Alphabet (GOOGL) enters late-2025 with double-digit revenue growth, best-in-class margins, and a stock pressing 52-week highs. Yet the next three years will likely be defined by two forces: U.S. antitrust remedies that could reshape search distribution and ads, and a capital‑intensive AI build‑out that stretches power and infrastructure. The company’s balance sheet, cash generation, and modest payout ratio give strategic flexibility, while analyst sentiment remains broadly constructive. Shares have rebounded from spring weakness and now trade near long‑term moving averages and prior highs. Our outlook weighs the potential earnings drag from legal outcomes against benefits from AI‑driven monetization and efficiency. We frame scenarios, key risks and catalysts, and the signposts investors should watch into 2026–2028.

Key Points as of August 2025

- Revenue (ttm) of 371.4B with quarterly revenue growth (yoy) of 13.80%; revenue per share 30.43.

- Profitability: profit margin 31.12%; operating margin (ttm) 32.43%; net income (ttm) 115.57B; gross profit (ttm) 218.91B; EBITDA 140.84B.

- Cash generation: operating cash flow (ttm) 133.71B; levered free cash flow (ttm) 49.79B; payout ratio 8.64%.

- Balance sheet: total cash (mrq) 95.15B vs total debt 41.67B; current ratio 1.90; debt/equity 11.48%.

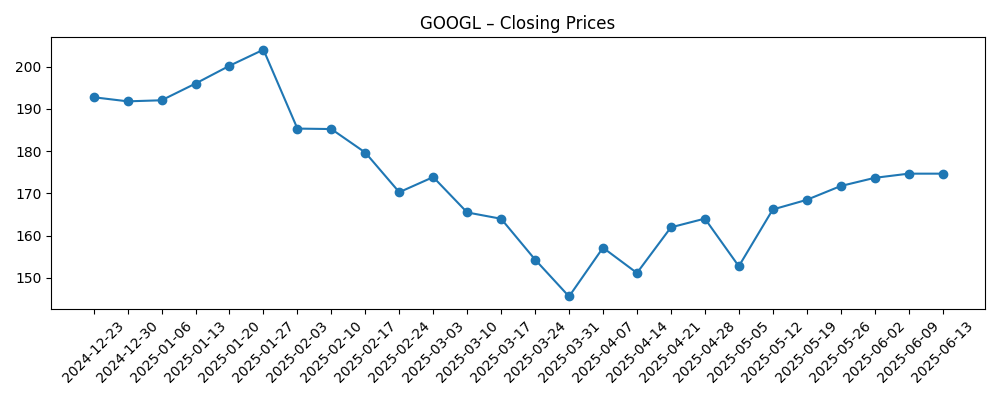

- Share price momentum: last weekly close ~207.48 (8/27/2025) vs 52‑week high 210.52 and low 140.53; 50‑day MA 188.69 and 200‑day MA 178.13; beta 1.01.

- Dividend profile: forward annual dividend rate 0.84 (yield 0.40%); trailing dividend 1.01 (yield 0.49%); ex‑dividend 9/8/2025; payment date 9/15/2025.

- Ownership & liquidity: institutions hold 80.89%; insiders 0.26%; float 10.84B shares; avg 3‑month volume 37.06M.

- Short interest remains modest: 59.17M shares short (1.02% of float; short ratio 1.6).

- Market value context: using implied shares outstanding (12.11B) and recent price implies market cap of roughly $2.5T.

- Analyst tone: recent coverage reiterates Buy ratings despite a looming DoJ case and an explicit $225 price target from one firm.

Share price evolution – last 12 months

Notable headlines

- Alphabet’s Google (GOOGL) Likely to Avoid Breakup, But Antitrust Remedies Could Hit Core Revenue

- Alphabet Stock (GOOGL) Gets Buy Reaffirmation as DoJ Case Looms

- Alphabet (GOOGL): Strong Fundamentals, with Q1 Operating Earnings up 20%

- Alphabet’s (GOOGL) Settles on Tennessee for Nuclear Power Plant amid AI Power Demands

- JMP Reiterates Bullish Stance on Alphabet (GOOGL) With $225 Price Target

- Alphabet Inc. (GOOGL) Is Doing Well, Says Jim Cramer

Opinion

Investors face a binary‑feeling debate around antitrust remedies: while a formal breakup looks less likely, behavioral or structural remedies could alter default search arrangements, revenue‑sharing economics, or parts of the ads stack. The financial snapshot shows Alphabet operating from strength, with a 31.12% profit margin and 32.43% operating margin that provide room to absorb change. The key watch‑outs are whether distribution costs rise, whether any mandated changes to ad buying/serving reduce take‑rates, and how quickly Google can re‑optimize products. We think near‑term sentiment will track court milestones, but the company’s scale and product depth argue for adaptation over dislocation. A measured rerating is plausible if remedies are manageable and execution remains tight.

