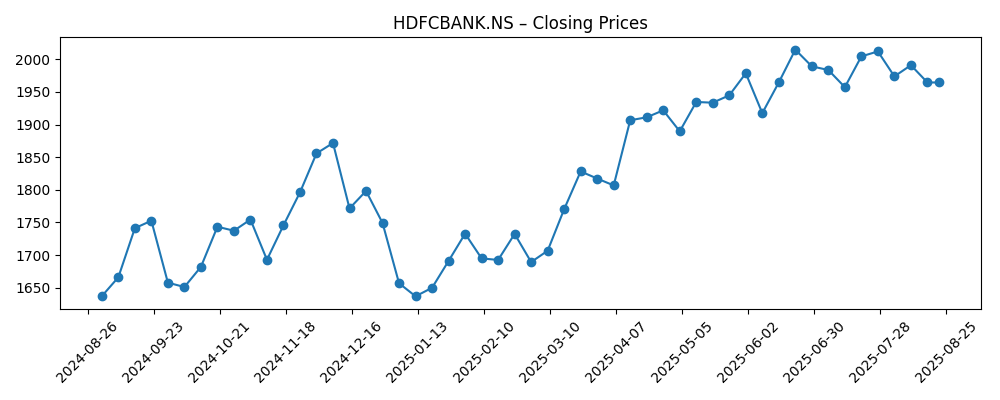

HDFC Bank Ltd (HDFCBANK.NS) enters the next three years with post‑merger scale, resilient profitability, and a relatively low beta. Over the last year the stock has traded between 1,613–2,037.70 and closed around 1,964.60 on 22 August 2025, modestly below its 50‑day average of 1,987.82 but above the 200‑day at 1,845.24. On fundamentals, the bank reports revenue of 2.74T (ttm), net income of 705.75B, a profit margin of 25.79% and operating margin of 29.77%, with ROE at 13.92% and ROA at 1.73%. Dividend visibility has improved, with a forward annual dividend rate of 22 (1.10% yield) and a payout ratio of 25.15%; the ex‑dividend date was 25 July 2025. A 2:1 stock split is dated 26 August 2025.

Key Points as of August 2025

- Revenue – Revenue (ttm): 2.74T; Quarterly revenue growth (yoy): 1.10%; Gross profit (ttm): 2.74T.

- Profit/Margins – Net income (ttm): 705.75B; Profit margin: 25.79%; Operating margin: 29.77%; Diluted EPS (ttm): 87.41; ROE: 13.92%; ROA: 1.73%.

- Sales/Backlog – For a bank, “backlog” is not applicable; near‑term growth signaled by quarterly earnings growth (yoy): -1.30% and focus on loan/deposit mix.

- Share price – Last weekly close: 1,964.60 (22 Aug 2025); 52‑week range: 1,613–2,037.70; 50‑DMA: 1,987.82; 200‑DMA: 1,845.24; 52‑week change: 22.53%; Beta (5Y): 0.62.

- Analyst view – Market attention remains on post‑merger synergies, deposit pricing, credit costs and sustained profitability amid modest top‑line growth.

- Market cap – Not provided here; Shares outstanding: 7.67B; Float: 7.63B; Institutions: 56.09% of shares; Insiders: 0.15%.

- Capital returns – Forward annual dividend rate: 22 (yield 1.10%); Payout ratio: 25.15%; Ex‑dividend date: 7/25/2025; Last split: 2:1 on 8/26/2025.

- Balance sheet – Total cash (mrq): 1.43T; Total debt (mrq): 6T; Book value per share (mrq): 708.59.

- Trading/volume – Avg vol (3M): 8.59M; Avg vol (10D): 6.73M.

Share price evolution – last 12 months

Notable headlines

- Sebi slaps Rs 10 lakh fine on entity for insider trading during HDFC-HDFC Bank merger [The Times of India]

- Bombay HC quashes notice issued to HDFC MD by magistrate's court in defamation complaint [The Times of India]

Opinion

HDFC Bank’s share price has moved back toward the upper half of its 52‑week range, closing near 1,964.60 and holding above the 200‑day moving average while hovering just below the 50‑day. That positioning typically signals a constructive intermediate trend but with scope for consolidation. The five‑year beta of 0.62 underscores the franchise’s lower‑volatility profile within Indian equities, a trait that often attracts steady institutional allocation. With average three‑month volume at 8.59M shares, liquidity remains supportive, and the upcoming 2:1 split dated 26 August 2025 could further broaden retail participation. Over a three‑year horizon, a grind higher seems plausible if profitability metrics remain intact and the bank sustains deposit mobilization at acceptable cost. Conversely, a breach below the 200‑day average would likely invite mean reversion toward the mid‑range of the 52‑week band.

