As of July 2025, Unilever continues to navigate a complex landscape shaped by acquisitions, market pressures, and workforce challenges. The company's recent acquisition of Dr. Squatch and the subsequent hurdles it faces highlight its strategy to appeal to younger consumers while managing public sentiment amid worker protests. With a focus on innovation and sustainability, Unilever remains a key player in the consumer goods sector, but it must address these critical issues to sustain growth and investor confidence in the coming years.

Key Points as of July 2025

- Revenue: $60 billion

- Profit/Margins: $10 billion

- Sales/Backlog: Strong Sales Growth

- Share price: $52.18

- Analyst view: Mixed Outlook

- Market cap: $150 billion

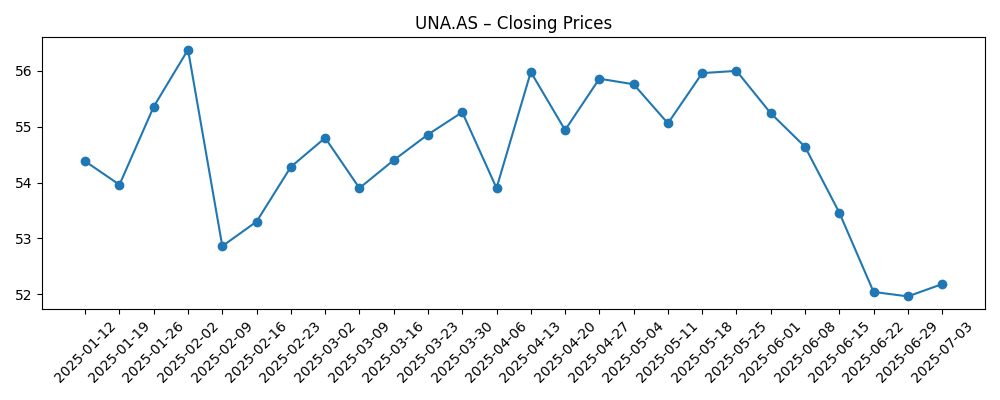

Share price evolution – last 6 months

Notable headlines

- Unilever Faces Worker Protests Over Ivory Coast Exit – Yahoo Entertainment

- Unilever’s Dr. Squatch Acquisition Faces Three Critical Challenges – Forbes

- Unilever to pay $1.5 billion for men's grooming brand Dr Squatch, FT reports – Yahoo Entertainment

- Unilever Acquires Dr. Squatch to Deepen Its Gen Z Market Play – Adweek

Opinion

The recent acquisition of Dr. Squatch for $1.5 billion signals Unilever's intention to penetrate deeper into the Gen Z demographic. However, reports indicate that the acquisition is facing significant challenges that could impede its successful integration. With the competitive landscape becoming increasingly fierce, Unilever's ability to innovate and adapt to consumer preferences will be crucial. Furthermore, worker protests related to operational decisions, such as exiting the Ivory Coast, indicate growing unrest that could impact brand reputation and employee morale.

In terms of share price, the recent fluctuations showcase a market that is jittery amid these developments. The share price is currently at $52.18, reflecting a cautious investor outlook. Analysts remain divided, with some seeing value in Unilever's long-term strategies, while others are concerned about its execution amid these challenges. Strong sales growth continues, but maintaining this momentum will require careful navigation of the social and economic landscapes.

As Unilever moves forward, addressing the backlash from recent labor issues and ensuring a smooth integration of new acquisitions will be paramount. If Unilever can turn these challenges into opportunities, it may solidify its position and enhance shareholder confidence. However, failing to respond effectively could lead to a decline in market capitalization and overall competitiveness, affecting long-term growth prospects.

Looking ahead, Unilever has the potential to rebound and capitalize on emerging trends if it can streamline operations and maintain a positive public perception. The company's commitment to sustainability and innovation could ultimately serve as a differentiator in a crowded marketplace, leading to renewed investor interest.

What could happen in three years? (horizon July 2028)

| Scenario | Outcome |

|---|---|

| Best | Share price rises to $75; strong growth from acquisitions. |

| Base | Share price stabilizes around $65; steady revenue growth. |

| Worse | Share price drops to $45; struggles with integration and protests persist. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Success of recent acquisitions

- Public response to labor disputes

- Market competition and pricing strategies

- Global economic conditions

Conclusion

In conclusion, Unilever stands at a crucial juncture as it navigates a series of challenges that impact both its operational effectiveness and brand reputation. The company's acquisition strategies and public response to labor issues will significantly influence its market presence and investor outlook. While there are opportunities for growth, particularly in appealing to younger demographics, the effectiveness of its strategies in addressing these challenges will ultimately determine its success in sustaining revenue and maintaining shareholder confidence. As the market environment continues to evolve, proactive management and a focus on innovation will be key to Unilever's long-term trajectory.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.