ArcelorMittal (MT.AS) enters the next three years with a firmer share price but mixed fundamentals. As of August 2025, the stock has risen 38.79% over 12 months and trades around 29.23, near its 50-day average of 27.97 and above the 200-day at 26.06. Revenue over the last twelve months stands at 60.63B, with quarterly sales down 2.00% year on year, and profitability modest: a 4.11% net margin and 0.47% operating margin. Cash generation is solid at 4.94B operating cash flow, though levered free cash flow is slightly negative, against 5.36B in cash and 13.73B of total debt. With a forward dividend of 0.52 (1.80% yield) and a payout ratio of 16.01%, the group continues returning capital while navigating cyclical steel demand and restructuring in select geographies.

Key Points as of August 2025

- Revenue: 60.63B (ttm); quarterly revenue growth (yoy) at -2.00%; gross profit 4.92B.

- Profit/Margins: Profit margin 4.11%; operating margin 0.47%; EBITDA 4.7B; diluted EPS 2.83; ROE 4.59%.

- Cash flow: Operating cash flow 4.94B; levered free cash flow -220.5M.

- Balance sheet: Total cash 5.36B; total debt 13.73B; current ratio 1.40; debt/equity 24.32%.

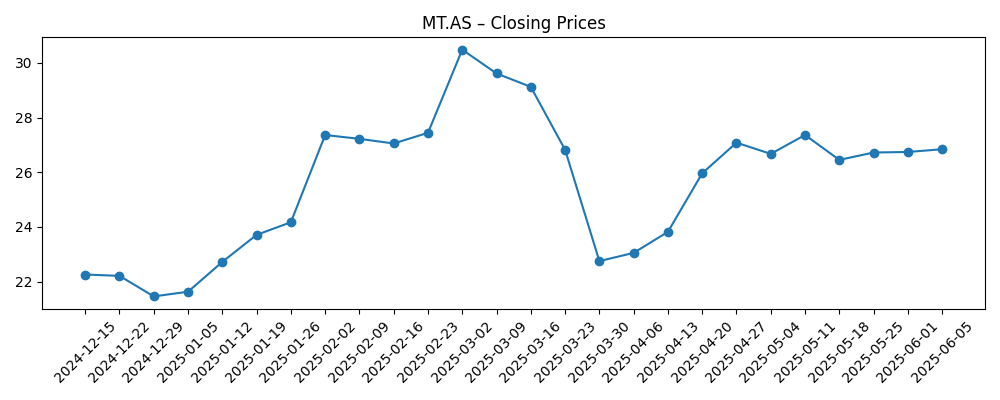

- Share price: 29.23 (Aug 25, 2025); 52-week range 19.65–32.18; 50-DMA 27.97; 200-DMA 26.06; beta 1.70.

- Performance: 52-week change +38.79% vs S&P 500 +15.13%.

- Sales/Backlog: Order book not disclosed in provided data; demand tied to automotive, construction and energy end-markets.

- Dividends: Forward annual dividend 0.52 (1.80% yield); payout ratio 16.01%; next ex-dividend date 11/12/2025.

- Market cap/Ownership: Market cap not provided; shares outstanding 760.49M; float 419.53M; insiders 39.87%; institutions 20.94%.

Share price evolution – last 12 months

Notable headlines

Opinion

The potential shutdown of ArcelorMittal South Africa’s long steel operations would be a pivotal operational decision with mixed near-term optics. On one hand, withdrawing from structurally loss-making volumes can lift consolidated efficiency and reduce cash burn, which matters when the group’s operating margin is just 0.47%. On the other, closures typically bring one-off costs, possible impairments, and stakeholder negotiations that can weigh on quarterly prints. For a global producer with 60.63B in trailing revenue and a 4.11% net margin, the key is whether any disruption is contained and replaced by higher-quality, higher-spread tonnes elsewhere. Investors should watch for the company’s playbook: asset rationalization, contract repricing, and disciplined capex to prevent temporary pain from spilling into a prolonged earnings drag.

