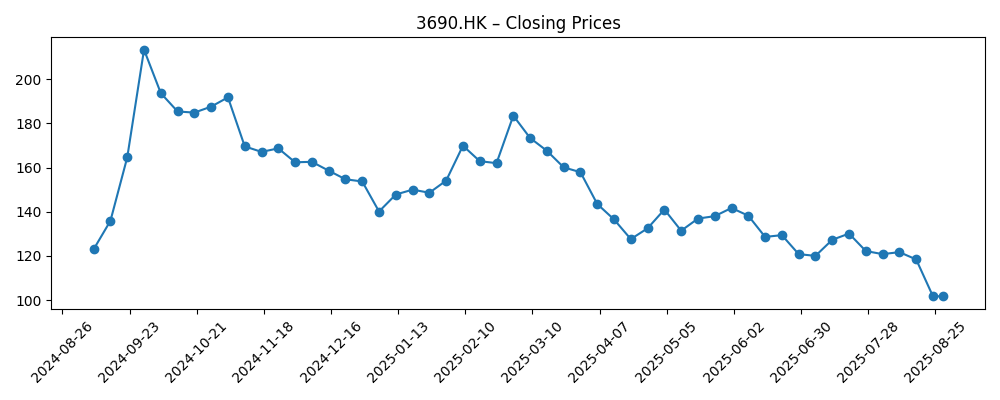

Meituan-W (3690.HK) enters August 2025 with resilient top-line growth but a widening debate on margins. Over the last year, trailing revenue reached 360.46B with gross profit of 133.03B and net income of 29.51B (profit margin 8.19%), yet the operating margin on a ttm basis is slightly negative at -0.28%. The balance sheet remains a strength: 171.02B in cash versus 50.98B of debt, a current ratio of 1.93, and levered free cash flow of 23.52B. Shares have slipped to 101.70, near the 52-week low of 101.00 and far below the 52-week high of 217.00, after a steady decline from March levels. With quarterly revenue growth at 11.70% year over year but quarterly earnings growth down 96.80%, the next three years hinge on execution—returning operating margins to positive territory while defending share against intensifying competition in local services.

Key Points as of August 2025

- Revenue: ttm 360.46B; quarterly revenue growth (yoy) 11.70%.

- Profit/Margins: profit margin 8.19%; operating margin (ttm) -0.28%; EBITDA 32.84B; diluted EPS 5.410.

- Sales/Backlog: platform breadth across food delivery, in-store and travel supports activity; no formal backlog disclosures typical for marketplaces.

- Share price: last at 101.70 (2025-08-28), down from 183.50 in early March; 52-week range 101–217; below 50-day and 200-day averages (124.468 and 146.299).

- Analyst view: market focus on path to sustained positive operating margin and competitive spend discipline across local services.

- Market cap: roughly 560–710B based on 5.53–6.98B shares and a ~101.7 per-share price.

- Balance sheet: cash 171.02B vs debt 50.98B; current ratio 1.93; levered free cash flow 23.52B.

- Ownership/liquidity: institutions hold 38.94%; float 5.37B; average 3-month volume 52.88M.

- Dividend policy: no dividend (trailing yield 0.00%).

Share price evolution – last 12 months

Notable headlines

Opinion

Markets are signaling caution. Despite a solid revenue base (360.46B ttm) and a positive profit margin of 8.19%, Meituan’s operating margin is slightly negative on a trailing basis (-0.28%). The divergence suggests non-operating gains and accounting effects have buoyed bottom line results while core operations face pressure from competition, incentives, and higher fulfillment costs. The share price tells the story: from 183.50 in early March to 101.70 by late August, now near the 52-week low of 101.00 and below key moving averages. Over the next three years, the crux is operational—tightening unit economics in delivery and in-store services without derailing growth. If management can restore operating leverage through logistics efficiencies, product mix shifts, and disciplined promotions, the stock could re-rate; if not, investors may continue to apply a discount to earnings quality.

