As of September 2025, L’Oréal (OR.PA) trades at a premium with a forward P/E of 26.45 and EV/EBITDA of 18.72, supported by durable margins and cash generation. Trailing revenue is 43.84B with quarterly revenue growth of 1.60% year over year, while quarterly earnings growth slipped to -7.90%. Shares closed at 365.05 on September 29, 2025, versus a 52‑week range of 316.30–408.45 and a 52‑week change of -8.74%, underperforming broad markets. Profit margin stands at 13.96% and operating margin at 21.09%, with ROE of 20.16% and beta of 0.85. The balance sheet shows total cash of 4.82B and total debt of 8.83B, with a current ratio of 1.19. Dividend yield is 1.91% (ex‑dividend 5/5/2025). This note outlines a three‑year outlook, key drivers, and scenario paths for the stock.

Key Points as of September 2025

- Revenue: TTM revenue of 43.84B; revenue per share 82.08; quarterly revenue growth (yoy) 1.60%.

- Profit/Margins: Profit margin 13.96%; operating margin 21.09%; gross profit 32.49B; EBITDA 9.82B; net income 6.12B.

- Sales/Backlog: No formal backlog disclosed; operating cash flow 9.02B supports inventory, marketing, and capex flexibility.

- Share price: Last close 365.05 (Sep 29, 2025); 52‑week high/low 408.45/316.30; 50‑day MA 385.07; 200‑day MA 364.88; beta 0.85.

- Analyst view proxy (valuation): Trailing P/E 32.13; forward P/E 26.45; PEG 3.70; EV/EBITDA 18.72; Price/Sales 4.48; Price/Book 6.27.

- Market cap and structure: Market cap 195.63B; enterprise value 199.64B; shares outstanding 533.2M; float 256.65M; insiders/institutions hold 57.29%/16.02%.

- Balance sheet: Total cash 4.82B vs total debt 8.83B; debt/equity 28.31%; current ratio 1.19; book value per share 58.50.

- Income trend: Quarterly earnings growth (yoy) -7.90% underscores near‑term execution risk despite strong brand assets.

- Dividend: Forward and trailing annual dividend rate 7; yield 1.91%; payout ratio 61.30%; last ex‑dividend date 5/5/2025.

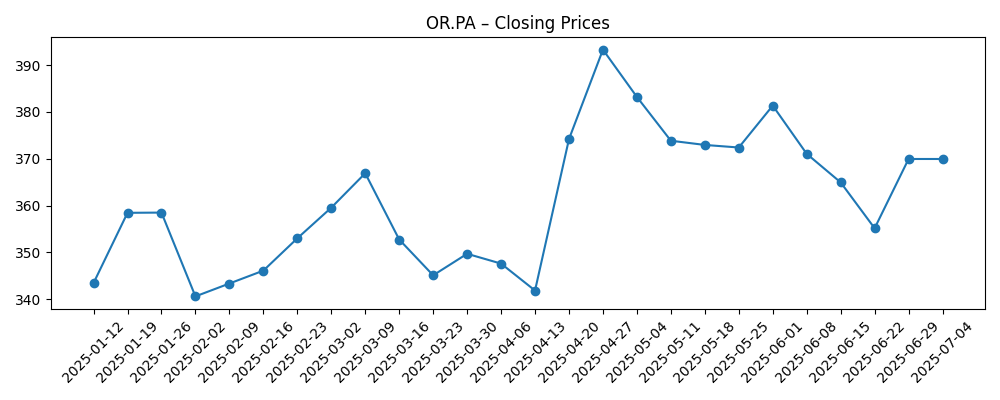

Share price evolution – last 12 months

Notable headlines

Opinion

L’Oréal’s premium valuation reflects the franchise’s breadth, pricing power, and strong cash conversion, but the recent deceleration in quarterly earnings (-7.90% yoy) reminds investors that even category leaders can experience slower patches. The share price has oscillated near long‑term trend levels, with the 200‑day moving average at 364.88 and the latest close at 365.05, suggesting the market is waiting for a fresh catalyst. Over a three‑year horizon, the debate centers on whether revenue can re‑accelerate from low growth while preserving margins above 20%. With a diversified portfolio across mass, premium, and dermocosmetics, L’Oréal retains multiple growth levers. Execution in innovation and channel mix remains critical, especially as digital and retail distribution continue to evolve. A steady dividend (1.91% yield) and robust operating cash flow provide downside resilience.

