As of June 2025, NVIDIA Corporation continues to play a crucial role in the semiconductor and AI sectors, despite facing significant challenges, including geopolitical tensions and export restrictions. With impressive financials, the company has achieved remarkable revenue growth and maintained strong profit margins, showcasing its dominance in the industry. Recent headlines reflect the ongoing scrutiny and strategic shifts within the company as it navigates market restrictions and seeks new opportunities in AI technology. Investors are closely watching NVIDIA's next moves, particularly in light of its recent performance and market conditions.

Key Points as of June 2025

- Revenue: $148.51B

- Profit Margin: 51.69%

- Quarterly Revenue Growth (yoy): 69.20%

- Share Price: $142.98

- Analyst View: Moderate caution amidst geopolitical tensions

- Market Cap: ~$3.48T

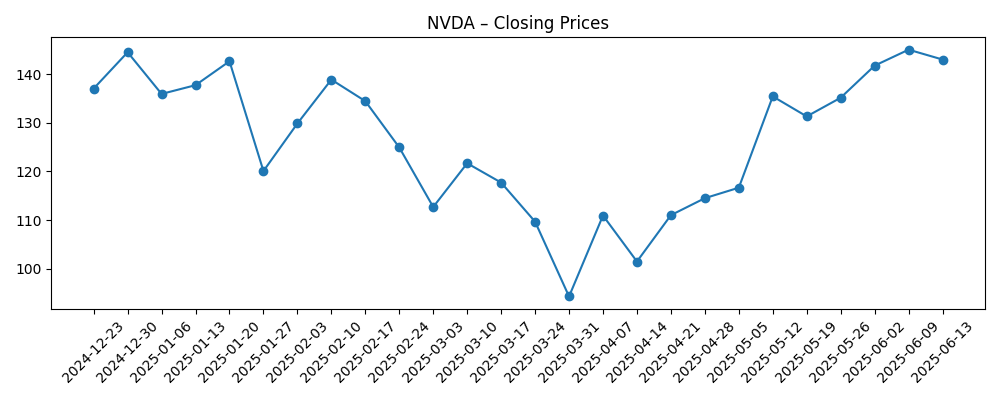

Share price evolution – last 6 months

Notable headlines

- Nvidia stock: What export controls mean for the chip giant – Yahoo Entertainment

- Jim Cramer on NVIDIA Corporation (NVDA): “The Stock’s in No Man’s Land” – Yahoo Entertainment

- Nvidia will release cheaper Blackwell AI chips in China to avoid U.S. restrictions, report says – Yahoo Entertainment

- Nvidia in advanced talks to invest in PsiQuantum, The Information reports – Yahoo Entertainment

- Nvidia beats on earnings again — even while it's locked out of China – Quartz India

- 'Deeply painful': Nvidia CEO says a new chip ban has cost it $15 billion – Quartz India

Opinion

The recent headlines surrounding NVIDIA indicate a complex landscape for the company as it tries to balance innovation against regulatory hurdles. The article detailing export controls illustrates how geopolitical dynamics can significantly impact a tech giant's strategy, particularly for those heavily involved in AI and semiconductors. With analysts indicating a cautious outlook, the stock's performance may reflect investor apprehensions regarding long-term profitability amid these challenges.

Moreover, NVIDIA's strategy to release cheaper Blackwell AI chips in China is a notable pivot intended to circumvent restrictions. While this move may help mitigate immediate revenue losses from export bans, it raises questions about the sustainability of such strategies. Analysts will keenly observe how this impacts overall market perception and customer adoption.

NVIDIA's recent earnings report showcased its resilience, beating expectations despite the adverse circumstances. This performance is indicative of the demand for AI technologies, underlining NVIDIA's critical role in this growing sector. However, ongoing restrictions could lead to volatility in share price as investors reassess NVIDIA's growth trajectory.

Overall, as NVIDIA continues to navigate these challenges, its ability to adapt and innovate will be paramount. The company's leadership, particularly CEO Jensen Huang, now faces the daunting task of maintaining momentum in an increasingly competitive and regulated environment.

What could happen in three years? (horizon June 2025+3)

| Scenario | Outcome |

|---|---|

| Best | Stock rebounds sharply as global demand for AI chips increases, with strategic partnerships enhancing growth. |

| Base | Continued revenue growth, but with fluctuations due to geopolitical tensions and competitive pressures. |

| Worse | Ongoing restrictions severely impact sales, leading to stagnant growth and a significant drop in market share. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Geopolitical developments impacting supply chains

- Demand trends in the semiconductor market

- Technological advancements in AI

- Competition from other semiconductor firms

- Regulatory actions affecting market access

Conclusion

In conclusion, NVIDIA Corporation is at a pivotal crossroads as it navigates both opportunities and threats in the semiconductor and AI markets. With substantial revenue and a robust profit margin, the company remains strong; however, the potential fallout from geopolitical tensions and export restrictions cannot be overlooked. The strategic decisions made in the coming months will be crucial in determining the future direction of the company.

Investors should remain vigilant, monitoring emerging market conditions and NVIDIA's responses to ongoing challenges. As the company strives to sustain its competitive edge, its actions will likely influence not only its share price but also its long-term viability in the rapidly evolving tech landscape.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.