Honda Motor (7267.T) enters the next three years with a mixed setup: stable cash generation and a dependable dividend offset by compressed profitability and uneven sales. Trailing 12‑month revenue stands at 21.62T with gross profit of 4.54T and EBITDA of 1.42T, yet the profit margin is 2.95% and quarterly earnings growth is -50.20% year over year. Liquidity is solid (current ratio 1.30; total cash 4.17T) against total debt of 11.87T and debt/equity of 98.42%. Shares recently closed at 1,637.5, near the 52‑week high of 1,674.5 and above both the 50‑day and 200‑day moving averages. A forward dividend yield of 4.27% with a 47.25% payout ratio provides income support. Recent updates include a June 2025 production/sales report and a push into insurance distribution.

Key Points as of August 2025

- Revenue: 21.62T (ttm); revenue per share 4,788.39; gross profit 4.54T; EBITDA 1.42T.

- Profit/Margins: Net income 637.85B; profit margin 2.95%; operating margin 4.57%; diluted EPS 143.94; quarterly earnings growth -50.20% yoy.

- Sales/Backlog: Quarterly revenue growth -1.20% yoy; June 2025 production and sales report released; operating cash flow 459.07B; levered free cash flow 593.41B.

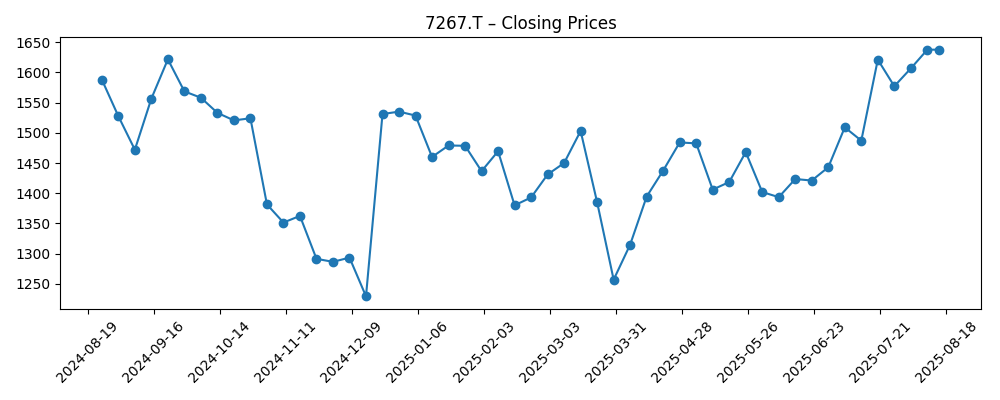

- Share price: 1,637.5 (Aug 15); 52‑week high/low 1,674.5/1,156.0; 50‑day MA 1,494.27; 200‑day MA 1,433.55; 52‑week change 4.47%; beta 0.33.

- Dividend: Forward yield 4.27%; trailing yield 4.19%; payout ratio 47.25%; next ex‑dividend date 9/29/2025.

- Ownership/Market view: Shares outstanding 3.99B; float 3.74B; insiders 3.29%; institutions 40.27%; average volume 18.91M (3M) and 19.63M (10D).

- Balance sheet: Total cash 4.17T; total debt 11.87T; debt/equity 98.42%; current ratio 1.30; book value per share 2,887.57.

Share price evolution – last 12 months

Notable headlines

- Honda Motor Co., Ltd. (HMC) Reports Production and Sales Report for June 2025

- Honda Launches Insurance Agency Powered by VIU by HUB

- Honda Motor Co., Ltd. (NYSE:HMC) Holdings Decreased by Choreo LLC

- Harbour Investments Inc. Purchases 520 Shares of Honda Motor Co., Ltd. (NYSE:HMC)

- PNC Financial Services Group Inc. Sells 351 Shares of Honda Motor Co., Ltd. (NYSE:HMC)

- Mitsubishi UFJ Asset Management Co. Ltd. Sells 610 Shares of Honda Motor Co., Ltd.

Opinion

Honda’s June 2025 production and sales update matters because it frames the recent revenue softness (quarterly revenue growth -1.20% yoy) and the steep earnings compression (-50.20% yoy). If the report signals normalizing output, mix improvement, or easing logistics costs, thin profitability (2.95% profit margin; 4.57% operating margin) could begin to rebuild into FY2026–FY2027. The share price already reflects better sentiment: after a December 2024 trough of 1,229.5, the stock has climbed back to 1,637.5, near its 1,674.5 high and above both the 50‑day and 200‑day moving averages. With beta at 0.33, the name has been a relatively low‑volatility way to participate in an auto recovery. The next leg higher likely requires evidence that volumes and pricing can lift cash conversion consistently, not just sporadically.

