TotalEnergies (TTE.PA) enters the next three years balancing resilient cash generation with a shifting project mix. The group’s trailing-12-month revenue stands at 187.12B, under pressure from a –9.20% year-on-year quarterly revenue decline and –29.00% earnings contraction, yet supported by 28.2B in operating cash flow and 10.91B in free cash flow. Management has flagged potential buyback moderation in 2026, suggesting capital will lean toward LNG growth—construction milestones in Iraq’s Gas Growth Integrated Project and new offshore permits in Liberia and Congo—while maintaining a high forward dividend yield of 6.27% (payout ratio 64.42%). Shares recently changed hands near 53.05, below the 200-day average of 54.09 and within the 52-week range of 47.65–63.48. Our three-year outlook weighs execution, policy, and commodity paths.

Key Points as of September 2025

- Revenue: TTM revenue 187.12B; quarterly revenue growth (yoy) –9.20%.

- Profit/Margins: Profit margin 6.83%; operating margin 9.52%; EBITDA 35.46B; net income 12.79B.

- Sales/Backlog: LNG-led pipeline—GGIP in Iraq moved into construction; new offshore exploration permits in Liberia and off Congo; partners signal Mozambique LNG restart potential.

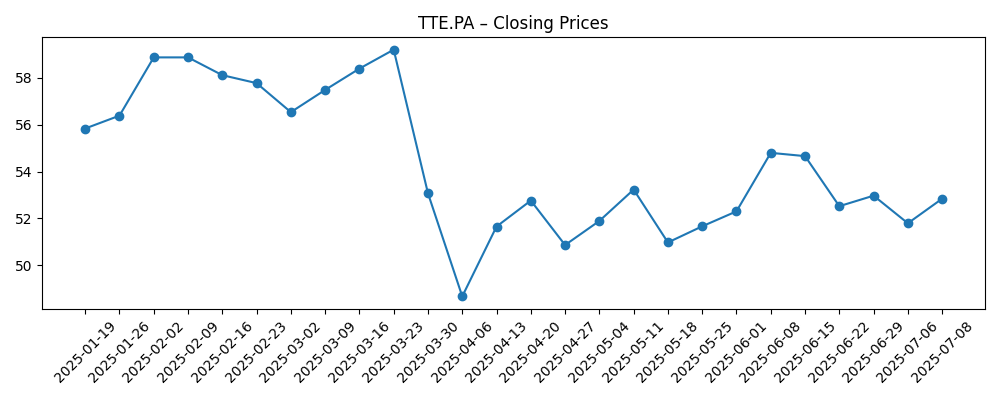

- Share price: Last close 53.05 (2025-09-29); 52-week change –7.26%; 50-day MA 52.71; 200-day MA 54.09; 52-week range 47.65–63.48.

- Capital returns: Forward dividend rate 3.4 with 6.27% yield; payout ratio 64.42%; possible 2026 share buyback slowdown flagged by management; next ex-dividend 10/1/2025.

- Market cap/Ownership: Large-cap profile with 2.17B shares outstanding; float 1.84B; insiders 5.10%; institutions 40.22%; beta 0.71.

- Balance sheet: Cash 25.61B vs. total debt 63.08B; current ratio 1.00; operating cash flow 28.2B; free cash flow 10.91B.

- Returns: ROE 10.92%; ROA 4.90%.

Share price evolution – last 12 months

Notable headlines

- TotalEnergies considers slowing share buybacks in 2026 amid market uncertainty

- TotalEnergies SE (TTE) announces the start of construction of the final two major components of its $10-Billion Gas Growth Integrated Project (GGIP) in Iraq

- TotalEnergies wins four offshore exploration permits in Liberia

- TotalEnergies (TTE) Secures New Exploration Permit off Congo Coast

- Nigerian regulator withdraws TotalEnergies’ asset sale approval

- TotalEnergies CEO says NextDecade to announce FID on Rio Grande LNG train on Tuesday, CNBC reports

- Oil India anticipates Mozambique LNG project restart by year-end

Opinion

TotalEnergies’ potential 2026 buyback slowdown signals a pragmatic pivot rather than a retreat. With operating cash flow of 28.2B and levered free cash flow of 10.91B, the company has room to protect a forward dividend yield of 6.27% despite softer year-on-year revenue (–9.20%) and earnings (–29.00%). A payout ratio of 64.42% leaves limited flexibility if commodity prices weaken further, but it also underlines management’s intent to prioritize income for shareholders while funding advantaged LNG growth. In our view, dialing back repurchases temporarily could reduce balance-sheet risk in a higher-rate environment and preserve capacity to advance low-cost, long-cycle gas projects. Over a three-year horizon, consistent execution and disciplined capex could compress the equity risk premium even without multiple expansion.

