Credicorp Ltd. (NYSE: BAP) enters August 2025 with strong profitability, rising revenues, and a share price testing record territory. Trailing-twelve-month revenue stands at 18.75B with a 30.76% profit margin and 53.26% operating margin, while ROE of 16.64% underscores solid capital efficiency. Shares have rallied 51.56% over the past year and recently approached the 52-week high of 250.41, supported by improving momentum above the 200-day moving average. Cash (39.42B) exceeds total debt (26.73B), and a forward annual dividend yield of 4.42% complements a roughly half-earnings payout ratio. Near term, investors await the company’s declared 2Q25 quiet period, with quarterly revenue growth of 13.10% and earnings growth of 17.60% yoy providing a constructive backdrop. Over the next three years, valuation discipline, dividend sustainability, and execution on growth will be central to BAP’s risk–reward.

Key Points as of August 2025

- Revenue (ttm): 18.75B; quarterly revenue growth (yoy): 13.10%.

- Profitability: Profit margin 30.76%; operating margin 53.26%; ROE 16.64%.

- Earnings: Net income (ttm) 5.77B; diluted EPS (ttm) 19.99; quarterly earnings growth (yoy) 17.60%.

- Balance sheet: Total cash 39.42B vs total debt 26.73B.

- Dividend: Forward yield 4.42%; payout ratio 49.16%; last dividend date 6/13/2025.

- Share price: 52-week range 164.15–250.41; 52-week change +51.56% vs S&P 500 +19.55%.

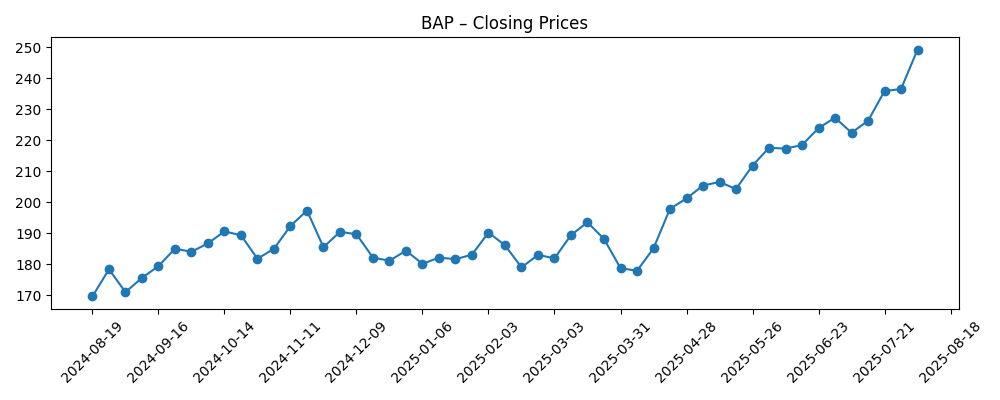

- Momentum: 50-day MA 225.25 above 200-day MA 197.88; recent close near 249.20 (8/04/2025).

- Ownership/sentiment: Institutions hold 78.12%; short ratio 2.61 with 1.11% of float shorted.

- Valuation context: Trades below book value per share (451.62); dividend supports total return.

Share price evolution – last 12 months

Notable headlines

- Credicorp Ltd.: Credicorp’s "2Q25 quiet period" (GlobeNewswire)

- Assetmark Inc. Sells 332 Shares of Credicorp Ltd. (NYSE:BAP) (ETF Daily News)

- Choreo LLC Has $728,000 Position in Credicorp Ltd. (NYSE:BAP) (ETF Daily News)

- Wealthquest Corp Purchases New Holdings in Credicorp Ltd. (NYSE:BAP) (ETF Daily News)

- Credicorp Ltd. (NYSE:BAP) Stock Holdings Lessened by Federated Hermes Inc. (ETF Daily News)

Opinion

The company’s declared 2Q25 quiet period suggests near-term information flow will be gated until results, but the latest trailing figures provide a supportive setup. With 13.10% revenue growth and 17.60% earnings growth yoy, BAP has operational momentum heading into earnings. Margins remain wide, and ROE at 16.64% indicates disciplined balance-sheet deployment. The market’s rerating over the past six months—shares moving from the high‑$170s to the high‑$240s—reflects improving confidence that growth is sustainable. Given the stock trades below book value per share, investors appear to be balancing cyclical and regulatory uncertainties against high returns and cash generation. The next print will likely focus on loan mix, credit costs embedded in the margin, and dividend durability.

