Kweichow Moutai (600519.SS) enters late 2025 with fortress margins, ample cash, and a historically defensive share profile. Trailing‑twelve‑month revenue is 178.36B with profit margin of 50.42% and operating margin of 63.69%. Net cash is substantial (total cash 178.71B vs total debt 268.63M) and liquidity strong (current ratio 5.73). Quarterly revenue growth year over year stands at 7.30% while quarterly earnings growth is 5.20%. Yet the stock has trended sideways to lower over six months, from 1,748.0 (Sep 2024) to 1,467.97 (week of Sep 19, 2025), below its 200‑day moving average of 1,493.19 and near the 50‑day at 1,457.00; 52‑week range is 1,260.66–1,910.00. With a forward dividend yield of 3.51% and beta of 0.76, Moutai offers income and stability; the three‑year question is growth durability and pricing power.

Key Points as of September 2025

- Revenue – TTM revenue of 178.36B; quarterly revenue growth (yoy) at 7.30% indicates steady demand for premium baijiu.

- Profit/Margins – Profit margin 50.42% and operating margin 63.69%; ROE 39.04% and ROA 26.37% reflect exceptional capital efficiency.

- Cash & Liquidity – Total cash 178.71B vs total debt 268.63M; current ratio 5.73 underpins resilience through cycles.

- Sales/Backlog – No backlog disclosed; operating cash flow of 68.96B and EBITDA 122.53B highlight healthy cash generation.

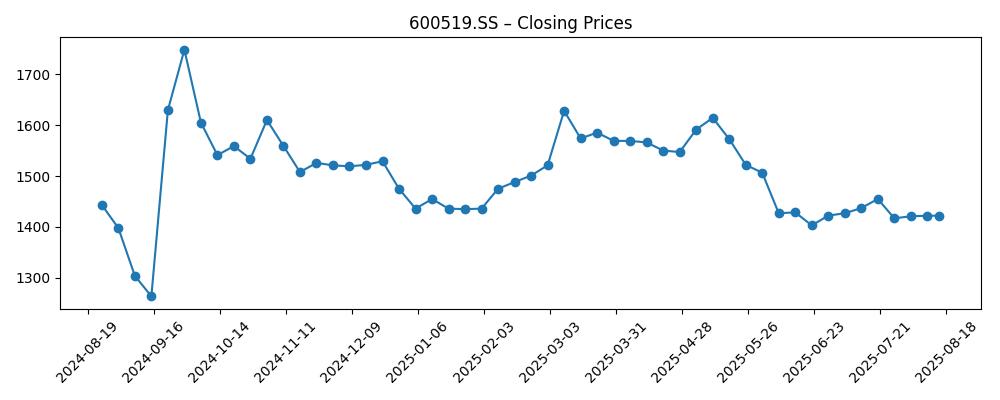

- Share price – Last six months drifted from 1,748.0 (Sep 2024) to 1,467.97 (Sep 19, 2025); 52‑week range 1,260.66–1,910.00; 50‑DMA 1,457.00; 200‑DMA 1,493.19; beta 0.76.

- Dividends – Forward annual dividend rate 51.56 (yield 3.51%); payout ratio 71.97%; last ex‑dividend date 6/26/2025.

- Ownership & Float – Insiders hold 61.84%; institutions 10.26%; float 545.42M; average volume ~3.77M (3‑month) and ~3.79M (10‑day).

- Market cap & status – Among the largest consumer‑staples listings in China; liquidity and brand strength shape long‑term positioning.

- Analyst/investor focus – Sustainability of premium pricing and channel discipline; quarterly earnings growth (yoy) at 5.20% watched for momentum.

Share price evolution – last 12 months

Notable headlines

Opinion

Over the next three years, Moutai’s investment case still starts with durability. Margins above 60% at the operating line and a profit margin above 50% offer a cushion against short‑term demand volatility. The recent share price drift—closing 1,467.97 in the week of September 19, 2025, versus 1,748.0 a year ago—suggests investors are waiting for clearer top‑line acceleration while taking comfort in a 3.51% forward yield and low beta. With net cash abundant and liquidity strong, the downside case is often framed by sentiment rather than balance‑sheet risk. In our view, the stock’s defensiveness remains intact; the key is whether growth can re‑accelerate without eroding price discipline.

