XPeng Inc. enters its next three-year stretch with rapid top-line expansion, improving product mix, and a stronger software story, but profitability remains the key swing factor. Trailing-12-month revenue stands at 60.29B with quarterly revenue growth of 125.30% year over year, while margins are still negative (profit margin -7.10%; operating margin -5.30%). The stock has rebounded sharply over the past year (52-week change 151.14%), though volatility is high (beta 2.50) and recent trading has been choppy. Liquidity is supported by 34.95B in cash against 16.95B in total debt and a current ratio of 1.14. Headlines highlight a first hybrid launch, a major system upgrade, delivery acceleration to 103,181 and an expanded Volkswagen partnership on software—potential catalysts if execution holds. Against a competitive and policy-sensitive backdrop, XPeng’s ability to lift margins will likely define returns.

Key Points as of September 2025

- Revenue: Trailing-12-month revenue at 60.29B; gross profit 9.63B; quarterly revenue growth 125.30% year over year.

- Profit/Margins: Profit margin -7.10%; operating margin -5.30%; EBITDA -2.92B; net income -4.28B; diluted EPS -0.63.

- Sales/Deliveries: Recent headlines cite deliveries growth accelerating to 103,181 and margins expanding; first hybrid launch and system upgrade could aid volume and mix.

- Share price: 52-week range 8.06–27.16; 50-day moving average 19.37; 200-day moving average 17.86; last late-August weekly close 21.02.

- Liquidity: Total cash 34.95B vs total debt 16.95B; current ratio 1.14.

- Ownership/Trading: Shares outstanding 777.03M; short interest 41.57M (short ratio 6.43; ~5.51% of float); average 3-month volume 7.62M (10-day 14.27M).

- Analyst view: Headlines indicate rising revenue expectations and sentiment tied to hybrid rollout and software upgrades; formal consensus not provided here.

- Market cap: Not specified in provided data; liquidity indicators and float (1.34B) suggest active trading depth.

- Strategic partnerships: Volkswagen expanded partnership to accelerate software upgrades across vehicle lines.

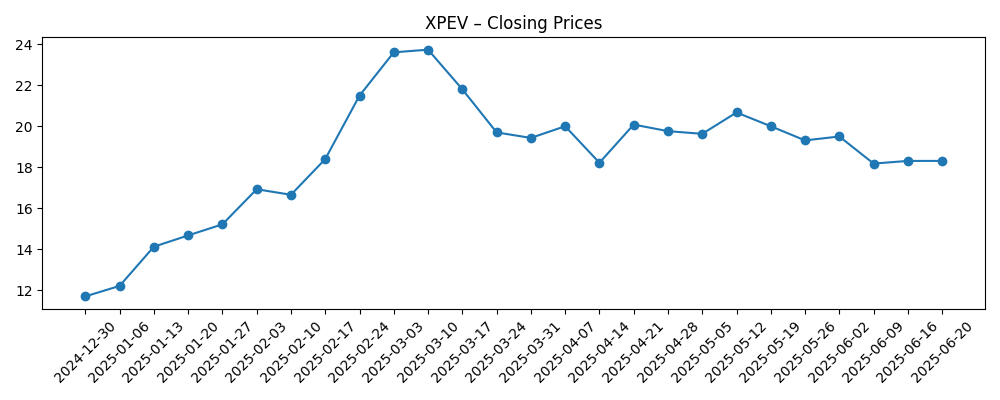

Share price evolution – last 12 months

Notable headlines

- XPeng (XPEV) Climbs 20% on Whopping Q3 Revenue Growth Expectations

- XPeng (XPEV) Extends Rally as First Hybrid Vehicle Launch Raises Sales Prospects

- XPeng (XPEV) Surges 8% on New Major System Upgrade

- Tesla Rival XPeng Deliveries Growth Accelerates To 103,181, Margins Expand

- XPeng (XPEV) Tumbles 6% as China Reports Lower EV Deliveries

- Volkswagen Expands XPeng Partnership To Speed Software Upgrades Across All Car Types

Opinion

XPeng’s investment case over the next three years hinges on turning today’s rapid growth into durable, margin-accretive scale. The numbers frame both promise and pressure: revenue at 60.29B with 125.30% year-over-year quarterly growth, but a -7.10% profit margin. Headlines highlight catalysts—hybrid launch, major system upgrade, and delivery acceleration to 103,181—suggesting a more competitive lineup and improving user experience. The expanded Volkswagen software partnership could speed development cycles and bolster brand credibility in advanced driver assistance and cockpit software. If XPeng can convert these product and software moves into higher average selling prices and better manufacturing absorption, operating leverage should improve. The market has rewarded momentum (52-week change 151.14%), yet sustained performance will likely require visible progress toward breakeven and evidence that software content can support margins.

