TotalEnergies SE enters August 2025 with resilient cash generation but softer topline trends. The stock has fallen 14.62% over the past year, closing the week at 53.50, near its 50‑day moving average of 52.89 and below the 200‑day at 54.27. Trailing 12‑month revenue stands at 187.12B with a 6.83% profit margin and 9.52% operating margin; net income is 12.79B and operating cash flow totals 28.2B. The forward dividend yield is a hefty 6.40% on a 3.4 per‑share annual rate, with a 64.42% payout ratio, and the next ex‑dividend date is 1 October 2025. Analysts covering the ADR cite a mid‑$60s consensus target, while a South African court has halted approval of a company oil block, underscoring project‑execution risk. Our three‑year outlook balances high income against regulatory and commodity uncertainty.

Key Points as of August 2025

- Revenue – TTM revenue 187.12B; quarterly revenue growth (yoy) −9.20%.

- Profit/Margins – Profit margin 6.83%; operating margin 9.52%; net income 12.79B; EBITDA 35.46B; OCF 28.2B; LFCF 10.91B.

- Sales/Backlog – Revenue per share 82.93; no backlog figure disclosed here.

- Share price – Last close 53.50; 52‑week range 47.65–63.48; 50‑day MA 52.89; 200‑day MA 54.27; beta 0.71; 52‑week change −14.62%.

- Analyst view – Recent ADR articles cite consensus targets around $66.45–$66.95.

- Dividend – Forward annual rate 3.4; forward yield 6.40%; payout ratio 64.42%; ex‑dividend date 10/1/2025.

- Balance sheet – Cash 25.61B; debt 63.08B; debt/equity 53.01%; current ratio 1.00.

- Market cap – About 116.6B (2.18B shares × 53.50).

- Ownership & liquidity – Institutions 40.71%; insiders 5.10%; avg 3‑month volume 4.16M.

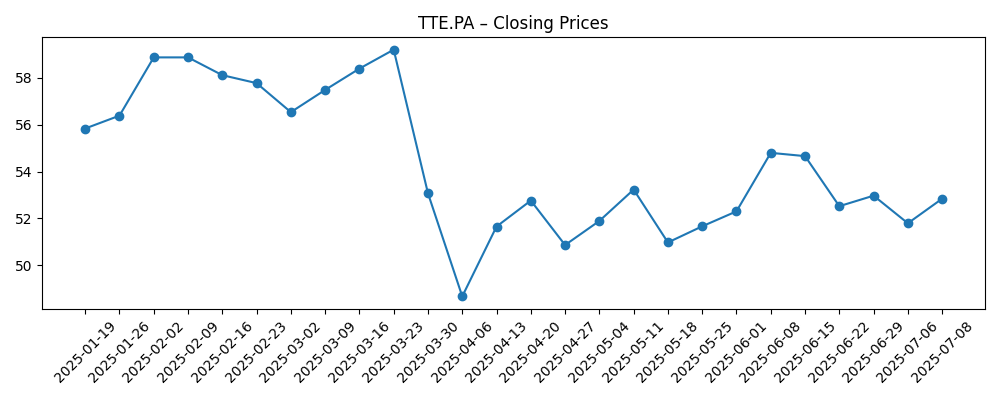

Share price evolution – last 12 months

Notable headlines

- S. African Court Halts Approval for TotalEnergies Oil Block [Financial Post]

- TotalEnergies SE Sponsored ADR (NYSE:TTE) Receives $66.45 Average Target Price from Analysts [ETF Daily News]

- TotalEnergies SE Sponsored ADR (NYSE:TTE) Receives $66.95 Consensus Price Target from Brokerages [ETF Daily News]

- Invesco Ltd. Has $11.95 Million Stock Holdings in TotalEnergies SE Sponsored ADR $TTE [ETF Daily News]

- Russell Investments Group Ltd. Acquires 9,724 Shares of TotalEnergies SE Sponsored ADR $TTE [ETF Daily News]

- Rep. Lisa C. McClain Sells TotalEnergies SE Sponsored ADR (NYSE:TTE) Shares [ETF Daily News]

Opinion

The market is treating TotalEnergies as a high‑income, lower‑beta way to own energy cyclicality. With beta at 0.71 and the share price hovering near its 50‑day average yet below the 200‑day, investor positioning looks cautious rather than capitulatory. The forward dividend yield of 6.40% is the centerpiece of the equity story, supported by 28.2B in operating cash flow and 10.91B in levered free cash flow. The 64.42% payout ratio appears manageable if commodity prices remain broadly supportive, but the recent −9.20% quarterly revenue contraction and −29.00% quarterly earnings growth signal that profitability is sensitive to macro winds. Over three years, range‑bound multiples alongside steady buybacks/dividends could still deliver mid‑single‑digit annualized total returns, with upside if project momentum resumes and downside if margins compress further.