Growth likely hinges on steady premiumization, disciplined channel management, and measured innovation around formats and gifting occasions. Quarterly revenue growth of 7.30% year over year is solid, but the market may ask for proof it is sustainable across seasonal comps. Maintaining scarcity and brand equity can preserve pricing, while any signs of channel inventory friction could pressure near‑term sell‑in. With a float of 545.42M against high insider ownership, liquidity is robust but not limitless; this can amplify moves around results or dividend events, particularly when average volumes cluster near the 3.77M–3.79M range.

Capital returns are a major pillar. A payout ratio of 71.97% and a forward dividend rate of 51.56 imply income support even through softer patches, backed by operating cash flow of 68.96B and minimal leverage (total debt 268.63M). The company has room to fund operations and product investments while keeping dividends central to the story. If earnings growth (yoy) of 5.20% strengthens, the market could reward the stock with a higher confidence premium; if it cools, the dividend may anchor total returns until growth visibility improves.

Technically, the stock sits close to its 50‑ and 200‑day moving averages (1,457.00 and 1,493.19). That usually defines a wait‑and‑see zone where catalysts determine the break. A constructive path would feature stable sequential revenue, clean channel indicators, and reiteration of disciplined pricing, allowing the shares to grind higher toward the upper end of their 52‑week range. Conversely, a soft consumer print or margin wobble could retest the lower band. Given beta of 0.76 and substantial cash, we expect drawdowns to be shallower than higher‑beta peers, but progress may be incremental unless top‑line momentum surprises positively.

What could happen in three years? (horizon September 2025+3)

| Scenario | Revenue trajectory | Margins | Capital returns | Share price drivers |

|---|---|---|---|---|

| Best | Sustained mid–high single‑digit growth from premiumization and disciplined channel sell‑through | Margins broadly preserved given brand pricing power | Stable to rising ordinary dividends alongside strong cash generation | Re‑rating on confidence in durable growth and steady inventory health |

| Base | Low–mid single‑digit growth with periodic seasonal swings | Margins hold near current levels with minor mix fluctuations | Dividend maintained; payout tuned to earnings cadence | Total return anchored by dividends; valuation range‑bound absent new catalysts |

| Worse | Subdued growth as consumer spending softens and channel restocking slows | Margins tighten modestly on mix and promotional pressure | Dividend covered but growth muted; cash prioritized for stability | De‑rating on weaker visibility; support emerges near long‑term averages |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- China consumer demand trends during key holidays and banquet seasons impacting premium baijiu sell‑through.

- Channel inventory discipline and pricing power across distributors and retail; evidence of overstocking or discounting.

- Policy or regulatory shifts affecting gifting, marketing, or alcohol category standards.

- Input costs and packaging availability influencing gross margin stability.

- Capital return policy (dividend cadence) relative to earnings growth and cash generation.

- Currency and market‑wide sentiment, which can affect foreign investor flows and valuation multiples.

Conclusion

Moutai’s three‑year setup is defined by cash strength, rarefied margins, and a shareholder‑friendly dividend, balanced against the market’s insistence on steady growth proof points. Today’s fundamentals—178.36B in TTM revenue, profit margin of 50.42%, operating margin of 63.69%, significant net cash, and a 3.51% forward yield—support a defensive stance. The shares have eased toward long‑term averages, reflecting a pause for confirmation rather than a break in the thesis. If revenue momentum remains consistent and pricing discipline holds, total returns can compound via dividends and modest multiple support. If demand or channel dynamics soften, the balance sheet and payout provide a buffer while management calibrates shipments and mix. For long‑term investors, the path to 2028 appears incremental rather than explosive, with brand equity and cash generation as anchors and growth delivery as the swing factor.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.