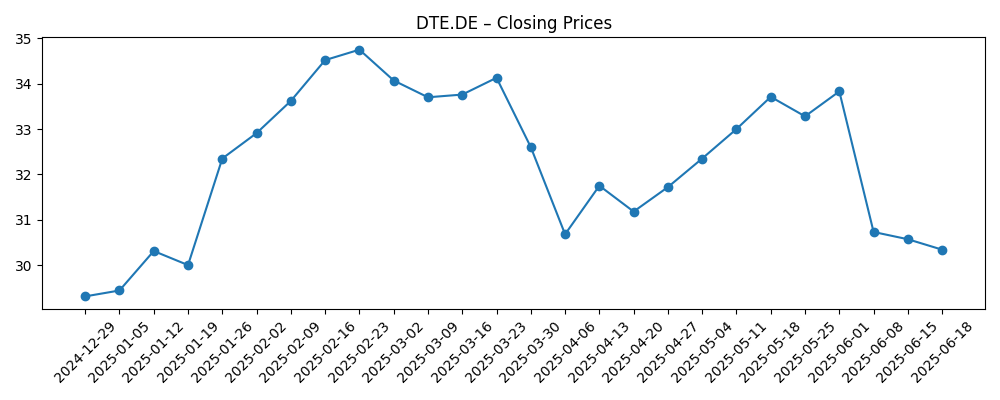

Deutsche Telekom’s Frankfurt‑listed shares (DTE.DE) have swung within a defined band in 2025, peaking near late‑February highs before sliding toward September lows. Over the past six months, the stock traded in a 28.65–34.75 range and last closed at 28.97 on October 6, 2025. With no fresh fundamentals provided here, the three‑year view hinges on strategic levers rather than short‑term datapoints: the cash‑generation profile of its U.S. exposure, pricing and cost discipline in core European markets, fiber and 5G monetization, and the pace of deleveraging versus capital returns. The setup suggests a mature, cash‑centric story where macro (rates, FX) and competition can nudge sentiment as much as company‑specific catalysts. Investors will watch whether management can defend margins while advancing network investments and simplifying the group structure to unlock value into the 2028 horizon.

Key Points as of October 2025

- Revenue: No current figures provided in this snapshot; mix remains anchored by U.S. wireless exposure and European fixed‑line/mobile operations.

- Profit/Margins: No margin data provided; scale in the U.S. likely supports group profitability while European energy and wage dynamics remain a watch‑item.

- Sales/Backlog: Telecoms rarely report "backlog"; commercial momentum depends on postpaid churn/pricing, fiber uptake, and enterprise ICT demand.

- Share price: Six‑month range 28.65–34.75; last close 28.97 (October 6, 2025) after retreating from February highs.

- Analyst view: Consensus details not provided; debate centers on capital intensity versus cash returns and the valuation of U.S. assets.

- Market cap: Not provided; the group is a large, liquid European telecom with broad investor following.

- Capital returns: Policy oriented to sustainable payouts; specifics and any buyback activity are not included in the supplied data.

- Balance sheet: Leverage path hinges on U.S. cash flows and asset optionality; interest rates and FX remain key external variables.

Share price evolution – last 12 months

Notable headlines

Opinion

Price action through 2025 sketches a balanced but hesitant market view. The stock’s February surge toward 34.75 likely reflected optimism around operating resilience and optionality in the group’s portfolio, while the subsequent slide into September lows near 28.65 echoes macro headwinds and a reset in risk appetite. Within telecoms, investors often toggle between a “bond‑proxy” lens and a growth‑via‑US‑exposure lens. When rates rise or recession fears loom, multiples compress; when cash visibility improves and competitive intensity stabilizes, sentiment heals. Into 2028, the question is whether Deutsche Telekom can tilt this balance toward cash compounding: defend ARPU with disciplined pricing, lower unit costs via fiber/5G densification, and keep service quality high enough to prevent churn‑driven leakage. If those ingredients hold, the equity case leans toward steady value creation rather than dramatic re‑rating.