Share behavior underscores the risk–reward. Price action climbed from single digits last fall to the low-20s by late August 2025, with a 52-week range of 8.06–27.16. The 50-day moving average (19.37) sits above the 200-day (17.86), reflecting a constructive intermediate trend amid elevated volatility (beta 2.50). Short interest of 41.57M shares and a short ratio of 6.43 can amplify swings, particularly around delivery updates and software release cycles. In our view, investors will watch for confirmation that the hybrid ramp broadens XPeng’s addressable market without reigniting heavy discounting. Execution on software features—from navigation to assisted driving—also needs to show measurable reliability and user adoption to support recurring revenue opportunities and reduce the industry’s sensitivity to hardware pricing.

Financial resilience is a relative bright spot. With 34.95B in cash against 16.95B in total debt and a current ratio of 1.14, XPeng has room to fund product refreshes and software development. That cushion matters in a market still grappling with competitive pricing, supply-chain normalization, and uneven demand signals. The company’s gross profit of 9.63B indicates that scale and mix are trending in the right direction, but EBITDA at -2.92B and net income at -4.28B show the path to profitability is unfinished. Over the next three years, the priority is narrowing losses through manufacturing efficiency, richer configurations, and software-enabled differentiation. Any evidence that the Volkswagen partnership accelerates time-to-market for features could be a structural advantage against peers.

External variables remain decisive. China’s EV policy environment, charging infrastructure buildout, and macro conditions can shift quickly, influencing both unit volumes and pricing. Export expansion can diversify revenue but adds regulatory and localization complexity. Meanwhile, headlines reveal sensitivity to monthly and quarterly delivery prints—both on the upside (rallies on growth expectations and upgrades) and downside (selloffs on softer sector data). Given average 3-month volume of 7.62M shares and a larger 10-day average of 14.27M, the tape can move fast on news. For long-term holders, the thesis rides on consistent delivery growth, tangible margin progress, and a credible software monetization path; for traders, momentum around product cycles and headline risk will likely continue to define entry and exit windows.

What could happen in three years? (horizon September 2028)

| Scenario | Narrative |

|---|---|

| Best | Hybrid lineup gains traction alongside core EVs; software features mature quickly under the Volkswagen partnership, supporting richer configurations. Manufacturing efficiency and scale lift unit economics and narrow losses toward breakeven. Brand perception improves on technology and reliability, supporting sustained growth and healthier pricing discipline. |

| Base | Deliveries expand steadily but price competition persists. Software upgrades enhance user experience, yet monetization is gradual. Margins improve modestly as scale builds, while liquidity remains adequate to fund development. The stock tracks execution milestones and broader sector sentiment, with volatility remaining elevated. |

| Worse | Competitive discounts and uneven demand weigh on mix and utilization. Software rollouts slip or fail to differentiate, while external policy or regulatory shifts disrupt export or domestic sales. Margin progress stalls and losses persist longer than expected, prompting cautious investor sentiment. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Execution on hybrid and new model launches, including delivery cadence and feature reliability.

- Software upgrade pace and perceived quality; outcomes from the expanded Volkswagen collaboration.

- Margin trajectory relative to price competition, input costs, and manufacturing efficiency.

- Liquidity and funding flexibility given cash, debt, and potential capital needs during expansion.

- Policy and regulatory developments in China and key export markets affecting demand or pricing.

- Trading dynamics: short interest, volume spikes around deliveries or upgrades, and overall risk appetite.

Conclusion

XPeng’s setup for the next three years is a balance between high-growth momentum and the need to translate scale into sustainable profitability. The company’s revenue expansion and improving gross profit underscore competitive products and growing demand, while a robust cash position offers strategic flexibility. At the same time, negative margins and ongoing losses signal that margin discipline, manufacturing efficiency, and software execution remain critical. Headlines point to potential catalysts—the first hybrid launch, major system upgrades, and a broadened partnership with Volkswagen—that could enhance differentiation and pricing power if delivered on time and at quality. The share price’s wide 52-week range and elevated beta suggest that news flow will continue to drive outsized moves. For investors, watching delivery trends, margin progress, and software milestones will be essential in assessing whether XPeng can convert today’s growth into durable value creation by 2028.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.