As of

Key Points as of October 2025

- Revenue – TTM revenue of €13.07B with 3.50% yoy quarterly growth; revenue per share €8.20.

- Profit/Margins – Profit margin 10.13% and operating margin 10.91%; ROE stands at 14.96%.

- Sales/Backlog – No disclosed backlog; gross profit €6.05B underscores earnings capacity amid modest top‑line growth.

- Share price – €6.79 last close (2025-10-06); 52‑week range €4.79–€6.99; 50‑DMA €6.56, 200‑DMA €6.14; beta 0.93; 52‑week change +18.48%.

- Analyst view – JPMorgan raised its price target by €0.85; Wall Street Zen upgraded Aegon to Strong‑Buy; Aegon AM turned more optimistic on US equities into 2026.

- Market cap – €10.64B; valuation at 8.66x trailing P/E and 8.29x forward P/E; EV/Revenue 0.69; price/book 1.15.

- Balance sheet – Total cash €3.2B vs. total debt €4.27B; total debt/equity 45.46%; current ratio 89.41.

- Dividend – Forward annual dividend €0.38 (5.62% yield); payout ratio 44.87%; ex‑dividend date 2025‑09‑04.

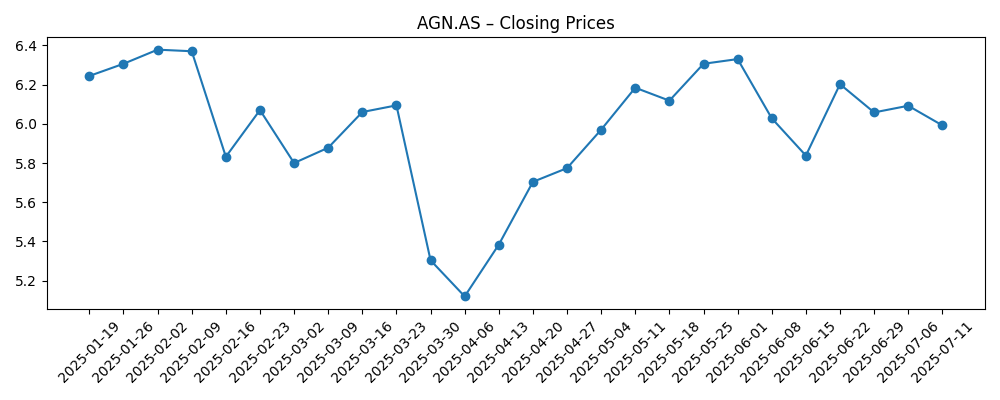

Share price evolution – last 12 months

Notable headlines

- More Optimistic About US Stocks Going Into 2026, Aegon Asset Management Says

- Aegon (NYSE:AEG) Upgraded by Wall Street Zen to Strong-Buy Rating

- Signaturefd LLC Trims Position in Aegon NV $AEG

- Aegon price target raised by EUR 0.85 at JPMorgan

Opinion

Aegon’s setup favors investors who value income and resilience. With a forward P/E of 8.29 and a 5.62% yield, the equity offers carry while leaving room for rerating if execution holds. The price has rebounded from spring lows (€5.12 on 2025‑04‑06) to €6.79 by early October, tracking improving sentiment and proximity to a €6.99 52‑week high. Profitability metrics (10.13% profit margin, 10.91% operating margin, 14.96% ROE) suggest earnings power is intact. We think the combination of moderate revenue growth (3.50% yoy), disciplined capital return (payout ratio 44.87%), and a contained beta (0.93) positions the stock as a defensive compounder. The market is likely to reward consistent delivery on earnings and capital allocation, particularly if management sustains cash generation alongside leverage discipline (debt €4.27B vs. cash €3.2B).

