DBS Bank (D05.SI) enters August 2025 with strong profitability and a share price near its 52‑week high. Over the past year, the stock rose 41.89% to 50.81 as of August 22, outpacing the S&P 500’s 15.13%. The bank reports trailing‑twelve‑month revenue of 22.1B and net income of 11.19B, supported by a 51.0% profit margin, 59.46% operating margin, and 16.81% return on equity. Income investors note a forward dividend yield of 5.20% (payout ratio 61.72%), with an ex‑dividend date on August 14, 2025. Meanwhile, DBS is expanding into tokenized structured notes on Ethereum, signaling product innovation that could diversify fee income. With a low 0.51 beta and ample liquidity, the three‑year outlook will hinge on rate‑cycle dynamics, digital execution, and capital discipline.

Key Points as of August 2025

- Revenue: TTM revenue 22.1B; quarterly revenue growth (yoy) 5.0%; revenue per share 7.78.

- Profit/Margins: Net income (ttm) 11.19B; profit margin 51.0%; operating margin 59.46%; ROE 16.81%; ROA 1.38%.

- Sales/Backlog: Banking has no backlog metric; quarterly earnings growth (yoy) 1.40% indicates steady, slower profit expansion.

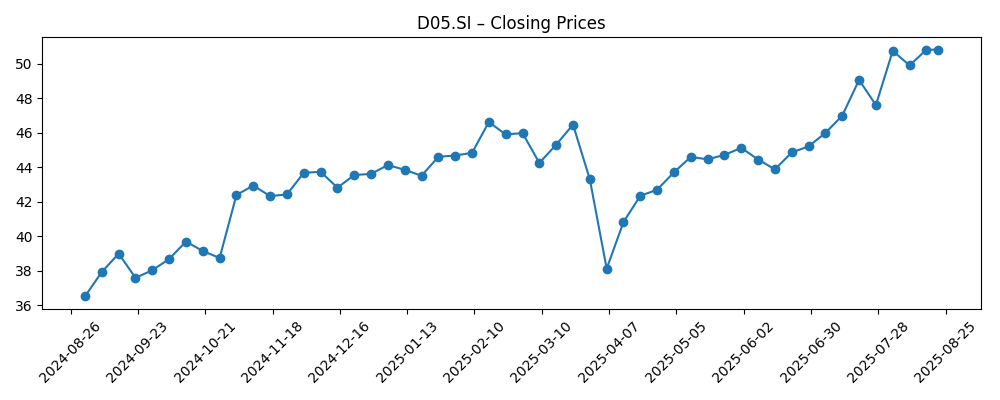

- Share price: Last close 50.81 (Aug 22, 2025); 52‑week range 35.52–51.45; 50‑ and 200‑day moving averages at 47.21 and 44.73; beta 0.51; 52‑week change 41.89%.

- Dividend: Forward annual dividend rate 2.64 and yield 5.20%; trailing dividend rate 2.34 and yield 4.62%; payout ratio 61.72%; ex‑dividend date 8/14/2025.

- Market cap: Approximately 144.3B (50.81 x 2.84B shares outstanding).

- Capital & liquidity: Total cash (mrq) 69.71B; total debt 172.78B; book value per share 23.81; operating cash flow (ttm) −28.58B.

- Trading activity: Average volume (3m) 4.32M; average volume (10d) 3.9M; float 2.03B; institutional ownership 53.36%.

- Analyst/strategy signals: DBS launched tokenized structured notes on Ethereum for institutions, highlighting digital‑asset product innovation.

Share price evolution – last 12 months

Notable headlines

- DBS expands crypto offerings with tokenized structured notes on Ethereum

- Ethereum Now Carries Tokenized Notes From Singapore’s Largest Bank

- DBS Bank to tokenize structured notes on Ethereum for institutional investors

- For next 3–4 months, US Fed has runway to cut rates: DBS’s Taimur Baig

Opinion

DBS’s move to offer tokenized structured notes on Ethereum is a notable step in institutional digital assets. For a universal bank with sizeable wealth‑management and treasury franchises, tokenization could streamline issuance and post‑trade processes while enabling fractional access and faster settlement for professional clients. If executed prudently under existing regulatory frameworks, these products can deepen client relationships and support higher non‑interest income. The launch also expands DBS’s technology stack and know‑how, potentially creating optionality for future offerings in tokenized bonds or funds. Over the next three years, the key will be balancing innovation with rigorous risk controls so that operational, custody, and smart‑contract risks do not offset the fee upside.