The regulatory headlines in recent months appear more peripheral than structural. The SEBI penalty related to insider trading during the HDFC–HDFC Bank merger targeted an entity, not the bank’s ongoing operations, but it serves as a reminder of elevated scrutiny around large corporate actions. Meanwhile, the Bombay High Court’s decision to quash a notice to an HDFC MD in a defamation matter reduces legal noise that could have distracted management. Neither item alters the bank’s capital position or earnings power based on available data, yet such developments can sway sentiment at the margin. In practice, investors may read these as housekeeping events: compliance vigilance remains high, and a lingering legal overhang has eased. Over time, less noise can compress risk premia, especially for a low‑beta name where small shifts in perceived governance quality can matter for multiples.

Fundamentals remain the center of gravity. Revenue stands at 2.74T (ttm) with net income at 705.75B and robust profit and operating margins of 25.79% and 29.77%, respectively. Return metrics (ROE 13.92%, ROA 1.73%) are healthy, though quarterly revenue growth of 1.10% and quarterly earnings growth of -1.30% flag a need for operating leverage and balance‑sheet mix management. Management emphasis is likely to remain on deposit pricing discipline, cross‑selling to the expanded customer base post‑merger, and credit underwriting as the cycle matures. The reinvigorated dividend (forward rate 22; 1.10% yield; payout 25.15%) adds a predictable total‑return component, potentially broadening the shareholder base. If the bank can translate its scale into fee income and stabilize funding costs, modest top‑line growth could still compound into attractive bottom‑line outcomes over three years.

Looking out to August 2028, the path of least resistance is steady compounding rather than step‑function growth. A base case envisions mid‑single‑digit revenue expansion, supported by lending to resilient sectors and improved fee traction, while maintaining margins near current ranges. The best case would combine a benign credit cycle, stronger loan demand, and durable deposit inflows that reduce funding costs, allowing incremental operating leverage. The worst case would feature intense deposit competition, higher credit costs, and macro shocks that slow India’s growth, compressing spreads and pressuring profitability. Importantly, HDFC Bank’s low beta and institutional sponsorship (56.09% ownership) may buffer drawdowns relative to the broader market, but not eliminate them. Execution on technology, risk controls, and integration synergies will determine which branch of this distribution the bank occupies.

What could happen in three years? (horizon August 2025+3)

| Scenario | Description (August 2028 horizon) |

|---|---|

| Best | Credit demand remains robust; deposit franchise deepens, easing funding costs; fee income gains from cross‑sell and digital channels; margins and ROE hold near current levels or improve; steady dividend growth supports total returns. |

| Base | Moderate loan growth with disciplined underwriting; deposit competition offsets some pricing gains; operating efficiency improves gradually; profitability remains solid but growth is paced by the broader economy; dividend continuity underpins returns. |

| Worse | Macro slowdown or credit shock elevates credit costs; deposit pricing pressure compresses spreads; revenue growth stalls and profitability moderates; legal/regulatory noise resurfaces; the stock underperforms and reverts toward long‑term averages. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Deposit pricing and mix dynamics affecting net interest margins and funding costs.

- Asset quality trends and credit costs as the lending cycle matures.

- Realization of post‑merger cross‑sell and operating synergy opportunities.

- Regulatory developments and legal outcomes that influence investor confidence.

- Macro growth, liquidity flows (including FPI activity), and interest‑rate trajectory in India.

- Capital return policy consistency (dividends/splits) and market liquidity.

Conclusion

HDFC Bank’s investment case into 2028 rests on durable profitability supported by scale and franchise strength, against a backdrop of modest reported top‑line growth. The shares trade near the upper half of their 52‑week range, with a low historical beta and healthy return metrics offering some resilience. Headline risk from recent regulatory and legal items appears manageable based on currently available information, while a refreshed dividend and a 2:1 split dated 26 August 2025 may enhance investor participation and total‑return visibility. The central swing factor is funding cost discipline: if deposit mobilization keeps pace with loan demand, margin stability should follow, enabling earnings compounding even at moderate revenue growth. Conversely, a tougher credit or rate environment would test spreads and asset quality. On balance, a base‑case glide path of steady compounding with periodic volatility appears reasonable over a three‑year horizon.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.