The U.S. footprint remains decisive. A healthy U.S. wireless cycle typically delivers scale benefits and cash that can support deleveraging and shareholder returns at the group level. Strategic optionality—ranging from incremental ownership optimization to efficient funding of network investments—can unlock value without relying on aggressive top‑line growth. Conversely, a re‑acceleration in U.S. promotional intensity or unexpected device subsidy pressure could crimp margin traction. For equity holders, this means monitoring U.S. postpaid trends, network quality metrics, and the cadence of capital return at the U.S. unit. A supportive U.S. backdrop would make it easier for the group to maintain or improve its financial flexibility while pursuing targeted growth areas in enterprise connectivity and convergent bundles.

Europe sets the floor for the story. The region’s fiber build and 5G rollout continue to shift cost curves, but benefits arrive gradually and are often offset by regulation and inflation. Pricing discipline, wholesale access economics, and energy costs will shape margin dynamics. If inflation normalizes and wage drift settles, Europe can stabilize as a steady cash contributor. Convergence—tying mobile, fixed, and services—helps retention and moderates churn, though it requires sustained commercial investment. For investors, the near‑term tell will be whether operational KPIs imply improving unit economics: rising fiber penetration where available, firm mobile ARPU, and manageable churn despite competition. Execution against these practical markers is more informative than headline targets that may be sensitive to macro swings.

Capital allocation is the swing factor that could nudge the equity narrative. In a constructive setup, management can blend disciplined capex with measured deleveraging and a predictable dividend path, while using portfolio moves to surface value. FX and rates will color the outcome: a firmer euro against the dollar would translate U.S. cash at less favorable terms, and higher long‑end yields would pressure valuation multiples and interest expense. Still, prudent liability management and selective asset actions can offset these headwinds. Into 2028, we see a distribution‑led, cash‑flow‑first profile with upside if competitive intensity remains rational. Should the operating environment deteriorate or financing costs remain stubbornly high, the path likely reverts to range‑bound trading as investors await clearer catalysts.

What could happen in three years? (horizon October 2025+3)

| Case | Operating themes | Share price implication | What to watch |

|---|---|---|---|

| Best | Rational competition, solid U.S. cash generation, steady European pricing, and visible deleveraging; fiber/5G efficiency gains compound. | Breaks above the February 2025 high (~34.75) and sustains higher highs on improved confidence in cash returns. | U.S. postpaid trends, churn, pricing discipline, capex efficiency, and any value‑unlocking portfolio moves. |

| Base | Mixed macro; stable but unspectacular growth; Europe offsets U.S. variability; capital returns remain predictable. | Range‑bound trading broadly around recent bands (approximately 28.65–33.70) as investors await stronger catalysts. | FX (EUR/USD), rate trajectory, incremental pricing moves, and execution on fiber uptake and enterprise wins. |

| Worse | Heightened competition or cost shocks; slower deleveraging; regulatory pressure; sustained higher rates/energy costs. | Re‑tests the 2024–2025 lows (roughly 28.00–28.65) with limited multiple support until visibility improves. | Promotional intensity, ARPU erosion, delays in network projects, and adverse regulatory or legal developments. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- U.S. wireless dynamics: postpaid net adds, churn, and pricing posture shaping cash generation and sentiment.

- European pricing and regulation: wholesale access terms, spectrum policy, and convergence economics affecting margins.

- Interest rates and refinancing: funding costs versus deleveraging pace, and the valuation impact of long‑end yields.

- FX (EUR/USD): translation of U.S. earnings/cash flows into euros and associated hedging effectiveness.

- Network investment execution: fiber/5G rollout efficiency, capex discipline, and service quality outcomes.

Conclusion

With the stock cycling between 28.65 and 34.75 over the past six months and closing at 28.97 on October 6, 2025, Deutsche Telekom looks set for a cash‑centric, execution‑driven chapter into 2028. The investment case hinges on the balance between steady European operations and leveraged exposure to the U.S., where cash generation can underpin deleveraging and distributions. Absent fresh financials in this snapshot, investors should focus on practical markers: pricing discipline, churn, fiber penetration, and capital allocation signals. A supportive competitive backdrop and prudent liability management could lift the shares above prior highs; persistent macro and regulatory friction would likely keep them range‑bound near recent levels. On balance, we see a base‑case of stable compounding with optionality for upside if operating momentum in the U.S. and Europe aligns, and if capital returns remain predictable.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.