Sentiment tailwinds matter. JPMorgan’s price‑target increase and a Strong‑Buy call from a research outlet signal improving expectations, while Aegon Asset Management’s constructive stance on US equities into 2026 supports fee income prospects in asset management. Although single‑account headlines do not define fundamentals, the direction of travel is supportive: more constructive risk appetite, rising asset prices, and narrower credit spreads typically underpin insurer investment portfolios and asset‑management flows. Against this backdrop, valuation multiples near historical trough levels for European financials can creep higher. Even modest multiple normalization from an 8–9x earnings range could lift total returns when combined with the current dividend yield, provided operating trends remain steady and there are no negative surprises on claims or capital ratios.

Two operational levers stand out: cost discipline and mix. With gross profit at €6.05B on €13.07B revenue, management has room to optimize expenses and sharpen product mix in protection and savings. Any incremental margin gains would magnify earnings given a stable revenue base. The payout ratio of 44.87% leaves headroom to keep the dividend at €0.38 or better through cycles, subject to regulatory capital. Moreover, the current price/book of 1.15 implies the market is paying a modest premium to book value per share (€5.85), which can still be consistent with attractive returns if ROE stays near 15%. On balance, we view disciplined underwriting, selective growth, and capital-light fee streams as the ingredients to sustain mid‑teens ROE without stretching risk.

Key watch‑items include rate paths and equity markets. Lower rates could compress reinvestment yields, while risk‑asset volatility can swing investment gains and asset‑management fees. Still, a beta of 0.93 indicates tempered market sensitivity, and the 200‑day trend (€6.14) has sloped upward, signaling accumulating confidence. We would monitor cash conversion (OCF currently slightly negative at €‑0.06B ttm vs. €2.42B levered free cash flow), as consistent operating cash flow would bolster the case for stable dividends and optional buybacks. If Aegon continues to compound book value and holds margins, the current valuation provides a reasonable entry point for income‑oriented investors, with scope for upside through modest rerating and dividend accrual over a three‑year horizon.

What could happen in three years? (horizon October 2025+3)

| Scenario | Narrative |

|---|---|

| Best | Stable macro and firm equity markets support investment returns and asset‑management flows; underwriting discipline lifts margins. Dividend is sustained or modestly increased from the current €0.38 level while capital remains strong. Valuation improves from low‑8 forward P/E and around 1.15x book as confidence builds. |

| Base | Steady, low growth in premiums and fees with broadly unchanged margins. Dividend maintained, payout near current levels. Share price tracks book value growth with limited multiple change, delivering mid‑single‑digit total returns primarily from yield. |

| Worse | Rates fall sharply or risk assets correct, pressuring investment income and fees; claims trend worsens. Management prioritizes balance sheet and keeps dividend flat or lower. Valuation de‑rates and price converges toward book, weighing on total returns. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Interest‑rate trajectory and credit spreads impacting investment income and reserve discount rates.

- Equity market levels driving asset‑management fees and investment gains/losses.

- Underwriting results and claims experience relative to pricing and reserving assumptions.

- Capital allocation (dividends/buybacks) versus organic growth and regulatory capital requirements.

- Cost efficiency and digital execution affecting operating margin durability.

- Regulatory and macro developments in core European/US markets.

Conclusion

Aegon offers a balanced risk‑reward into October 2028. The investment case rests on three pillars: income, value, and operational stability. Income is anchored by a 5.62% forward yield on a 44.87% payout. Value is reflected in undemanding multiples (8.29x forward P/E; 1.15x book), which provide scope for modest rerating if execution holds. Stability is evident in resilient profitability (10.13% profit margin; 10.91% operating margin; 14.96% ROE) and a manageable balance sheet (cash €3.2B vs. debt €4.27B). Near‑term sentiment has improved with a JPMorgan target lift and constructive views from Aegon Asset Management. Risks remain—particularly around rates and markets—but the stock’s beta of 0.93 and an upward‑sloping 200‑day average suggest a measured risk profile. For investors seeking steady dividends with potential upside from incremental growth and multiple normalization, Aegon merits a place on the watchlist.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.