Royal Bank of Canada (RY.TO) enters the next three years with momentum and mixed signals. The stock has climbed 21.39% over the past year, while trailing revenue stands at 60.27B amid double‑digit growth in both sales and earnings. What changed: investor confidence firmed as profitability and capital generation improved, supported by steady operating margins and a dependable dividend. Why it changed: rising fee income and disciplined costs have cushioned rate‑cycle swings, while limited short interest suggests fewer near‑term skeptics. Why it matters: with shares near recent highs and analysts split between a fresh price‑target raise and a downgrade, the debate now centers on sustainability—can benign credit and stable funding costs persist as the rate cycle evolves? In the broader context, Canada’s concentrated, tightly regulated banking system typically rewards scale and prudence, but it also limits outsized growth. Over the coming 12–36 months, valuation resilience will hinge on credit quality, deposit pricing, and fee momentum, making execution and risk discipline the key variables for investors across the bank sector.

Key Points as of October 2025

- Revenue – Trailing 12‑month revenue is 60.27B with quarterly year‑over‑year growth of 15.30%.

- Profit/Margins – Profit margin is 31.77%; return on equity is 14.73%, indicating solid capital efficiency for a universal bank.

- Sales/Backlog – Loan or deal backlog metrics not disclosed; watch management commentary on pipeline and credit demand.

- Share price – Last close near 203.61; 52‑week change is 21.39%, with a 52‑week high of 206.90 and 50/200‑day averages of 194.89/176.84.

- Analyst view – Recent moves are mixed: one price‑target increase and one downgrade signal debate on upside from here.

- Market cap – Implied at roughly 287B (price × 1.41B shares outstanding).

- Dividend – Forward dividend rate 6.16 (3.03% yield); payout ratio 44.78%; ex‑dividend 10/27/2025; pay date 11/24/2025.

- Risk posture – Short interest remains low at 0.55% of shares outstanding; beta near 1.03 suggests market‑like volatility.

- Cash flow – Operating cash flow (ttm) is negative (‑33.02B), a common outcome for banks given balance‑sheet flows.

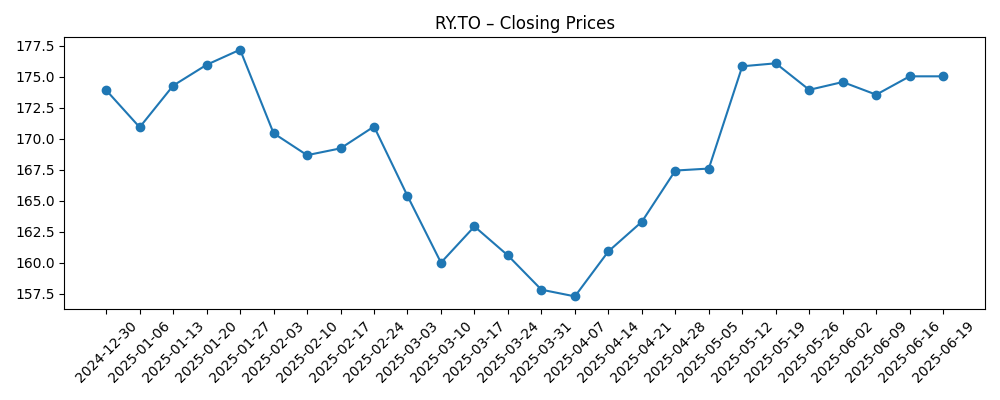

Share price evolution – last 12 months

Notable headlines

- BMO Capital Raises Royal Bank of Canada (RY) PT to C$203

- CIBC Downgrades Royal Bank of Canada (RY) to Neutral From Outperform

- Dividend Reliability and Global Reach: The Case for Royal Bank of Canada (RY)

Opinion

What the numbers say (1): The top‑line and bottom‑line trends point to a franchise leaning on both net interest income and stable fee pools. Revenue growth of 15.30% year over year alongside 20.80% earnings growth implies operating leverage—costs rising slower than income—and a favorable business mix. A 31.77% profit margin with 14.73% ROE signals capital is being deployed productively. The dividend profile (forward yield about 3% with a sub‑50% payout) leaves buffers for credit normalization without stressing capital distributions. The low short interest further indicates limited near‑term skepticism.

What the numbers say (2): The share price recovery from the March trough to near the 52‑week high, and trading above the 50‑ and 200‑day averages, tells us the market is giving weight to improving fundamentals. On valuation, the current price versus book value per share (88.30) implies a rough price‑to‑book near 2.3x—consistent with a bank perceived to have durable returns and franchise strength. One caveat: negative operating cash flow in banks can reflect balance‑sheet timing and is not a standalone quality signal; credit costs and funding dynamics remain the decisive levers.

Sector lens (1): In Canada’s concentrated, highly regulated banking system, scale and diversified income streams tend to sustain mid‑teens ROE through cycles. For RY, that backdrop supports a premium narrative—if credit quality stays benign and deposit pricing remains contained as policy rates evolve. Competitive intensity from digital players is rising, but incumbents’ funding breadth and risk management typically blunt margin erosion. The mix of fee businesses can help offset interest‑margin volatility, stabilizing earnings through rate transitions.

Sector lens (2): The debate that will shape the multiple is about duration and quality of earnings: can the bank maintain double‑digit revenue momentum as the credit cycle matures, and will capital returns be steady without compromising buffers? Recent analyst moves—one target hike and one downgrade—capture this push‑pull. If macro conditions favor stable employment and contained losses, the market can keep paying for reliability. If losses normalize faster or deposit betas rise, the narrative could pivot from growth to protection, pressuring valuation toward sector averages.

What could happen in three years? (horizon October 2025+3)

| Scenario | Narrative |

|---|---|

| Best case | Soft‑landing economy with stable employment, modest rate cuts that support loan demand without compressing margins, and disciplined costs. Credit losses stay contained, fee income expands, and steady dividend growth underpins a premium valuation. |

| Base case | Normalizing credit costs and a gradual drift lower in net interest margins offset by resilient fees and measured expense control. Earnings grow in line with nominal GDP, with valuation holding near historical sector ranges and dividends maintained. |

| Worse case | Sharper credit deterioration and higher deposit pricing pressure margins; capital markets activity softens. Management prioritizes balance‑sheet defense over growth, slowing earnings and constraining dividend growth until conditions stabilize. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Path of interest rates affecting net interest margins and deposit pricing.

- Credit quality trends across consumer and commercial portfolios.

- Fee income resilience in wealth management and capital markets.

- Capital and regulatory requirements influencing dividends and buffers.

- Competitive dynamics from digital challengers and technology adoption.

- Market risk and liquidity conditions impacting trading and issuance activity.

Conclusion

Royal Bank of Canada’s setup into the next three years blends solid profitability with a valuation that already discounts steady execution. The data show broad‑based momentum—double‑digit revenue and earnings growth, robust margins, and a dependable dividend—balanced by the usual banking variables: funding costs, credit normalization, and market‑sensitive fees. With shares near recent highs and sentiment split across the Street, the narrative hinges on whether returns can hold in a maturing cycle. A premium price‑to‑book can persist if credit losses remain contained and deposit costs stabilize, but it could compress if the cycle turns sharper. Watch next 1–2 quarters: credit cost trends; deposit betas and margin trajectory; fee revenue durability; expense discipline; and capital return signals around the dividend timetable. These markers will clarify whether today’s momentum is cyclical lift or a sturdier earnings base that can carry RY’s premium over the medium term.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.