Royal Bank of Canada (RY.TO) enters the next three years with improving fundamentals and a firm share-price backdrop. Over the last year the stock is up 21.88%, sits near its 52‑week high of 204.60 after a recent 199.58 close, and outpaced the S&P 500’s 16.84%. Revenue (ttm) is 60.27B with quarterly revenue growth of 15.30% and quarterly earnings growth of 20.80%, underpinned by a 31.77% profit margin and 14.73% ROE. The bank continues to return cash, with a forward dividend of 6.16 (3.09% yield) and a 44.78% payout ratio. Strategically, management is exploring a potential $2 billion sale of Moneris (with BMO) and partnering with a new defence bank, while Barclays recently flagged stronger Q3 prospects and raised its price target. These drivers frame the risks and catalysts ahead.

Key Points as of August 2025

- Revenue – ttm of 60.27B; quarterly revenue growth (yoy) 15.30% and quarterly earnings growth (yoy) 20.80%.

- Profit/Margins – Profit margin 31.77%, operating margin 45.38%; ROE 14.73%, ROA 0.89%.

- Sales/Backlog – Exploring a potential ~$2B sale of Moneris with BMO; partnership with a new defence bank may support future deal flow.

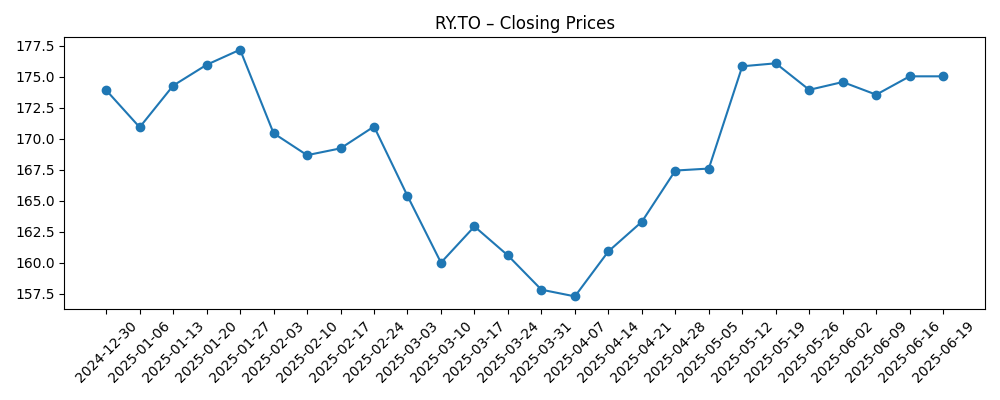

- Share price – Recent close 199.58; 52‑week range 151.25–204.60; 50‑day/200‑day MAs at 182.88/173.31; beta 1.03; 52‑week change 21.88% vs S&P 500’s 16.84%.

- Analyst view – Barclays signaled stronger Q3 and raised its price target; short interest 4.21M shares, short ratio 0.95; institutions hold 49.04%.

- Market cap – Implied at about 281B based on 1.41B shares outstanding and a 199.58 recent close.

- Dividend – Forward dividend 6.16 (3.09%); trailing 5.92 (2.95%); payout ratio 44.78%; next ex‑dividend date 10/27/2025.

- Balance sheet – Total cash 730.76B and total debt 438.98B; operating cash flow (ttm) −33.02B; book value/share 88.30; diluted EPS (ttm) 13.21.

Share price evolution – last 12 months

Notable headlines

- Barclays Sees Stronger Q3 Results, Raises Price Target for Royal Bank of Canada (RY)

- RBC, BMO explore sale of $2 billion payments processor Moneris, Reuters reports

- RBC and BMO explore $2bn sale of Moneris payments business - Reuters

- RBC to partner with new defence bank that could help Canada meet its NATO target

Opinion

The reported exploration of a Moneris sale could be an elegant way for RBC to simplify operations and recycle capital into higher‑return core banking and wealth businesses. While the eventual valuation, structure, and timing remain uncertain, an exit from merchant acquiring would likely reduce operational complexity and technology investment needs tied to payments processing. Proceeds could support organic lending, wealth advisory expansion, or capital buffers. Even without disclosing figures beyond the reported ~$2B headline, the strategic signal is notable: RBC appears willing to prune noncore assets to reinforce scale advantages where it already competes effectively. For investors, a credible divestiture path could lower conglomerate discount risk and bolster confidence in near‑ to medium‑term return on equity durability, especially as profitability metrics (profit margin 31.77% and ROE 14.73%) remain supportive.

