SoftBank Group (9984.T) enters August 2025 with momentum tied to the AI cycle and renewed operating performance. Over the past year the shares have gained 84.99%, approaching a 52‑week high of ¥15,860. Fundamentals have improved: trailing‑twelve‑month revenue stands at ¥7.36 trillion, gross profit at ¥3.79 trillion, and profit margin at 23.76%, supported by EBITDA of ¥1.2 trillion and diluted EPS of ¥779.19. The balance sheet remains leveraged (total debt ¥19.65 trillion versus total cash ¥4.19 trillion; current ratio 0.84), but free cash flow is positive on a levered basis. A 0.30% dividend yield and low 5.65% payout leave flexibility for investment. With headlines highlighting an AI‑led profit recovery and a push into AI server manufacturing via a Foxconn Ohio plant deal, investors will watch execution, valuations and capital allocation closely.

Key Points as of August 2025

- Revenue: Trailing‑twelve‑month revenue is ¥7.36 trillion; quarterly revenue growth (y/y) is 7.00%.

- Profit/Margins: Profit margin 23.76%; operating margin 10.79%; gross profit ¥3.79 trillion; EBITDA ¥1.2 trillion.

- Sales/Backlog: Growth re-accelerating (7.00% y/y TTM revenue growth in the latest quarter); backlog not disclosed.

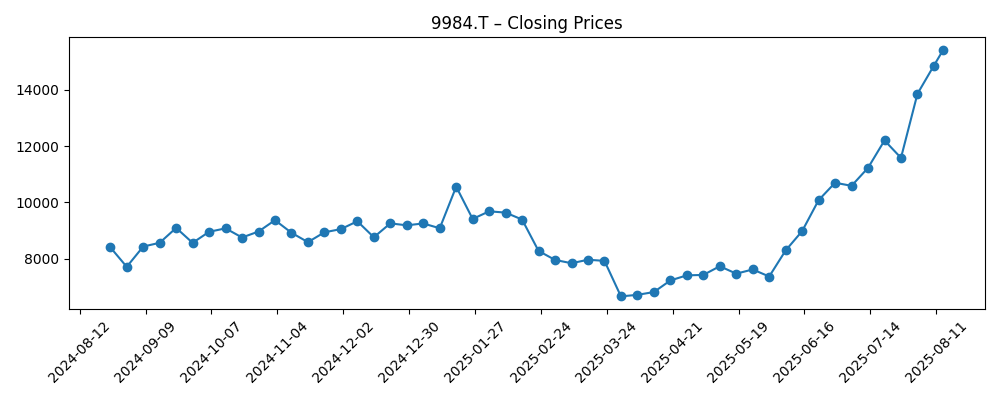

- Share price: Up 84.99% over 52 weeks; 52‑week range ¥5,730–¥15,860; recent level near ¥15,435 with 50‑day MA ¥10,215.16 and 200‑day MA ¥8,913.51; beta 0.50.

- Balance sheet: Total debt ¥19.65 trillion vs total cash ¥4.19 trillion; debt/equity 144.41%; current ratio 0.84.

- Market cap: Approximately ¥21.9 trillion (1.42B shares × ~¥15,435).

- Cash flows: Operating cash flow (ttm) −¥24.01 billion; levered free cash flow ¥1.7 trillion.

- Dividend policy: Dividend yield 0.30% (rate ¥44); payout ratio 5.65%; next ex‑dividend date 2025‑09‑29.

- Analyst/market focus: Execution on AI server build‑out and investment marks from AI equities are central to the valuation narrative.

Share price evolution – last 12 months

Notable headlines

- SoftBank Shares Surge to Record on AI-Fueled Profit Recovery

- SoftBank Shares Depend on AI More Than Ever After $65 Billion Rally

- SoftBank Buys Foxconn’s Ohio Plant to Boost Stargate AI Push

- SoftBank buys Foxconn plant in Ohio for $375M to make AI servers

- SoftBank Group sees better fortunes on surging AI stocks

- SoftBank buys Foxconn's Ohio plant to jumpstart Stargate AI push

- Japan tech giant SoftBank Group sees better fortunes on surging AI stocks

Opinion

SoftBank’s latest strategic move—purchasing Foxconn’s Ohio facility to accelerate its Stargate AI ambition—signals a deeper shift from investment holding to hands‑on enablement of AI infrastructure. In principle, vertical exposure to AI servers can improve control over timelines and capture more value from the compute cycle. It could also help soften the variability of investment earnings with an operating revenue stream tied to secular demand. That said, hardware manufacturing carries execution risks: supply chain dependencies, yield management, and customer qualification can all complicate ramp‑ups, especially in a market where technology standards evolve rapidly. The company’s levered free cash flow is positive, but operating cash flow is currently negative; funding an efficient scale‑up while preserving balance sheet flexibility will be the near‑term test. A staged ramp with milestone gating and disciplined customer onboarding would reduce the risk of overbuilding into a cyclical air pocket.