AI infrastructure is the second defining theme. The Tennessee nuclear plan, if realized, signals a willingness to secure long‑duration, low‑carbon power for data center and model training needs. That could stabilize compute costs and lower carbon intensity, supporting long‑run AI economics and brand positioning. Regulatory approvals, construction timelines, and cost discipline are execution risks, but Alphabet’s 95.15B cash and 133.71B operating cash flow (ttm) provide flexibility to sequence investments. Over three years, reliable power procurement can become a competitive moat, especially as model inference expands across Search, YouTube, and Workspace. The nearer‑term signal for investors will be management’s capital allocation cadence versus free cash flow and how quickly new AI features translate into monetization.

On fundamentals, revenue growth of 13.80% (yoy, most recent quarter) and strong cash generation provide a cushion against cyclical ad softness. Cloud remains a strategic lever: even without disclosing specific margins here, continued scale could offset ads cyclicality and support consolidated profitability, which is already robust at the group level. The modest payout ratio (8.64%) and the introduction of a forward dividend yield of 0.40% suggest confidence in recurring cash flows. We’d watch whether management prioritizes sustained opex discipline to preserve a 30%+ operating margin profile while investing in AI safety, distribution, and infrastructure. If so, earnings quality could improve, dampening the impact of legal or macro noise.

Technically and sentiment‑wise, the stock’s recovery from the March 2025 trough (weekly close 145.60 on 3/31/2025) to late‑August levels near 207.48 is notable, with the price above both the 50‑day (188.69) and 200‑day (178.13) moving averages. The 52‑week change of 28.25% versus the S&P 500’s 15.91% reflects relative strength, aided by resilient earnings. That said, proximity to the 52‑week high (210.52) raises the bar for upside surprises. Into 2026–2028, we expect the stock to be driven by clarity on DoJ remedies, the pace of AI product monetization, and capital returns policy. Pullbacks on legal headlines may offer opportunities if fundamentals and cash generation stay intact.

What could happen in three years? (horizon August 2025+3)

| Scenario | Operational outline | Implication for stock |

|---|---|---|

| Best case | Antitrust remedies are manageable; Search and Ads adapt with minimal disruption. AI features lift engagement across Search, YouTube, and Workspace, supported by reliable power procurement and disciplined capital allocation. | Valuation expands as visibility on earnings durability improves; dividend capacity and optionality for further returns increase, supported by strong operating cash flow. |

| Base case | Remedies introduce some friction to distribution and ad tech, but execution offsets most impacts. AI investments proceed in phases; energy strategy reduces volatility in compute costs over time. | Shares track earnings growth with periodic volatility around legal and regulatory milestones; steady dividend and selective reinvestment remain the narrative. |

| Worse case | Remedies materially alter default placements and ad economics; execution stumbles slow AI monetization and inflate infrastructure costs due to delays or constraints. | Multiple compresses as growth visibility weakens; investors prioritize balance sheet strength and cost control while awaiting clearer inflection points. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Outcome and timing of U.S. antitrust remedies affecting search distribution and advertising technology.

- AI infrastructure execution, including power procurement (e.g., Tennessee nuclear plans), regulatory approvals, and capital discipline.

- Macro ad spending and competitive dynamics in search and video; any changes to traffic acquisition costs.

- Google Cloud growth and profitability trajectory as a buffer against ads cyclicality.

- Capital returns policy (dividends and potential buybacks) versus free cash flow and investment needs.

- Product velocity in generative AI features across Search, YouTube, and Workspace and associated monetization.

Conclusion

Alphabet’s investment case into 2028 hinges on two levers it can shape and one it cannot. It cannot fully control the legal outcome, but its scale, margins, and product portfolio argue for adaptation rather than disruption. It can, however, shape AI economics by securing reliable power and prioritizing high‑ROI product work, and it can tune capital allocation with a growing cash engine. Today’s fundamentals are strong—371.4B in ttm revenue, 32.43% operating margin, and 133.71B in operating cash flow—while valuation support comes from modest short interest and a new dividend policy (0.40% forward yield). Near term, headlines may dominate tape action as the stock sits near a 52‑week high. Over three years, steady execution on AI and pragmatic legal remedies could sustain earnings quality and cash returns, with volatility offering entries for long‑term holders.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.