Fund flow headlines show a mixed but active institutional base, with some position trims offset by new or incremental buys. While these transactions are modest in size, they underscore an ongoing rebalancing as the stock approaches all‑time highs. Institutional ownership of 78.12% and a low short interest (1.11% of float; short ratio 2.61) suggest positioning is constructive but not overly crowded. That backdrop can dampen downside volatility if fundamentals meet expectations, though it may limit incremental multiple expansion without new catalysts. For long-only investors, the forward dividend yield of 4.42% and roughly half-earnings payout present a tangible carry while awaiting updates on growth.

The dividend profile is a central pillar of the three‑year case. A 49.16% payout ratio offers room to maintain or moderately grow distributions provided earnings continue to expand and credit quality holds. With cash of 39.42B exceeding debt of 26.73B, the balance sheet supports flexibility. However, the trailing annual dividend figure is elevated by timing effects; forward indicators point to normalization at a sustainable level. Over the horizon to August 2028, total return is likely driven by a blend of earnings compounding, a steady dividend, and any valuation convergence toward fundamentals like book value. Execution on cost discipline and stability in funding costs are key.

Technically, momentum remains favorable: the 50‑day moving average (225.25) is above the 200‑day (197.88), and the stock recently traded near 249.20, just shy of its 52‑week high at 250.41. That said, the magnitude of the 52‑week gain (+51.56%) raises the bar for positive surprises. Into the next three years, a base‑building phase would be healthy if earnings cadence slows from recent double‑digit rates. Conversely, reiteration of mid‑teens growth, stable credit, and a consistent dividend could sustain the uptrend. In our view, risk–reward skews favorable if the company defends margins and demonstrates prudent capital allocation while keeping payout discipline intact.

What could happen in three years? (horizon August 2025+3)

| Scenario | What it looks like by August 2028 | Implications for BAP |

|---|---|---|

| Best | Revenue and earnings compound at low‑ to mid‑teens, margins remain resilient, and credit costs stay benign. Dividend grows in line with earnings while payout discipline holds near current levels. | Valuation narrows the gap to book value; total return driven by dividend plus price appreciation as sentiment improves. |

| Base | Growth moderates to mid‑ to high‑single digits as the cycle normalizes; margins ease but remain healthy; dividend broadly maintained with modest increases. | Shares track earnings growth with periodic consolidations; total return anchored by income and modest multiple stability. |

| Worse | Macro or credit headwinds drive slower growth and higher provisions; margins compress and dividend growth pauses to preserve capital. | Multiple de‑rates; stock tests support near long‑term averages until visibility on credit normalizes. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Earnings cadence vs expectations, especially revenue growth (13.10% yoy) and margin sustainability.

- Credit quality and provisioning trends that could affect the 30.76% profit margin and ROE of 16.64%.

- Dividend policy relative to the 49.16% payout ratio and forward yield of 4.42%.

- Funding costs and balance‑sheet strength, including cash (39.42B) vs debt (26.73B).

- Market sentiment and flows: institutional ownership (78.12%), short interest (1.11% of float), and momentum vs 50‑/200‑day MAs.

Conclusion

Credicorp’s setup into 2028 is underpinned by healthy profitability, strong capital efficiency, and visible income support. The company posts 13.10% revenue growth and 17.60% earnings growth yoy, a 30.76% profit margin, and ROE of 16.64%, while cash exceeds debt—ingredients that argue for resilience across cycles. Shares have rerated to near record highs after a 51.56% 12‑month gain, and momentum remains positive above long‑term averages. The forward dividend yield of 4.42% and a near‑50% payout ratio add carry to the thesis, with flexibility to maintain distributions if earnings hold. Key watch items include credit costs, funding dynamics, and the tone of the upcoming results following the 2Q25 quiet period. In a base case of moderating but durable growth, we see total returns driven by income plus earnings compounding, with valuation upside contingent on sustained execution.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.