Embraer S.A. (ERJ) enters August 2025 with momentum after a 79.52% 52‑week gain, supported by a record $30 billion backlog and improving fundamentals. The company’s trailing 12‑month revenue stands at 39.8B with operating margin at 9.97% and profit margin at 5.37%, while return on equity is 11.32%. Shares recently closed at 58.71, within a 52‑week range of 31.76–61.65, and trade above the 50‑day and 200‑day moving averages. Analyst sentiment has tilted constructive following an upgrade to Outperform and a price target lift to $67, even as some institutions trimmed positions. With 6.86B in cash versus 12.68B of debt and solid operating cash flow of 5.59B, the balance sheet supports execution. This note outlines a three‑year view centered on backlog conversion, margins, and catalysts.

Key Points as of August 2025

- Revenue: 39.8B (ttm); revenue per share 216.82; quarterly revenue growth (yoy) 30.90%.

- Profit/Margins: Operating margin 9.97%; profit margin 5.37%; gross profit 7.39B; EBITDA 4.08B; ROA 3.56%; ROE 11.32%.

- Sales/Backlog: Record $30 billion backlog cited for Q2; quarterly earnings growth (yoy) −13.80% underscores execution discipline needed.

- Balance sheet and liquidity: Cash 6.86B; debt 12.68B; debt/equity 64.42%; current ratio 1.33; operating cash flow 5.59B; levered free cash flow 2.37B.

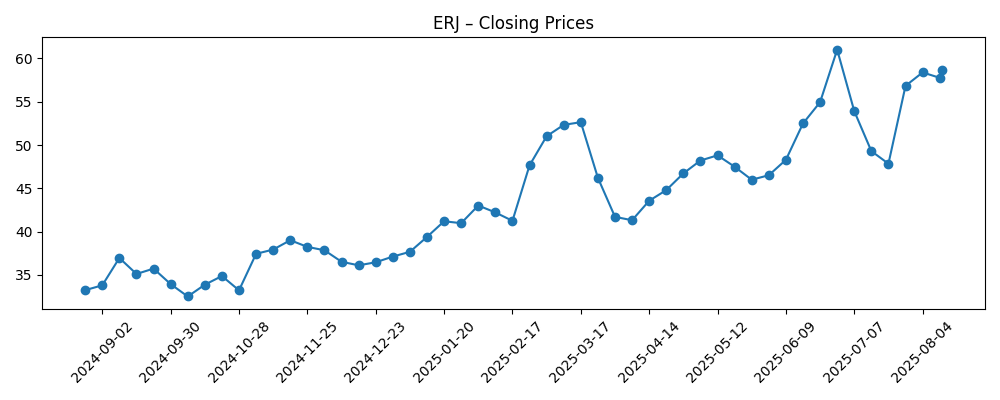

- Share price and technicals: Last weekly close 58.71 (8/12/2025); 52‑week range 31.76–61.65; 50‑day MA 52.65; 200‑day MA 44.87; beta 1.12; 52‑week change 79.52% vs S&P 500 17.28%.

- Ownership and short interest: Shares outstanding 183.39M; short interest 7.17M (short ratio 2.57); short at 3.91% of shares outstanding and 4.35% of float; institutions hold 49.29%.

- Analyst view: Rating upgrade to Outperform and a recent price target raise to $67 signal improving sentiment.

- Dividends: Forward annual dividend 0.05 (0.09% yield); trailing dividend 0.07 (0.12% yield); payout ratio 2.40%; ex‑div 5/16/2025; dividend date 6/2/2025.

- Market cap: Company remains a mid‑cap aerospace name; market value not specified here.

Share price evolution – last 12 months

Notable headlines

- Here Is Why Wolfe Research Upgraded Embraer S.A. (ERJ)’s Stock Rating To Outperform

- Brazil planemaker Embraer ends Q2 with record $30 billion backlog

- Embraer-Empresa Brasileira de Aeronautica (NYSE:ERJ) Price Target Raised to $67.00

- Victory Capital Management Inc. Sells 494,437 Shares of Embraer (NYSE:ERJ)

- Embraer (NYSE:ERJ) Holdings Reduced by Assetmark Inc.

- Embraer (NYSE:ERJ) Shares Sold by Envestnet Asset Management Inc.