In the absence of company‑specific headline catalysts in recent months, the stock’s path has largely tracked fundamentals and sector sentiment. The forward P/E of 26.45 and EV/EBITDA of 18.72 imply the market is still willing to pay for quality and predictability, but tolerance for earnings misses has narrowed. If management returns growth toward historical patterns through product cycles and geographic balance, the current premium can be maintained. Conversely, if low growth persists, valuation could compress toward peers, even without a major earnings downgrade. Investors may therefore focus on interim trading updates for signs that price/mix and new launches are offsetting any soft spots in demand.

Margin durability is a central pillar for the next three years. With a 21.09% operating margin and 13.96% net margin, L’Oréal has room to reinvest in marketing, science, and supply chain while maintaining attractive returns (ROE 20.16%). The company’s scale enables procurement advantages and consistent innovation cadence, which historically supports premiumization. However, cost inflation, FX volatility, and promotional intensity could challenge near‑term profitability. The balance sheet shows total cash of 4.82B against total debt of 8.83B and a current ratio of 1.19, which appears manageable given 9.02B in operating cash flow. Maintaining discipline on working capital and capex should keep free cash flow healthy enough to fund dividends and selective strategic initiatives.

Technically, the shares remain within a broad 52‑week range of 316.30–408.45. The recent pullback from late‑August strength to 365.05 may create a more balanced risk‑reward if growth stabilizes. Trading liquidity (average 3‑month volume 291.7k; 10‑day 461.29k) is adequate for incremental institutional interest, though insider ownership (57.29%) and a relatively modest float (256.65M) can amplify moves around newsflow. Over three years, a constructive path likely requires clear evidence of demand resilience across regions and categories, continued success in dermocosmetics and prestige, and disciplined resource allocation. In that case, the premium multiple could be defended; otherwise, range‑bound or lower outcomes are plausible until growth re‑accelerates.

What could happen in three years? (horizon September 2025+3)

| Scenario | Narrative | Valuation view | Watch items |

|---|---|---|---|

| Best | Growth re‑accelerates on successful launches, resilient premium demand, and effective digital execution. Margins hold firm as scale, mix, and efficiency offset cost pressures. | Premium multiple sustained; potential for modest re‑rating if consistency improves and earnings volatility eases. | Quarterly revenue and earnings trend vs prior year; innovation pipeline cadence; marketing ROI; channel mix. |

| Base | Steady, mid‑single‑digit type growth profile with disciplined reinvestment. Margins remain broadly stable, supported by portfolio balance and cost control. | Valuation broadly maintained; returns largely delivered through earnings growth and dividends. | Category share stability; pricing vs promotion; inventory health; operating cash flow strength. |

| Worse | Prolonged soft demand or heightened competition leads to slower sales and pressure on operating leverage. Promotional intensity rises, weighing on profitability. | Multiple compression risk if growth remains subdued and visibility declines; share price gravitates toward long‑term averages. | Sequential sales momentum; margin mix; FX and input costs; evidence of category down‑trading. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Execution on innovation and brand building across premium and dermocosmetics, sustaining price/mix without eroding volumes.

- Regional demand trends and channel mix, including travel retail and e‑commerce dynamics that affect sell‑out vs sell‑in.

- Margin drivers: input costs, FX, and promotional intensity vs efficiency and scale benefits.

- Capital allocation: balance between dividends (1.91% yield), reinvestment, and any strategic portfolio moves.

- Competitive responses from global and local players, particularly in skin care and prestige fragrances.

- Regulatory and sustainability requirements affecting product development, labeling, and supply chain.

Conclusion

L’Oréal’s equity story remains grounded in category leadership, brand breadth, and strong cash generation. The current setup is a balance of premium valuation and near‑term growth noise: forward P/E at 26.45 and EV/EBITDA at 18.72 imply investors expect stability and gradual expansion, yet quarterly earnings growth of -7.90% signals execution risks that must be monitored. Over the next three years, steady innovation and portfolio depth can support a normalization to more consistent growth, while the 21.09% operating margin and 9.02B operating cash flow provide resilience to invest through cycles. The dividend yield of 1.91% adds to total return potential, albeit modestly. Without fresh, company‑specific catalysts, shares may trade around long‑term trend levels until data points confirm re‑acceleration. For long‑term holders, maintaining focus on margins, cash flow, and the cadence of launches will be key to validating the premium.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.