Capital allocation will likely define the next leg of the equity story. The dividend remains modest and sustainable at a 16.01% payout and 1.80% forward yield, a stance consistent with a cyclical business preserving flexibility. Operating cash flow of 4.94B provides a base, but slightly negative levered free cash flow signals either elevated investment or financing costs that require close monitoring. Management’s ability to prioritize high-return projects, trim lower-return footprints (including in South Africa), and maintain a conservative balance sheet (current ratio 1.40; debt 13.73B vs. cash 5.36B) could steadily de-risk the equity. If these levers deliver, incremental margin expansion from today’s low operating base would likely translate quickly into improved earnings power.

The share price backdrop is constructive but volatile. After a strong 38.79% 12‑month advance, the stock trades near 29.23, above its 200‑day moving average and close to its 50‑day trend line, with a beta of 1.70 underscoring sensitivity to macro swings. This setup can support further upside if execution improves and steel spreads remain stable, yet it also raises the bar for surprises. With a 52‑week range of 19.65–32.18, investors have recently been rewarded for buying weakness and fading strength. The durability of this pattern over the next three years will hinge on whether the company can compound cash flow through the cycle rather than merely ride price momentum.

Macro and policy currents remain the wildcard. Demand from automotive, construction and energy is inherently cyclical, while trade policies and regulatory decisions in key geographies can quickly alter import flows, capacity utilization and pricing. For ArcelorMittal, the combination of targeted restructuring, prudent dividends, and optionality to pivot volume to better markets provides levers to manage volatility. However, should energy or raw material costs firm and global spreads compress, thin starting margins could leave little cushion. Over a three‑year horizon, the most balanced stance is cautious optimism: the company appears positioned to improve from a low operating base, but discipline around capital spending and portfolio mix will likely determine whether outperformance versus broader indices can persist.

What could happen in three years? (horizon August 2025+3)

| Scenario | Operations | Financials | Share price setup |

|---|---|---|---|

| Best | Successful asset rationalization (including South Africa), improved product mix and stronger demand in autos/construction. | Margins recover toward mid‑cycle levels; operating cash flow builds; dividend grows within current payout discipline. | Valuation re‑rates closer to book value per share; stock sustains above long‑term averages with lower volatility. |

| Base | Selective restructuring; stable production with modest efficiency gains and steady contract pricing. | Earnings stabilize; cash generation covers capex and dividend; balance sheet remains conservative. | Range‑bound trading around moving averages; returns track sector with episodic swings on macro data. |

| Worse | Prolonged spread pressure and cost inflation; restructuring delays or higher‑than‑expected closure costs. | Free cash flow remains tight; leverage concerns rise; dividend growth pauses or is recalibrated. | Shares revert toward the lower end of the 52‑week range until visibility on margins and policy improves. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Steel price spreads across key regions (autos, construction, energy end‑markets) and capacity utilization.

- Outcome and timing of South Africa long products restructuring, including one‑off costs and stakeholder actions.

- Energy and raw material costs (including alloys) and their pass‑through to contracts.

- Trade and regulatory decisions in major markets that alter import flows, tariffs or quotas.

- Capital allocation discipline given slightly negative levered free cash flow and decarbonization needs.

- Currency moves and emerging‑market exposure affecting local profitability and translation.

Conclusion

ArcelorMittal’s equity case into 2028 rests on translating a strong share recovery into durable fundamentals. The company combines scale (60.63B revenue ttm) with modest profitability today, leaving ample operating leverage if spreads normalize. Cash generation is adequate and the dividend prudent, but slightly negative levered free cash flow argues for continued discipline as management navigates restructuring—most visibly in South Africa. With the stock trading above its long‑term averages and a beta of 1.70, results will likely remain sensitive to macro data and policy shifts. A credible plan to streamline lower‑return assets, hold the line on costs, and allocate capital to higher‑margin volumes could sustain performance beyond cyclical tailwinds. Conversely, prolonged spread pressure or execution slip‑ups could compress the thin operating margin base. Net‑net, a balanced three‑year outlook skews to gradual improvement, contingent on consistent execution and a cooperative macro backdrop.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.