The launch of a Honda insurance agency, powered by VIU by HUB, is strategically notable. It extends the customer relationship beyond the vehicle sale into ownership and risk services, creating the potential for stickier lifetime value and incremental fee income. Near term, the P&L impact may be modest relative to 21.62T of revenue, but strategically it supports a broader service ecosystem around financing, protection, and maintenance. That can smooth cyclicality, especially if auto demand wobbles. Execution will hinge on distribution reach, underwriting partners, and how seamlessly insurance integrates into retail and digital experiences. For investors, the initiative adds an option on steadier, higher‑margin revenue streams without materially increasing balance‑sheet risk, which is important given total debt of 11.87T and a near‑100% debt/equity ratio.

Income support remains a differentiator. A forward dividend yield of 4.27% with a 47.25% payout ratio looks defensible against 459.07B in operating cash flow and 593.41B in levered free cash flow, provided margins don’t erode further. The low beta (0.33) and proximity to moving‑average support suggest pullbacks could be orderly, although the 52‑week total change of 4.47% trails broader benchmarks (S&P 500 at 15.01%). If the production cadence stabilizes and service adjacencies slowly scale, the stock could graduate from a yield‑plus‑value setup to a moderate growth profile. Without that, returns may remain anchored to the dividend and incremental buybacks, with valuation capped by mid‑single‑digit margins.

Fund‑flow headlines show mixed but incremental institutional activity. Small position trims and adds (e.g., updates from Choreo LLC, Harbour Investments, PNC Financial Services, and Mitsubishi UFJ Asset Management) are not thesis‑changing on their own but reflect ongoing portfolio rebalancing near the 52‑week high. The technical backdrop is constructive: price above the 50‑day and 200‑day moving averages, with liquidity supported by average three‑month volume of 18.91M. Near‑term catalysts include monthly production data and the 9/29/2025 ex‑dividend date, which can draw income‑focused demand. Risks center on margin recovery timing, the pace of product transition, and macro sensitivity in key markets. Overall, the setup argues for patience: let operating data confirm that early optimism embedded in the price can be sustained.

What could happen in three years? (horizon August 2025+3)

| Scenario | Business picture | Implication for the stock |

|---|---|---|

| Best | Production normalizes, product mix improves, and service adjacencies (including insurance) gain traction. Cash generation strengthens while maintaining disciplined capital spending. | Re‑rating toward a quality yield‑plus‑growth profile; dividend perceived as increasingly secure; drawdowns remain shallow. |

| Base | Volumes stabilize but price/mix and costs offset each other. Services contribute steadily but modestly. Balance sheet metrics remain broadly unchanged. | Range‑bound performance around long‑term averages; total return driven mainly by dividend and selective buybacks. |

| Worse | Demand softens and input costs or recalls pressure margins. Services underwhelm and cash conversion weakens, limiting financial flexibility. | De‑rating toward value‑only; dividend policy faces scrutiny; stock tracks lower with occasional relief rallies on data points. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Monthly production/sales momentum versus cost inflation’s impact on thin margins.

- Execution of service adjacencies (including the new insurance agency) and their contribution to recurring revenue.

- Capital allocation discipline relative to dividend sustainability and free cash flow trends.

- Balance‑sheet leverage and funding conditions given total debt and debt/equity near parity.

- FX and macro demand in core markets affecting pricing, mix, and export competitiveness.

Conclusion

Honda’s investment case into 2026–2028 mixes resilience with execution risk. The company brings scale, liquidity (current ratio 1.30; total cash 4.17T), and an appealing income profile (forward dividend yield 4.27%; payout 47.25%). Yet the near‑term datapoints remind investors to be selective: quarterly revenue slipped and earnings compressed sharply year over year, leaving profit and operating margins thin. The stock’s recovery from the late‑2024 trough to near its 52‑week high suggests improving confidence, supported by a low beta and constructive technicals. From here, fundamentals must validate price: consistent production, stable mix, and incremental contribution from services such as insurance could underpin gradual margin repair. If that occurs, total return could exceed the dividend as modest growth re‑enters the story. If not, the shares may remain a cautious income holding. Monitoring monthly reports and capital discipline will be key.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.