LNG remains the most credible growth vector. The start of construction on Iraq’s Gas Growth Integrated Project should de-bottleneck gas supply and potentially lift cash flows once onstream, while new offshore permits in Liberia and off Congo expand the option set. Any favorable FID cadence around U.S. LNG—where management has publicly engaged on NextDecade’s Rio Grande LNG train—would add medium-term volume visibility. A restart at Mozambique LNG, as partners have hinted, would be a notable milestone for a project with scale and strategic relevance. These are multi-year, sequencing-sensitive catalysts: the nearer-term investment case rests on progress updates, safety and schedule adherence, and early appraisal results rather than immediate earnings uplift.

The regulatory setback in Nigeria, where approval for an asset sale was withdrawn, highlights execution and portfolio-reshaping risk. While such outcomes can delay proceeds and complicate simplification plans, the diversified upstream and integrated gas portfolio reduces single-country exposure. We think management’s willingness to adjust buybacks offers a buffer against timing slippage on disposals or project starts. Investors should watch for how the company reallocates capital if exits take longer or if terms shift—especially toward projects with faster paybacks or infrastructure tie-ins. Clarity on the sequencing between exploration optionality in West Africa and brownfield debottlenecking elsewhere will shape confidence in medium-term returns.

Shares trade near 53.05, down –7.26% over 52 weeks and hovering between the 50-day (52.71) and 200-day (54.09) moving averages, with a beta of 0.71. The rich dividend yield provides carry while fundamentals stabilize from a weaker comparative base. Over three years, we see a balanced path: upside if LNG milestones land on time and if macro gas tightness sustains margins; range-bound outcomes if project timing and prices net out; and downside if regulatory or security issues disrupt key assets. Against that mosaic, the investment debate turns on confidence in execution versus the allure of income. Transparent updates on Iraq, Mozambique, and any U.S. LNG exposure should be the primary share-price drivers.

What could happen in three years? (horizon September 2025+3)

| Scenario | Narrative | Projects | Capital returns | Share implications |

|---|---|---|---|---|

| Best | Commodity backdrop supportive; margins stabilize and gradually improve as LNG mix rises. | GGIP Iraq on schedule; Mozambique LNG restart proceeds smoothly; exploration in Liberia/Congo yields commercial finds. | Dividend maintained with potential growth; buybacks re-accelerate once visibility improves. | Re-rating toward prior cycle highs as execution risk fades and free cash flow visibility increases. |

| Base | Mixed macro; modest margin recovery offset by occasional outages and hub price volatility. | Key projects progress with manageable delays; select exploration success, others deferred. | Dividend sustained; buybacks remain paced below recent peaks pending balance-sheet priorities. | Total returns driven mainly by dividend; valuation anchored near long-run averages. |

| Worse | Prolonged price weakness and cost inflation compress margins; operational hiccups persist. | Mozambique/LNG timelines slip; regulatory setbacks (e.g., Nigeria) complicate portfolio moves. | Dividend policy reviewed for flexibility; buybacks curtailed to preserve liquidity. | De-rating as earnings and cash flow underwhelm; focus shifts to balance-sheet defense. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Oil and gas price volatility and downstream/refining margins impacting revenue and profitability.

- Project execution and regulatory environment in Iraq, Nigeria, Mozambique, Liberia and Congo.

- Capital allocation in 2026 and beyond—pace of buybacks versus sustaining a 6.27% forward yield.

- Balance-sheet flexibility given 63.08B total debt and 25.61B cash, along with interest-rate dynamics.

- Exploration outcomes and safety performance affecting timing of reserves additions and start-ups.

- ESG, legal or sanctions exposures that could alter access to capital or timetable key assets.

Conclusion

TotalEnergies’ three-year setup blends high-income characteristics with a tangible, LNG-led growth pipeline. Fundamentals show pressure—revenue and earnings declines on a year-ago basis—but cash generation remains solid, supported by 28.2B in operating cash flow and 10.91B in free cash flow. Management’s signal of potential 2026 buyback moderation looks consistent with funding discipline for large gas projects while protecting a 6.27% forward dividend yield. Execution is the hinge: progress on Iraq’s GGIP, clarity on Mozambique LNG, and maturation of West African exploration will shape medium-term cash flows. Regulatory friction in Nigeria and macro price swings are credible offsetting risks. With shares near the 50-day and below the 200-day average, we see a carry-driven profile with project milestones as catalysts for any re-rating. Transparent delivery on schedule, safety and capital discipline will likely determine outcomes by 2028.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.