Opinion

The record $30 billion backlog is the cornerstone of Embraer’s medium‑term story. In our view, that level of contracted demand provides unusual revenue visibility for a cyclical, capital‑intensive business. The company’s recent 30.90% year‑over‑year quarterly revenue growth suggests deliveries and services are scaling, but the negative quarterly earnings growth highlights the importance of mix, pricing, and cost control when converting the backlog. Over the next three years, management’s challenge will be to translate backlog into higher‑margin output without overstretching working capital. With 6.86B in cash and healthy operating cash flow, Embraer appears equipped to navigate supply chain twists, but execution around supplier readiness and on‑time certification milestones remains critical to keeping schedules and margins intact.

Analyst signaling has turned more constructive, with a high‑profile upgrade to Outperform and a price target increase to $67. Such moves can broaden the shareholder base and lower the cost of capital, particularly when coinciding with rising estimates. For Embraer, improving operating margin (9.97% ttm) and ROE (11.32%) provide a fundamentals‑based backdrop for these calls. That said, the market will likely demand evidence of sustained profitability beyond a single strong quarter of revenue growth. Watch for commentary on production cadence, unit economics, and services attach rates; incremental proof points on these fronts could validate the upgrade narrative and support multiple expansion, even if macro conditions become less supportive for aerospace.

Shares have rerated meaningfully, closing at 58.71 and sitting just below the 52‑week high of 61.65, with the 50‑day and 200‑day moving averages trending higher. The stock’s 79.52% 12‑month outperformance versus the S&P 500’s 17.28% signals confidence in the turnaround and growth path. Volatility has been notable in recent weeks, reflecting a broader rotation and profit‑taking after a strong run. With beta at 1.12 and short interest modest (short ratio 2.57), swings may be more tied to delivery headlines, macro inputs, and order announcements than to positioning extremes. For long‑term holders, maintaining focus on backlog burn, margin trajectory, and cash conversion is likely more important than short‑term technical fluctuations.

Institutional flows have been mixed, with several asset managers trimming positions despite improving sentiment. That dynamic is not unusual after a sharp appreciation and can reflect mandate‑driven rebalancing rather than a fundamental call. Over a three‑year window, the more consequential factor is whether Embraer can compound free cash flow (2.37B ttm) while keeping leverage in check (debt/equity 64.42%). If management sustains operational discipline and services growth, we see room for continued deleveraging and selective capital returns, even with a low current payout ratio of 2.40%. Conversely, if supply chain bottlenecks or execution hiccups elongate delivery timelines, working capital could tighten and weigh on margins, tempering the re‑rating that has unfolded through mid‑2025.

What could happen in three years? (horizon August 2028)

| Scenario | Assumptions | Operational outcomes | Potential market reaction |

|---|---|---|---|

| Best | Backlog converts on schedule; new orders replenish pipeline; stable supply chain; disciplined costs and capex. | Improved mix and services lift margins; cash conversion remains strong; leverage trends lower; consistent execution across Commercial, Defense, and Services. | Multiple expansion supported by sustained growth and profitability; shares track near the upper end of recent performance bands. |

| Base | Deliveries largely on plan with periodic hiccups; pricing stable; modest macro headwinds; steady services contribution. | Margins hold around recent levels; free cash flow funds incremental deleveraging and modest shareholder returns. | Valuation stabilizes; shares move with fundamentals and newsflow on orders and execution milestones. |

| Worse | Supply chain disruptions and certification delays; slower backlog conversion; cost inflation pressures. | Margin compression; working capital strain; slower cash generation limits balance sheet improvement. | Multiple contracts; shares retrace toward longer‑term averages until visibility improves. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Backlog conversion pace and delivery execution, including supplier readiness and on‑time certifications.

- Margin trajectory across programs and services, with sensitivity to mix, pricing, and input costs.

- Order intake and pipeline health, particularly in regional jets, defense platforms, and aftermarket services.

- Balance sheet management and cash generation versus capex needs, affecting leverage and capital returns.

- Macro and regulatory backdrop (rates, FX, trade), which can influence financing costs, demand, and timing of deliveries.

Conclusion

Embraer’s investment case into 2028 hinges on converting a record backlog into profitable growth while maintaining financial discipline. The company’s current profile—revenue of 39.8B (ttm), operating margin of 9.97%, and ROE of 11.32%—supports the narrative of an improving operator with healthier cash generation (5.59B operating cash flow, 2.37B levered free cash flow). The stock’s strong performance and constructive analyst tone raise the bar for execution, and recent trims by some institutions underscore that expectations have risen. We think the base path is continued, steady improvement, with upside if supply chains remain stable and services expand, and downside if delays sap margins or working capital. Monitoring quarterly commentary on production cadence, cost control, and order momentum should provide early signals of which path is unfolding.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.