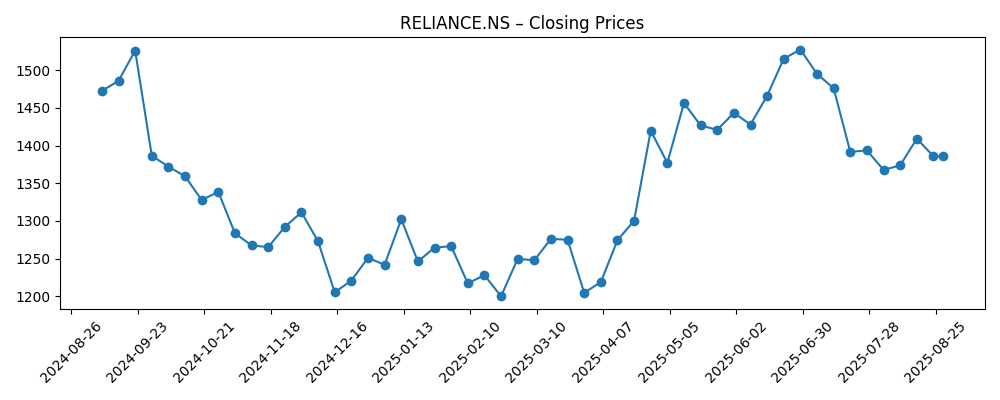

- Share price: Last weekly close 1,379.00 (2025-09-26); 52-week range 1,114.85–1,551.00; 52-week change -6.70%; 50-DMA 1,391.50; 200-DMA 1,342.12; beta 0.22.

- Balance sheet: Total cash 2.25T vs total debt 3.7T; debt/equity 36.61%; book value per share 623.05.

- Dividend: Forward annual dividend rate 5.5; forward yield 0.40%; payout ratio 8.30%; ex-dividend date 2025-08-14.

- Ownership: Shares outstanding 13.53B; float 6.61B; insiders hold 49.66%; institutions hold 28.83%.

- Liquidity: Avg volume 9.98M (3M) and 9.34M (10D); low volatility profile supports steady trading conditions.

Share price evolution – last 12 months

Notable headlines

- Ambani’s Reliance boosts borrowing with loan, asset backed deal [Bloomberg]

- Reliance Industries shares in focus after new AI unit launch [The Times of India]

- RCPL signs MoU with Maharashtra govt to invest ₹1,513 crore in food and beverage facility [Livemint]

Opinion

The reported loan and asset-backed issuance signals a pragmatic approach to capital structure in a period of measured growth. With 2.25T in cash and 3.7T in total debt, Reliance appears to be optimizing funding costs and tenor while preserving liquidity for expansion. A low payout ratio of 8.30% and modest 0.40% yield suggest headroom to sustain capex without stressing free cash flows. Execution risk centers on refinancing and deployment efficiency: if new funding channels reduce average cost of debt and align with cash-generating assets, leverage can stay manageable; if spreads widen or global risk appetite tightens, refinancing could weigh on earnings. Against a 0.22 beta, funding moves may not trigger outsized volatility, but they set the tone for the next investment cycle and the stock’s medium-term multiple.

The launch of a new AI unit places digital capabilities at the center of Reliance’s next growth leg. With Jio’s scaled network and retail touchpoints, the company has distribution to seed AI-enabled services across consumer and enterprise use cases, from personalization to process automation. The near-term question is monetization cadence versus investment load. AI initiatives typically compress near-term margins before revenue ramps; Reliance’s operating margin of 11.93% provides some buffer, but investors will watch opex discipline and partnership models closely. If the unit can leverage cloud, data, and connectivity assets already in place, payback periods could be shortened and reduce capex intensity. Clear disclosure milestones, such as product rollouts and early customer wins, would help frame expectations and could support a gradual re-rating if supported by improving revenue growth beyond the current 5.10% yoy.

In consumer, RCPL’s MoU for a food and beverage facility underscores Reliance’s strategy to deepen its FMCG footprint and integrate more of the value chain. Vertical integration can enhance control over quality and pricing while supporting retail margins during input cost swings. For shareholders, the key is mix: higher-margin consumer and digital revenues can stabilize consolidated profitability relative to more cyclical refining and petrochemicals. The balance sheet’s scale, plus a conservative dividend policy, gives room to pursue category expansion and brand building. Still, execution will hinge on ramp timelines, distribution efficiency, and brand resonance in competitive segments. Any delays or cost overruns could narrow the margin benefits, although the group’s retail reach may help compress time-to-scale once commissioning and sourcing are in place.

Price action has been range-bound relative to moving averages, with the last close at 1,379.00 near the 50-DMA of 1,391.50 and the 200-DMA of 1,342.12. The 52-week change of -6.70% and a low beta point to a defensive profile, but catalysts can still shift sentiment. Over the coming quarters, clarity on funding costs from the borrowing plan, visibility into AI productization, and tangible milestones in consumer manufacturing should be most consequential for multiples. If these strands cohere into accelerating earnings and cash conversion, the stock could gravitate toward the upper end of its 1,114.85–1,551.00 range. Conversely, a risk-off macro or slower execution may keep performance muted. For now, liquidity metrics and ownership structure provide stability while investors await stronger signals on growth mix and margin trajectory.

What could happen in three years? (horizon September 2025+3)

| Scenario | Key drivers | Operating outcomes | Share-price setup |

|---|---|---|---|

| Best | AI unit scales with strong enterprise wins; retail manufacturing ramps smoothly; favorable refining and petchem spreads; funding costs stay contained. | Revenue growth outpaces recent trends; margin mix improves with higher digital and consumer contribution; leverage moderated by robust cash generation. | Multiple expansion as growth visibility improves and volatility remains low; price gravitates toward upper bound of recent ranges or higher. |

| Base | Steady execution in AI pilots and consumer ramp; energy cycle mixed; gradual optimization of debt stack. | Mid-single-digit revenue growth sustained; margins broadly stable; balance sheet strength maintained with selective capex. | Range-bound performance around long-term moving averages; returns track earnings growth and dividends. |

| Worse | Delayed AI monetization; cost overruns in consumer capacity; weaker refining/petchem cycle; tighter credit conditions. | Growth slows; margins compress; refinancing risk nudges interest costs higher; discretionary capex deferred. | De-rating toward lower end of historical ranges with limited near-term catalysts until execution visibility improves. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Progress on borrowing plan and refinancing costs relative to cash flows and the 3.7T debt load.

- Execution and monetization pace of the new AI unit across consumer and enterprise offerings.

- Refining margins and petrochemical spreads impacting energy segment earnings and cash generation.

- Scale-up of consumer manufacturing (RCPL) and retail mix effects on consolidated profitability.

- Regulatory developments across telecom, retail and energy that affect pricing, competition or capital allocation.

Conclusion

Reliance’s three-year setup hinges on synchronizing capital, capability and category expansion. The financing initiatives highlighted by recent borrowing activity can lower funding friction if executed prudently, complementing a balance sheet that already carries substantial cash. The AI unit introduces optionality in higher-growth adjacencies but will demand disciplined investment and clear commercialization milestones. In parallel, the consumer manufacturing push aims to deepen integration and improve margin resilience within retail. With TTM revenue of 9.77T, EBITDA of 1.71T and net income of 815.04B, the group has the scale to absorb cyclical swings, while a modest dividend and low beta support downside protection. Near-term, investors will watch cost of capital, AI product rollouts, and commissioning progress in consumer facilities. Delivering on these vectors should support steadier earnings growth and potential multiple repair; missteps could prolong a range-bound trajectory.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.