Kweichow Moutai enters the remainder of 2025 with enviable profitability but a cooler growth pulse. The baijiu leader reports trailing‑twelve‑month revenue of 178.36B, a profit margin of 50.42% and an operating margin of 63.70%, with net income at 89.94B and ROE of 39.04%. Liquidity is strong: cash of 178.71B against just 268.63M of debt and a 5.73 current ratio. The share price has steadied near recent levels around 1,422, leaving the 52‑week change at −0.24% and beta at 0.76. Income remains a draw, with a 3.63% forward dividend yield and a 71.97% payout ratio following the 6/26/2025 ex‑date. Growth has moderated (Q2 yoy revenue +7.3%, earnings +5.2%), and recent coverage highlighted the weakest expansion in years as consumers pare back. Against this backdrop, we map a three‑year outlook as of

Key Points as of August 2025

- Revenue: TTM revenue of 178.36B; recent quarterly revenue growth at 7.30% yoy and earnings growth at 5.20% yoy.

- Profit/Margins: Profit margin 50.42%; operating margin 63.70%; EBITDA 122.54B; gross profit 163.52B; ROE 39.04%.

- Sales/Backlog: No formal backlog metric disclosed; demand visibility tied to channel allocations. Recent media flagged the slowest growth in years as consumers pare back.

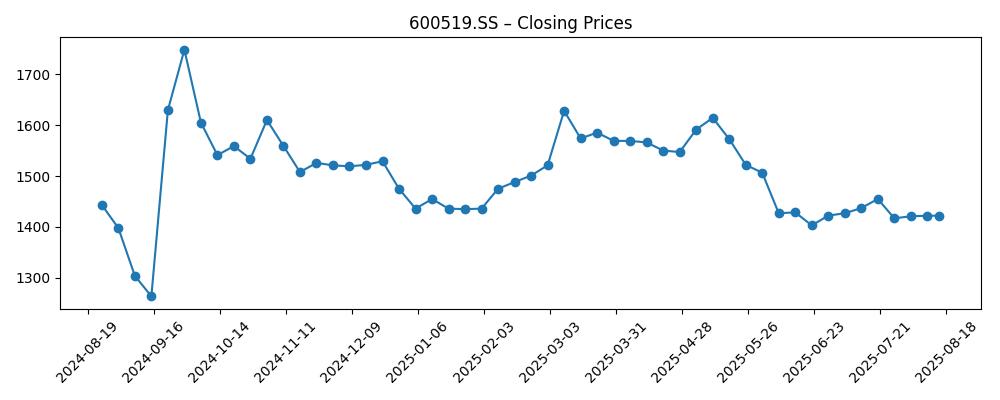

- Share price: Traded mostly in the 1,403.09–1,628.01 range over the last six months; 50‑day MA 1,431.86 vs 200‑day MA 1,501.51; 52‑week change −0.24% (high 1,910.00; low 1,245.83).

- Market tone: Defensive profile (beta 0.76). Ownership concentrated (insiders 61.65%; institutions 9.93%; float 547.63M). Liquidity: avg 3‑mo volume 3.22M.

- Balance sheet: Cash 178.71B; debt 268.63M; current ratio 5.73 – a conservative structure.

- Dividend: Forward yield 3.63% on a 51.56 per‑share annual rate; payout ratio 71.97%; last ex‑dividend date 6/26/2025.

- Valuation context: Using recent price and EPS (71.67), implied P/E is around 19–20x; market cap approximates ~1.8T using recent price and shares outstanding (1.26B).

Share price evolution – last 12 months

Notable headlines

Opinion

The recent slowdown highlighted by media coverage raises the central question for the next three years: is this a cyclical soft patch or a structural shift in premium baijiu demand? Kweichow Moutai’s moat is anchored in brand scarcity and pricing power, which, historically, have proven resilient through macro swings. Today’s fundamentals support that case: operating margin at 63.70% and profit margin above 50% give ample buffer even if volumes wobble. On valuation, a P/E around 19–20x sits near long‑run quality staples in China, neither distressed nor exuberant. If consumer confidence normalizes and gifting/banqueting demand stabilizes, unit sell‑through could improve without aggressive discounting. In that outcome, investors would likely reward durable cash generation and the company’s ability to compound earnings from a very high base.