Interest‑rate trajectory remains the other swing factor. DBS’s economist guidance that the Federal Reserve has scope to cut in the coming months implies eventual pressure on net interest margins after a peak‑rate period. However, lower rates can lift credit demand, support asset quality, and revive capital‑markets activity—areas where DBS can monetize through lending, WM flows, and brokerage/treasury fees. With a 16.81% ROE and 51.0% profit margin, the bank has room to absorb gradual NIM normalization if fee engines pick up. The 5.20% forward dividend yield and a 61.72% payout ratio anchor total returns, provided earnings growth, even at low single digits, remains positive.

The share price action supports a constructive stance. DBS trades near its 52‑week high (range 35.52–51.45) and above its 50‑ and 200‑day moving averages (47.21 and 44.73), with a 0.51 beta underscoring defensive characteristics. After the August 14 ex‑dividend date, the stock typically adjusts for the cash payout, but yield support can steady demand on dips. The 52‑week gain of 41.89% outpacing the S&P 500’s 15.13% reflects sustained profitability and investor confidence. Over a three‑year horizon, maintaining momentum will likely require clear evidence that digital initiatives drive fee income and that credit costs remain contained through the rate cycle.

Execution is the watchword. Tokenized products necessitate robust compliance, cybersecurity, and vendor oversight, especially when integrating public‑chain rails with institutional controls. Any operational incident could slow adoption and attract scrutiny. Competition at home is intense, and peers can replicate product features, making distribution, trust, and ecosystem partnerships decisive. On the balance‑sheet side, funding costs and deposit mix will influence margin durability, while macro shocks can affect loan growth and wealth flows. Against this backdrop, DBS’s ample liquidity, strong ROE, and brand strength are advantages—but delivery against these strategic vectors will determine whether today’s premium is maintained into 2028.

What could happen in three years? (horizon August 2025+3)

| Scenario | Three‑year view (to August 2028) |

|---|---|

| Best | Digital asset offerings scale with institutional uptake; fee income expands, offsetting NIM drift from lower rates. Asset quality stays robust and WM inflows accelerate. Shares sustain above the upper end of the recent range, supported by dependable dividends. |

| Base | Rate cuts compress NIM moderately, but lending volumes and treasury/WM fees balance the impact. Tokenized products gain measured traction with limited balance‑sheet usage. Returns remain near current levels and dividends grow in line with earnings. |

| Worse | Rapid margin compression and weaker trading/WM activity coincide with higher credit costs. Digital initiatives face regulatory or operational setbacks, slowing adoption. Shares retest prior range lows as investors prioritize capital preservation. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Interest‑rate path and deposit mix shaping net interest margin resilience.

- Execution and regulatory acceptance of tokenized structured notes and broader digital‑asset offerings.

- Credit quality trends across corporate and consumer portfolios through the cycle.

- Wealth‑management flows, capital‑markets activity, and treasury income sensitivity to volatility.

- Capital return policy relative to earnings (dividends) and balance‑sheet flexibility.

Conclusion

DBS enters the next three years with enviable profitability, a strong dividend, and a stock trending near its 52‑week high. The core debate is how quickly net interest margins normalize versus the pace at which fee businesses—wealth management, treasury, and now tokenized structured notes—can fill the gap. Current metrics (profit margin 51.0%, ROE 16.81%, low beta of 0.51) argue for resilience, while average volumes and institutional ownership indicate sustained investor interest. The newly announced tokenization of structured notes is strategically important: it can deepen client engagement and differentiate service, provided operational controls remain tight. On balance, a base‑case path of steady returns with modest earnings growth appears reasonable, with upside if digital initiatives scale more quickly. Risks center on rate volatility, credit costs, and execution in digital assets, but the franchise’s scale and balance sheet underpin a constructive long‑term stance.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.