Competitive dynamics in local services remain intense. Short-form video platforms and rival delivery ecosystems continue to court merchants and consumers with traffic and subsidies, challenging Meituan’s take rates and user acquisition costs. Meituan’s advantage is density, data and logistics know-how, which can drive better batching, routing, and cross-selling across food delivery, in-store services and travel. A product cadence that enhances merchant ROI—better tools, advertising yield, and loyalty mechanics—can defend monetization even if headline order growth moderates. Over a three-year horizon, success looks like stable consumer frequency, improved courier productivity, and incremental merchant services monetization. Failure would show up as persistent promotional intensity, lower order economics, and pressure on reported margins. The market’s focus will be whether growth can be sustained without subsidizing users and merchants.

Capital allocation is a latent catalyst. With 171.02B in cash against 50.98B in debt, a current ratio of 1.93, and levered free cash flow of 23.52B, Meituan has the flexibility to invest through the cycle while absorbing competitive pressures. Strategic uses include logistics technology, category expansion, and merchant tools. Shareholder returns could come via opportunistic buybacks if management sees limited near-term ROI elsewhere; the absence of a dividend (0.00% trailing yield) keeps optionality high. Over three years, investors will likely reward visible returns on invested capital and a clear bridge from free cash flow to per-share value creation. Conversely, prolonged loss-leading in adjacent categories without demonstrable payback could keep the equity multiple compressed even if headline revenue continues to grow.

Valuation frames the debate. At a price around 101.70 and diluted EPS of 5.410, the stock trades at about 18.8x trailing earnings. Using revenue per share of 55.12, that’s about 1.85x sales, and with book value per share of 28.56, about 3.56x book. These multiples are not demanding for a scaled consumer internet platform if operating margins can turn and expand; they are less forgiving if profitability remains reliant on below-the-line items. A credible path to positive operating margin, coupled with stable double-digit revenue growth, would support multiple expansion; weak unit economics and elevated competitive spend would argue for a value-trap profile. Over a three-year horizon, the valuation outcome is likely to track the operating margin line more than the revenue line.

What could happen in three years? (horizon August 2028)

| Case | Narrative | Signals to watch | Equity implication |

|---|---|---|---|

| Best | Operating margin turns sustainably positive with improving delivery efficiency and healthier merchant monetization; growth remains resilient across core local services. | Lower promo intensity, improving unit economics, stable or rising take rates, steady user/merchant retention. | Multiple expansion as earnings quality improves; sentiment shifts from defensive to growth-at-a-reasonable-price. |

| Base | Growth remains steady but margin progress is gradual; competitive spend continues selectively; cash flow funds reinvestment and limited buybacks. | Mixed margin prints, stable revenue growth, disciplined opex; balanced commentary on competition. | Range-bound valuation; returns track earnings growth with modest re-rating risk. |

| Worse | Competitive pressure forces sustained subsidies; operating margin stays around breakeven or negative; expansion bets underperform. | Elevated incentives, weaker merchant ROI, rising fulfillment costs, cautious guidance. | Multiple compression; stock tests trough range until a strategic reset or industry consolidation. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Sustained turn to positive operating margin and visibility on margin expansion.

- Intensity of competition in local services and required promotional spend.

- Regulatory developments affecting platform economics and merchant relations.

- China consumer demand trends impacting order frequency and ticket sizes.

- Capital allocation discipline, including pacing of investments and any buybacks.

- Execution in new or adjacent categories that can diversify profit pools.

Conclusion

Meituan’s three-year setup is a classic quality-versus-execution trade-off. The company’s scale, cash position (171.02B), and recurring-use cases offer a solid foundation, and revenue growth of 11.70% yoy in the most recent quarter shows demand resilience. However, with a slightly negative operating margin on a trailing basis and shares near the 52-week low, investors are signaling the need for clearer proof that core operations can carry earnings without heavy incentives. If management delivers steady operating leverage while protecting growth, the current valuation—about 18.8x trailing EPS, roughly 1.85x sales, and around 3.56x book—leaves room for re-rating. If not, the stock may remain range-bound despite healthy revenue. Over the next three years, watch unit economics, competitive spend, and capital allocation; they will likely determine whether Meituan compounds value or remains a show-me story.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.