Analyst targets clustered in the mid‑$60s (ADR) point to moderate upside from current levels, implying the market discounts execution and policy risks. We read these targets as a vote of confidence in the cash‑flow engine more than a call on rapid topline growth. With a 52‑week range of 47.65–63.48 and average volumes that have cooled in recent weeks, liquidity is ample but conviction is muted. The base case is that price tracks cash distributions while awaiting catalysts: project sanctions, a clearer downstream margin outlook, and progress in power/renewables where capital discipline remains a watchword. If earnings quality stabilizes—e.g., operating margins holding near the current 9.52%—the equity could re‑rate modestly without requiring heroic commodity assumptions.

The South African court’s halt of an oil‑block approval highlights the non‑price risks that shape multi‑year outcomes. Regulatory timelines, legal challenges, and environmental permitting can defer volumes and inflate project break‑evens, even when subsurface potential is attractive. For TotalEnergies, the direct financial impact is uncertain in this dataset, but the signal is clear: geographic diversification does not fully immunize the portfolio from localized legal risk. Over a three‑year horizon, the company’s ability to stagger project FIDs, recycle capital across regions, and pace spending against cash generation will matter as much as any near‑term discovery news. Delays can be managed if balance sheet flexibility is preserved; they become problematic if they coincide with margin compression or policy headwinds in multiple jurisdictions.

Balance sheet dynamics look adequate for a steady‑as‑she‑goes playbook: 25.61B cash against 63.08B debt, debt/equity of 53.01%, and a current ratio of 1.00. That mix should support dividends and selective growth while maintaining room to maneuver if spreads widen or demand softens. Institutional ownership of 40.71% and insider ownership of 5.10% suggest aligned but not concentrated stewardship, with recent holdings updates (and a small political‑insider sale) unlikely to move the needle. Over three years, we see three levers to drive equity value: maintaining margin discipline through the cycle, delivering on fewer but higher‑return projects, and articulating a credible capital‑return framework that adapts to commodity volatility. Execution on these fronts, more than macro luck, will determine whether today’s income‑led thesis compounds into durable total returns.

What could happen in three years? (horizon August 2028)

| Case | Narrative | Implications for TTE.PA |

|---|---|---|

| Best | Commodity prices remain supportive; legal/regulatory hurdles ease or are worked around; project pacing prioritizes high‑return barrels and integrated gas; power and low‑carbon units contribute steady cash without crowding out returns. | Dividend sustained and gradually rising; modest re‑rating as margins hold; share price tracks cash returns with additional upside from improved sentiment. |

| Base | Mixed macro with intermittent price volatility; selective delays in approvals offset by portfolio rotation; operating margin stays near current levels; capital discipline maintained. | Total return driven mainly by dividend; range‑bound valuation; incremental gains when catalysts land, setbacks when projects slip. |

| Worse | Weaker demand or sustained price softness; multiple regulatory setbacks; cost inflation pressures new projects; margins compress from current levels. | Dividend policy faces pressure; potential de‑rating; management pivots to cash preservation, limiting growth optionality. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Commodity price trajectory and downstream margin spreads affecting earnings and cash flow.

- Regulatory and legal outcomes on upstream projects (e.g., approval timelines and court rulings).

- Capital allocation between dividends, buybacks, and growth capex relative to free cash flow.

- Execution on project delivery and cost control, impacting operating margin sustainability.

- Balance sheet flexibility amid rate and credit‑spread movements.

Conclusion

TotalEnergies’ investment case into 2028 is anchored by visible cash returns and comparatively low beta. The company’s financials show healthy cash generation (28.2B OCF; 10.91B LFCF) against a balanced but levered capital structure, supporting a 6.40% forward yield with a 64.42% payout ratio. The equity’s recent underperformance (−14.62% over 12 months) and proximity to longer‑term moving averages suggest expectations are contained, leaving room for upside if execution firms. Key swing factors include resolution of permitting challenges (as flagged in South Africa), the cadence of high‑return project FIDs, and stability in operating margins near the current 9.52%. In our base case, income dominates total returns while valuation remains range‑bound; in a better tape, modest multiple expansion could add to yield‑driven gains. Conversely, a weaker macro or sustained legal frictions would push management toward cash preservation and capex deferral.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.