Still, the next leg up likely requires re‑acceleration beyond 2025’s pace (revenue +7.3% yoy; earnings +5.2%). The path to that outcome runs through disciplined channel management, curated product mix, and protecting the prestige tier. Any signs of elevated inventory or widening discounts would be watched closely because they can erode pricing power faster than headline volumes suggest. Against those risks, Moutai’s balance sheet is a strategic asset: 178.71B in cash, negligible debt (268.63M), and strong operating cash flow (68.96B) and free cash flow (56.31B) provide flexibility to sustain brand investment, optimize distribution, and support shareholder returns even in a slower macro tape.

From a market perspective, the stock’s defensive profile (beta 0.76) and near‑flat 52‑week change suggest investors view it as a high‑quality anchor rather than a momentum vehicle. Technically, it trades below the 200‑day moving average (1,501.51), which often keeps multiples range‑bound until fresh catalysts arrive. Such catalysts could include firmer sell‑through data around holidays, clearer evidence that premiumization persists, or commentary that dispels concerns about sustained consumer frugality. Conversely, confirmation of ongoing demand softness could cap the multiple, making the 3.63% dividend yield a larger share of total return in the near term.

Over three years, the investment debate centers on whether Moutai can convert brand equity into steady, inflation‑beating growth without sacrificing margins. The payout ratio at 71.97% is elevated but covered by robust free cash flow, leaving room to maintain or modestly raise distributions while funding core initiatives. With insiders holding 61.65%, governance continuity and long‑term orientation are often cited as supportive for strategic consistency. The downside scenario is not a balance‑sheet risk but an earnings‑quality risk if the company must lean on pricing or non‑core items to meet expectations. The upside hinges on measured volume growth, sustained mix upgrades, and careful channel control that keeps secondary‑market pricing aligned with flagship positioning.

What could happen in three years? (horizon August 2025+3)

| Scenario | Revenue trajectory | Margins | Capital allocation | Share price drivers |

|---|---|---|---|---|

| Best | Growth re‑accelerates above the 2025 pace as premium demand and sell‑through normalize. | Operate near current levels, supported by strong brand pricing and disciplined channels. | Dividend maintained and gradually increased while preserving a conservative balance sheet. | Multiple expands from the current ~19–20x P/E as confidence in durability returns. |

| Base | Growth holds around the 2025 pace with periodic softness offset by mix management. | Margins broadly stable with modest fluctuations tied to promotions and input costs. | Dividend growth closely tracks earnings; cash remains ample for brand investment. | Valuation range‑bound; yield and fundamentals anchor total returns. |

| Worse | Growth slips below the 2025 pace due to prolonged consumer frugality and channel drag. | Margins compress if discounting rises or operating leverage fades. | Dividend maintained cautiously; discretionary spending prioritized to defend brand equity. | Multiple compresses; price tracks earnings downgrades until demand stabilizes. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Evidence of demand normalization or sustained softness in premium baijiu consumption, especially around key festivals.

- Pricing power and product mix discipline versus any rise in channel discounting or inventory build‑ups.

- Macroeconomic conditions in China that affect consumer sentiment and corporate/banquet spending.

- Policy and regulatory signals that influence gifting and business entertainment behavior.

- Capital allocation stance — dividend trajectory versus reinvestment — given high free cash flow and low leverage.

Conclusion

Kweichow Moutai’s three‑year risk‑reward balances fortress‑like economics against a slower demand backdrop. The company’s financial profile — 63.70% operating margin, 50.42% profit margin, ample cash and negligible debt — suggests resilience even if volumes ebb. With a 3.63% forward yield and a payout ratio of 71.97%, income is a visible component of returns, while the balance sheet supports continued brand investment. The share price’s muted 52‑week move and sub‑200‑day trading range point to a market awaiting proof of re‑acceleration after reports of the weakest growth in years. If sell‑through strengthens and pricing discipline endures, valuation could drift higher from roughly 19–20x P/E. If frugality persists, returns may be more yield‑driven. On balance, we see a base case of steady, quality‑led compounding, with upside tied to consumer normalization and downside mitigated by cash generation and brand strength.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.