Microsoft enters August 2025 with robust fundamentals and renewed product momentum. Trailing-12-month revenue stands at $281.72B, supported by a 44.90% operating margin and 36.15% profit margin, translating to $101.83B in net income. Strong cash generation (operating cash flow $136.16B; levered free cash flow $61.07B) underpins reinvestment and a 0.66% forward dividend yield, offset by a manageable $112.18B in total debt and $94.56B in cash. Shares have advanced 22.66% over the past year, near the 50-day average of $507.20 and above the 200-day average of $441.54, reflecting optimism around Copilot and Windows ecosystem upgrades. Headlines point to deeper Copilot integration across Windows and Xbox and strategic shifts at GitHub, even as employee activism highlights cultural and reputational risks. This note outlines a balanced three-year outlook grounded in Microsoft’s financial strength and evolving AI strategy.

Key Points as of August 2025

- Revenue: TTM revenue at $281.72B with quarterly revenue growth (yoy) of 18.10%.

- Profit/Margins: Profit margin 36.15%; operating margin 44.90%; net income $101.83B; operating cash flow $136.16B; levered free cash flow $61.07B.

- Sales/Backlog: Demand tied to AI and cloud workloads; backlog not disclosed here; gross profit $193.89B underscores pricing power.

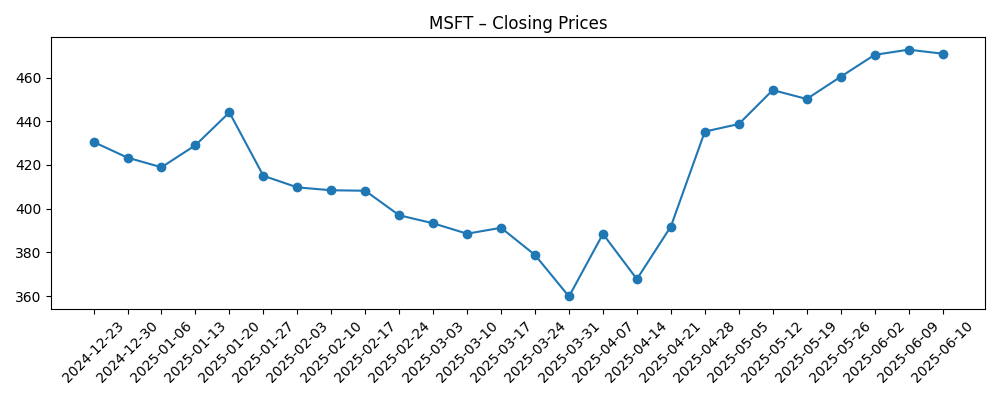

- Share price: Six‑month rebound from March low ($359.84 on 2025‑03‑31) to ~$506.74; 52‑week change 22.66%; beta 1.05; 50‑day MA $507.20 vs 200‑day MA $441.54.

- Analyst view: Investor focus on Copilot monetization, Windows engagement and Azure attach; 0.66% dividend yield with a 23.75% payout ratio.

- Market cap: Approximately $3.77T (price ~$506.74 × 7.43B shares outstanding).

- Ownership/Short interest: Institutions hold 74.50%; short interest 0.76% of float (short ratio 2.77).

- Balance sheet: Total cash $94.56B vs total debt $112.18B; current ratio 1.35.

Share price evolution – last 12 months

Notable headlines

- Microsoft is finally improving Windows 11’s dark mode

- Windows 11 test brings AI file search to the Copilot app

- Microsoft is bringing its Xbox Copilot to the Windows Game Bar

- Microsoft is bringing PC gaming apps and stores to its Xbox app on Windows

- GitHub is no longer independent at Microsoft after CEO resignation

- Microsoft employees occupy headquarters in protest of Israel contracts

- A decade later, Windows is still bringing Control Panel features to the Settings app

Opinion

Copilot’s spread across Windows and Xbox is central to the next leg of Microsoft’s growth narrative. Integrating AI file search within Copilot and surfacing Copilot tooling in the Windows Game Bar are not just convenience updates; they expand daily touchpoints with consumers and developers, deepening engagement and opening avenues for incremental subscription and cloud consumption. If Microsoft can translate usage into premium features and differentiated enterprise bundles, the company’s high margins and cash generation provide room to reinvest in inference infrastructure while sustaining shareholder returns. The combination of Windows distribution and Azure capacity remains a defensible flywheel, with revenue growth of 18.10% yoy in the latest quarter suggesting customer appetite for AI‑enhanced workflows.