The equity narrative is increasingly tethered to AI equities—an explicit theme of recent headlines noting an AI‑fueled profit recovery and sensitivity to the AI complex. When the AI tide rises, portfolio marks and sentiment tend to re‑rate SoftBank; when it pauses, that linkage can amplify drawdowns. The 50‑day and 200‑day moving averages sit well below the current price, underscoring how quickly expectations have reset. A practical implication is that quarterly disclosures around investment marks and any visibility on AI server orders could trigger outsized stock moves. With a five‑year beta of 0.50, the shares have historically exhibited dampened market correlation, but factor exposures can change in a regime shift. Investors should expect higher idiosyncratic volatility around AI catalysts—even if headline beta remains modest.

Leverage remains the central counterweight to the AI opportunity. Total debt of ¥19.65 trillion dwarfs cash of ¥4.19 trillion, and a current ratio of 0.84 highlights limited near‑term liquidity coverage. While the payout ratio is just 5.65% and the dividend yield 0.30%, leaving room for reinvestment, the capacity to compound depends on refinancing at tolerable rates and maintaining access to liquidity. In a benign case, higher‑quality assets, improving EBITDA and positive levered free cash flow support self‑funding. In a tougher case, mark‑to‑market swings could pressure equity buffers and tighten financial policy. SoftBank historically leans on active portfolio management; clarity on asset monetization and pacing of AI capex would help investors underwrite the path to a sturdier balance sheet without dampening growth initiatives.

Price action contextualizes the dilemma. The stock has advanced 84.99% over the last 12 months and trades near a 52‑week high of ¥15,860, with the recent print around ¥15,435. Such momentum can persist if AI execution delivers credible revenue traction and if portfolio marks stay constructive. Yet sharp rallies often invite periods of consolidation as expectations recalibrate. Technically, a large gap to the 50‑day moving average suggests a broader reaction band to news—both positive and negative—over the next 6–12 months. Over a three‑year horizon, the bull case rests on translating AI headlines into operating scale, while the bear case centers on execution slippage and capital structure friction. The base case is a more balanced glide path: steady revenue growth, moderated leverage, and selective capital recycling to compound through the cycle.

What could happen in three years? (horizon August 2025+3)

| Scenario | Narrative |

|---|---|

| Best | AI server ramp executes smoothly, customer wins support sustained shipments, and investment marks remain favorable. Revenue growth stays positive, margins hold, and balance sheet flexibility improves through asset recycling and disciplined capex. Valuation benefits from clearer earnings visibility and reduced perceived risk. |

| Base | Execution is mixed but serviceable: AI initiatives contribute, though below early hopes; investment results normalize. Revenue growth is steady, with margins bounded by ramp costs. Leverage trends sideways as cash generation funds most needs. Shares track fundamentals with bouts of sentiment‑driven volatility. |

| Worse | Ramp delays and component constraints limit AI server traction while investment marks turn adverse. Revenue growth slows, operating cash flow remains pressured, and refinancing conditions tighten. Management prioritizes liquidity over growth, leading to a de‑rating until execution and balance sheet signals improve. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Execution on the Stargate AI server build‑out, including supply chain resilience and customer adoption timelines.

- Mark‑to‑market swings tied to AI equities (e.g., Nvidia‑related exposure referenced in recent headlines) and their impact on reported earnings.

- Balance sheet management: refinancing costs, debt reduction, and liquidity, given debt/equity of 144.41% and current ratio of 0.84.

- Macro and FX dynamics affecting asset values and funding capacity, particularly yen volatility and global rates.

- Regulatory and geopolitical developments around semiconductor exports, cross‑border deals, and data security.

- Capital allocation choices—pace of investment versus returns to shareholders—within the context of 31.58% insider and 28.16% institutional ownership.

Conclusion

SoftBank’s investment case over the next three years pivots on converting AI enthusiasm into durable, cash‑generative operations while managing leverage. The company is benefitting from favorable AI sentiment and improving profitability metrics, with revenue at ¥7.36 trillion and strong margins, but it must execute on the Ohio facility ramp to demonstrate that AI infrastructure can be a repeatable business rather than a one‑off headline. A modest dividend and low payout maintain flexibility, yet the balance sheet—debt at ¥19.65 trillion versus cash at ¥4.19 trillion—keeps risk management front and center. With the share price near a 52‑week high after an 84.99% advance, the bar for positive surprises is higher, and volatility around AI catalysts should be expected. Success likely looks like steady growth, disciplined capex, and gradual de‑risking; shortfalls would revolve around execution delays and tighter funding conditions.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.