The partnership with a new defence bank adds a different vector of optionality. Defence‑related financing and advisory mandates can be cyclical and policy‑dependent, yet they also tend to be relationship‑driven and long‑tailed. For a bank with RBC’s balance sheet depth (total cash 730.76B and total debt 438.98B), selective participation could translate into fee opportunities and incremental lending with strong counterparties. The reputational and policy context will matter, but in principle the arrangement broadens RBC’s addressable deal pipeline and may foster cross‑sell into treasury, FX, and capital markets. Execution discipline is essential: ensuring appropriate risk‑adjusted returns, compliance, and stakeholder alignment will determine whether this partnership becomes a durable contributor or remains a modest, episodic source of business.

Technically, the shares have regained momentum since the March trough and now trade near the upper end of their 151.25–204.60 range, above both the 50‑day and 200‑day moving averages (182.88 and 173.31). That backdrop, combined with a forward dividend of 6.16 (3.09% yield) and a 44.78% payout ratio, supports a balanced total‑return case heading into the next three years. Valuation discipline still matters: the stock trades at a premium to its book value per share of 88.30, which is typical for profitable Canadian banks but leaves less room for error if growth moderates. In our view, sustained revenue growth (15.30% yoy in the most recent quarter) and cost control will be pivotal to justify the premium and sustain the rally toward or beyond the 52‑week high.

Sentiment is constructive. Barclays’ call for stronger Q3 and a raised target adds incremental credibility to the rebound narrative, while a low short ratio (0.95) and modest short interest (4.21M shares) suggest limited embedded skepticism. Institutional ownership of 49.04% provides a stable demand base but also implies that marginal shifts in large holders’ views can move the stock. Watchlist items over the next few quarters include net interest margin trends as rates evolve, credit quality in consumer and commercial books, and the capital deployment pathway if the Moneris process advances. If management continues to pair dividend growth with selective portfolio optimization, the three‑year outlook skews constructive, albeit with typical macro and regulatory sensitivities for a systemically important bank.

What could happen in three years? (horizon August 2025+3)

| Scenario | Narrative |

|---|---|

| Best | RBC streamlines by exiting noncore assets like Moneris on attractive terms, redeploys capital into core banking and wealth, and benefits from steady credit quality and supportive deal flow from initiatives such as the defence bank partnership. Dividend growth and selective buybacks enhance total returns. |

| Base | Operational momentum persists with stable profitability and prudent risk management. Strategic moves progress but are paced to market conditions. The stock tracks underlying earnings and dividends, with valuation remaining near historical ranges for a leading Canadian bank. |

| Worse | A tougher credit cycle or regulatory tightening pressures margins and loan growth. Strategic actions take longer or occur on less favorable terms, while market volatility tempers capital markets fees. The shares lag until visibility improves and capital deployment accelerates. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Outcome and capital deployment from any Moneris transaction, including timing and valuation.

- Credit quality and risk costs across retail and commercial portfolios as the rate environment evolves.

- Net interest income trajectory versus operating expenses, with sensitivity to policy rates and yield curves.

- Regulatory capital requirements and supervisory expectations that could affect dividend and buyback capacity.

- Deal flow in wealth and capital markets, including opportunities from the defence bank partnership and broader corporate activity.

Conclusion

RBC’s investment case into 2028 balances solid fundamentals with targeted strategic change. The bank is growing at a healthy clip, evidenced by 15.30% quarterly revenue growth and 20.80% quarterly earnings growth, and maintains attractive profitability (31.77% profit margin, 14.73% ROE). The shares have outperformed over the last year and now trade near highs, supported by improving technicals and a dependable dividend policy (forward 6.16, 3.09% yield; 44.78% payout ratio). A potential Moneris sale could simplify the portfolio and free capital, while the defence bank partnership may widen the fee funnel. Analyst sentiment is turning more positive, and short interest is low. Key watch items remain credit costs, rate sensitivity, and regulatory capital. If management executes, RBC appears positioned to deliver a balanced mix of income and moderate growth over the next three years.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.