On the enterprise side, the GitHub transition under Microsoft’s core AI umbrella signals tighter alignment of developer platforms with the broader Copilot stack. Closer integration could accelerate product velocity—from code generation to security—while streamlining go‑to‑market across seats and clouds. The risk is organizational: loss of perceived independence can alienate parts of the open‑source community or partners who value neutrality, potentially slowing adoption. Still, Microsoft’s scale in distribution and the company’s $136.16B operating cash flow enable sustained investment in developer tooling, which is increasingly the gateway to cloud workloads. Executed well, this alignment could turn GitHub from a standalone asset into a multiplier for Azure and Windows ecosystem engagement.

Consumer signals from Windows 11’s continued refinements—such as improved dark mode and Control Panel migration—are incremental but meaningful. Quality‑of‑life updates, when paired with embedded AI search, can drive higher daily active use and support OEM refresh cycles tied to AI‑capable hardware. Bringing third‑party stores to the Xbox app on Windows suggests a more open retail strategy designed to keep users in Microsoft’s orbit even when purchases occur elsewhere. That openness, combined with Xbox Copilot features, could increase time spent, advertising surface, and cloud gaming consideration. While these are not needle‑moving alone, together they create optionality that compounds with scale, supporting sustained top‑line momentum and high gross profit of $193.89B.

Counterbalancing the product cadence are people and policy risks. The employee protest over Israel‑related contracts underscores cultural tension around large public‑sector deals. Beyond reputation, such episodes can affect talent retention in critical AI and cloud teams. With institutions owning 74.50% and short interest at just 0.76% of float, the shareholder base appears supportive, but sentiment could shift quickly if controversies intersect with regulatory scrutiny or decelerating demand. Valuation already reflects optimism—the stock is near its 50‑day average and below the 52‑week high of 555.45—so delivery against AI monetization milestones will matter. Microsoft’s balance sheet (cash $94.56B vs debt $112.18B) and 0.66% dividend yield provide some downside buffers, yet execution remains the key catalyst for returns over the next three years.

What could happen in three years? (horizon August 2025+3)

| Scenario | Summary | What it means for shareholders |

|---|---|---|

| Best | Copilot becomes a default workflow across Windows, Xbox services, and developer tools, driving stronger adoption of premium features and cloud consumption. GitHub integration accelerates developer attach, and Windows upgrades sustain engagement. | Durable growth with margin resilience; valuation supported by expanding recurring revenue and continued cash returns alongside reinvestment. |

| Base | AI features deepen within core products, but adoption varies by segment. Gaming and Windows openness increases engagement without materially changing market share. Organizational changes at GitHub settle with limited disruption. | Steady growth and healthy margins; shares track fundamentals with periodic volatility around product cycles and macro spend. |

| Worse | AI monetization underwhelms, developer backlash slows platform traction, and controversies weigh on hiring and brand. Product updates fail to spur upgrades, and cloud demand normalizes. | Multiple compression and slower cash generation; management focuses on cost discipline and targeted investments to stabilize momentum. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Adoption and paid conversion of Copilot across Windows, Office, GitHub, and gaming surfaces.

- Enterprise cloud demand and AI workload intensity impacting margins and cash flow.

- Developer ecosystem sentiment following GitHub’s integration and product roadmap cadence.

- Regulatory and reputational risks, including employee activism around public‑sector contracts.

- PC and console engagement trends, plus the effectiveness of opening the Windows/Xbox app ecosystem.

- Capital allocation balance between reinvestment, dividends (0.66% yield), and potential buybacks.

Conclusion

Microsoft’s investment case into 2028 rests on converting product reach into durable AI monetization. The company’s financial base is strong—$281.72B in TTM revenue, $101.83B in net income, and $136.16B in operating cash flow—providing the resources to scale inference infrastructure, improve Windows and Xbox experiences, and deepen developer tools. Recent headlines show a clear path: integrate Copilot broadly, refine Windows to increase engagement, and align GitHub with the core AI roadmap. Offsetting strengths, cultural and policy controversies introduce talent and brand risks, while any slowdown in enterprise AI adoption could test the current valuation. With shares near recent highs and a modest dividend yield, the next three years likely hinge on execution against AI usage and monetization milestones. If management delivers, the existing margins and ecosystem scale offer a favorable setup; if not, expectations may reset quickly.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.