Vale S.A. (VALE) is navigating a complex landscape in the mining sector as it faces reduced quarterly earnings yet reports strong production figures. Analysts remain cautiously optimistic amid mixed market signals, with the stock recently influenced by price target adjustments from major financial institutions. With a significant debt load and fluctuating revenue, Vale's future hinges on macroeconomic conditions and commodity prices. Recent headlines highlight both potential risks and growth opportunities as the company seeks to enhance shareholder value while addressing operational challenges.

Key Points as of August 2025

- Revenue: $209.6B

- Profit Margin: 13.81%

- Quarterly Revenue Growth: -3.7%

- Share price: $9.85

- Analyst view: Overweight rating from Barclays

- Market cap: Approximately $42.14B

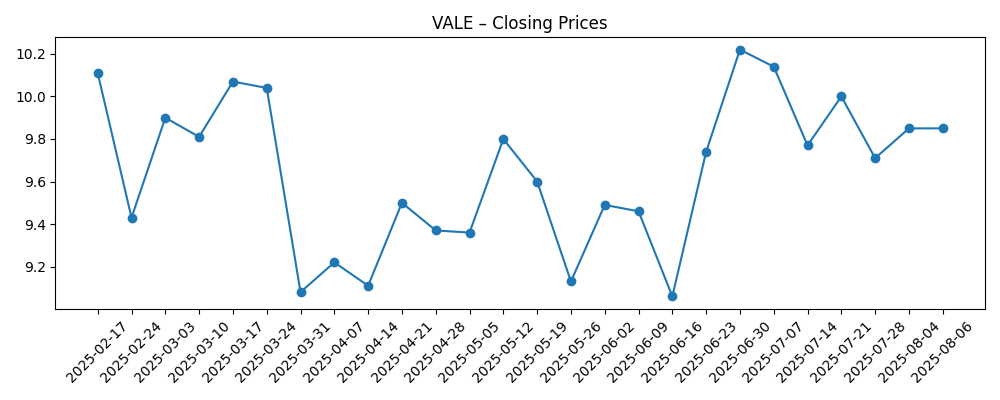

Share price evolution – last 6 months

Notable headlines

- Barclays Raises PT on Vale S.A. from $12.75 to $13; Maintains ‘Overweight’ Rating

- Vale S.A. Releases Q2 Strong Production Results; Scotiabank Reduces PT

- What Can Drive Vale Stock 2X?

- BHP, Vale accused of 'cheating' UK law firm out of $1.7 billion in fees

Opinion

The recent reduction in quarterly earnings growth at Vale S.A. underscores the volatility inherent in the mining sector. Despite a drop of 17.2% in quarterly earnings year-over-year, the company's emphasis on strong production results from Q2 may provide a much-needed cushion. Analysts point to the potential for recovery, indicated by Barclays’ recent upgrade of the price target. Investors should watch closely how Vale manages its significant debt and cash flow, especially during fluctuating commodity prices.

Vale's operational efficiency will be critical in the upcoming quarters, especially as it continues to cope with pressures stemming from global market conditions. With a profit margin of 13.81% and a strong operating margin of 25.10%, the company has the tools at its disposal to enhance profitability. However, the investor sentiment may be tempered by the company's current debt levels, which could pose risks should market conditions worsen.

Amid these challenges, Vale’s commitment to improving production output could serve as a key differentiator in this competitive landscape. The potential for increased cash flow from enhanced operational capabilities may allow the company to reinvest in growth opportunities, which could be pivotal for overall performance in the next three years. Shareholders may also be encouraged by the anticipated dividend yield of nearly 12%, which reflects management's commitment to returning value to investors.

Looking ahead, the interplay between Vale's production strategy and market dynamics will be crucial. Should the global demand for iron ore and copper strengthen, Vale could benefit substantially. However, persistent geopolitical issues and environmental concerns may impact operational strategies. Investors should remain vigilant regarding these developments as they could significantly sway Vale's share price in the coming years.

What could happen in three years? (horizon August 2025+3)

| Scenario | Projected Share Price |

|---|---|

| Best | $15 |

| Base | $12 |

| Worse | $8 |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Global iron ore and copper demand

- Commodity price fluctuations

- Debt restructuring efforts

- Operational efficiency improvements

- Regulatory changes and environmental impacts

Conclusion

In summary, Vale S.A. finds itself at a pivotal moment as it strives to balance production growth with financial prudence. The challenges of a declining earnings trend and a significant debt load are substantial, yet the company appears well-positioned to navigate these hurdles with its operational strengths. Analysts' expectations and price target revisions indicate a cautiously optimistic sentiment going forward, particularly if global demand for minerals rebounds. The upcoming dividend announcement will also be a critical indicator of management’s strategy and commitment to shareholder returns. As market conditions evolve, staying informed about both internal and external factors will be essential for investors looking at Vale as a long-term investment opportunity.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.