NN Group’s set-up into 2026–2028 has shifted as investor expectations reset around earnings quality versus growth. The stock’s 52‑week change of 33.04% and a forward P/E of 7.19 suggest the market now prices in improving returns without assigning a full premium for consistency. What changed: revenue growth accelerated while year‑on‑year earnings growth turned negative, a mix that often reflects investment income tailwinds offset by claims, costs, or one‑offs. Why it changed: the European insurance backdrop is still dominated by the interest‑rate cycle, claims inflation, and capital discipline; valuation has followed improving sentiment while questions on cash conversion linger. Why it matters: for insurers, the path of return on equity (ROE) and the reliability of capital returns tend to drive multiples more than top‑line expansion. In a sector where pricing, reinsurance costs, and investment yields shape earnings visibility, the next few quarters will determine whether NN Group’s recent valuation reset can translate into a sustainably stronger narrative.

Key Points as of October 2025

- Revenue: trailing-twelve-month revenue is 14.45B with quarterly revenue growth (yoy) of 35.70%.

- Profit/Margins: profit margin stands at 9.17% and operating margin at 36.83%; diluted EPS (ttm) is 4.68.

- Sales/Backlog: insurers do not disclose “backlog”; new business value and premium volumes not disclosed here.

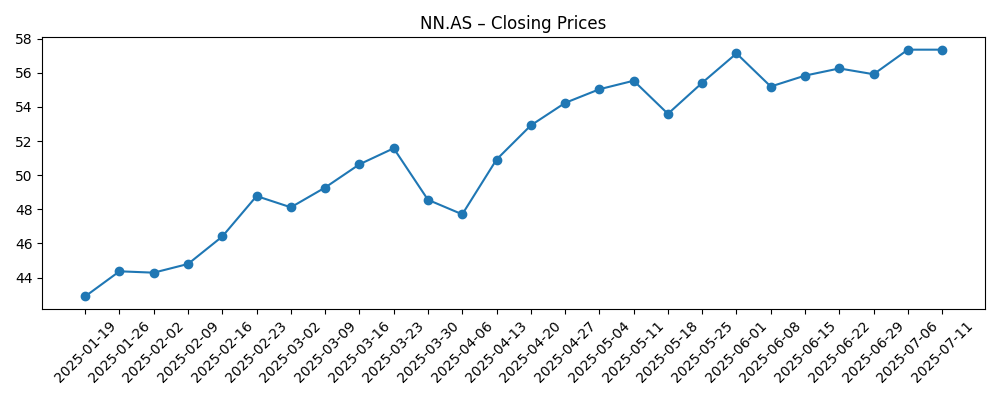

- Share price: last weekly close on 2025‑10‑14 was about 61.28; 52‑week range spans 40.44–63.58; beta is 0.63.

- Analyst view proxy: forward P/E of 7.19 and PEG of 0.72 indicate low implied growth expectations relative to price; price/book is 0.72.

- Market cap: 15.61B; enterprise value of 21.16B; price/sales is 2.02 and EV/revenue is 2.69.

- Balance sheet/capital: total cash 62.24B versus total debt 13.31B; book value per share is 81.72; debt/equity 61.25%.

- Cash generation: operating cash flow (ttm) is 249M and levered free cash flow 175.5M, indicating light cash conversion versus accounting earnings.

- Dividends: forward annual dividend yield is 5.82% with a payout ratio of 73.50%; ex‑dividend date was 2025‑08‑12.

Share price evolution – last 12 months

Notable headlines

Opinion

The most striking feature of NN Group’s print is the split between strong reported revenue growth and a sharp decline in year‑on‑year earnings growth. That combination often appears in insurers when investment income and premium pricing help the top line while loss trends, expenses, or non‑recurring items weigh on bottom‑line momentum. Margins remain healthy at the operating level, and the company’s profit margin suggests core underwriting and fee businesses are intact. However, low cash conversion relative to net income tempers the quality signal. In market terms, a forward P/E below high single digits and a price/book below 1.0 indicate that investors still want evidence that accounting profits can translate into distributable cash and sustainably higher ROE.

On capital and income, a near‑6% forward dividend yield paired with a payout ratio in the 70% range signals commitment to returns but leaves less cushion if volatility persists. The balance sheet shows substantial cash and moderate leverage by the disclosed metrics, which supports resilience. Still, insurance cash flows can be timing‑sensitive, and regulatory capital (not disclosed here) ultimately governs distribution capacity. Against that backdrop, the market seems to be granting a partial rerating as rates stabilize while reserving judgment on earnings durability. The valuation may continue to hinge on whether the company can lift ROE from the current 6.24% toward levels that typically command a price/book above book value.

Industry dynamics are constructive but uneven. The European rate environment supports investment income, yet claims inflation and reinsurance costs can offset pricing gains, especially in protection and property lines. Competitive intensity in life and pensions remains high, and fee businesses tethered to markets can add volatility when risk assets fluctuate. For NN Group, pricing discipline, product mix, and cost control will determine whether recent margin resilience is sustainable as the cycle matures. If the company can keep underwriting steady while benefiting from carry on its investment portfolio, narrative momentum could shift from recovery to compounding.

That narrative shift matters for the multiple. A stable path of ROE improvement and visible cash generation typically expands price/book multiples for European insurers, while patchy earnings or opaque one‑offs compress them. With beta at 0.63, the shares have behaved defensively, which can attract yield‑oriented investors but also cap upside in risk‑on periods. Over the next year, disclosures around cash generation and any clarity on growth investments versus payouts will likely shape sentiment more than absolute revenue growth. In three years, the stock’s story could pivot from “cheap for a reason” to “quality income compounder” if delivery aligns, or revert if loss trends or markets turn against the model.

What could happen in three years? (horizon October 2025+3)

| Scenario | Narrative |

|---|---|

| Best | Claims cost trends normalize, investment yields remain supportive, and efficiency programs lift underwriting discipline. ROE steps higher, cash conversion strengthens, and the dividend remains covered. The market rewards improved visibility with a multiple closer to book value or above, with sentiment anchored by consistent delivery. |

| Base | Earnings cadence is choppy but upward over time as pricing and investment income offset cost pressures. Cash generation gradually aligns with accounting profits, supporting a steady dividend. Valuation stays near current ranges with modest rerating as execution becomes more predictable. |

| Worse | Claims inflation and adverse market moves pressure earnings and capital flexibility. Cash conversion stays weak, limiting distribution growth and undermining confidence. The market applies a sustained discount to book value and the narrative reverts to capital preservation rather than growth. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Execution on margins and loss ratios – evidence that operating profitability can translate into higher ROE.

- Interest‑rate and credit cycle – impacts on investment income and asset valuations across the portfolio.

- Cash generation and capital headroom – alignment of operating cash flow with earnings and regulatory capital (not disclosed here).

- Claims inflation and reinsurance costs – potential to erode pricing gains or drive volatility in results.

- Dividend policy and payout sustainability – adherence to stated payouts amid earnings variability.

- Market performance for fee businesses – equity and credit market swings affecting fees and solvency buffers.

Conclusion

NN Group’s investment case over the next three years hinges on closing the gap between reported earnings and cash generation while steadily lifting ROE from 6.24%. Today’s setup blends supportive margins with strong revenue growth but mixed earnings momentum, resulting in an undemanding valuation (forward P/E 7.19; price/book 0.72) and a yield that compensates for execution risk (5.82%). In a rate‑sensitive sector, the balance between pricing discipline, claims trend management, and investment income will drive whether the shares sustain their 52‑week rerating. Watch next 1–2 quarters: ROE trajectory; underwriting/loss trends; investment income stability; operating cash conversion; dividend coverage. If delivery improves and volatility subsides, the narrative could shift toward consistent compounding, supporting a firmer multiple. If cash conversion remains light or claims pressures persist, the stock may remain range‑bound as investors prioritize capital preservation over growth.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.