As of June 2025, Royal Bank of Canada (RY.TO) finds itself navigating a complex economic landscape marked by rising provisions for loan losses and strategic share repurchases. With the Canadian banking sector experiencing heightened risks stemming from trade and policy uncertainties, RBC's approach reflects its commitment to maintaining financial stability while returning value to shareholders. Recent performance has shown fluctuations in share prices, creating a varied outlook for investors as they consider the implications of recent developments and market conditions.

Key Points as of June 2025

- Revenue: $50.2 billion

- Profit/Margins: $14.5 billion (28.9% margin)

- Sales/Backlog: Strong loan growth, particularly in mortgages

- Share price: $175.03

- Analyst view: Mixed outlook with cautious optimism

- Market cap: $250 billion

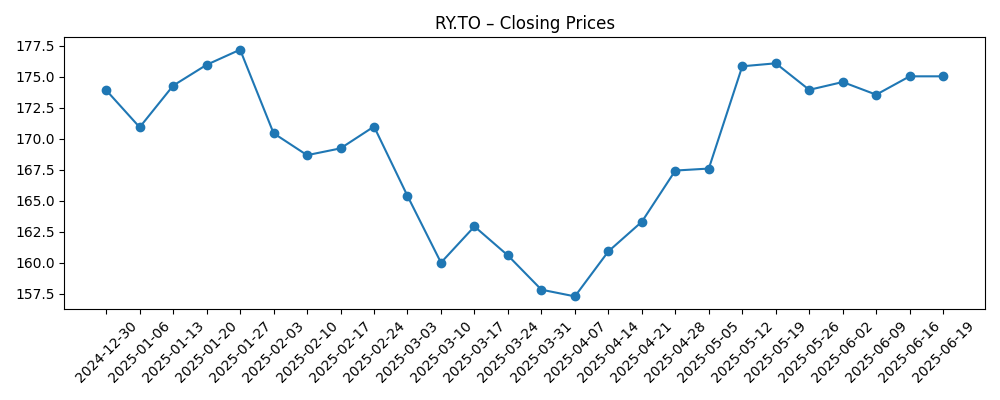

Share price evolution – last 6 months

Notable headlines

- RBC and CIBC ramp up provisions for loan losses amid higher risks stemming from trade and policy uncertainty – Biztoc.com

- Royal Bank of Canada (RY) Returning Value by Repurchasing 35 Million Common Shares – Yahoo Entertainment

- RBC ties RTO to boosting culture; layoffs are imminent – Ragan.com

Opinion

Royal Bank of Canada is currently grappling with a fluctuating market landscape, where recent headlines indicate heightened concerns over loan loss provisions. This raises questions regarding the sustainability of profit margins in an unpredictable economic environment. RBC's decision to repurchase shares amidst such uncertainty could signal confidence in its underlying business strategy or an attempt to bolster share prices in the face of potential downturns. Analysts will be closely monitoring how these maneuvers affect overall market perceptions.

Moreover, the implication of potential layoffs within the organization could play a crucial role in RBC's operational efficiency moving forward. Balancing workforce dynamics while attempting to improve profitability will be key for management as they navigate both internal challenges and external pressures. The anticipated shifts in lender sentiment could further influence consumer confidence and behavior in the Canadian banking sector.

Investors are likely to weigh these developments heavily in their decision-making process given the current stock performance fluctuations. The share price has shown volatility, ranging from highs of $177.18 to recent drops below $160, leading to a mixed analyst outlook. Indications of stabilizing return strategies and maintaining stakeholder value might provide some reassurance to the market.

In the coming months, Royal Bank of Canada's ability to handle these challenges while returning value to its shareholders will be critical. As trade dynamics continue to evolve, stakeholders will be assessing how effectively RBC can adapt its strategies to maintain its competitive edge in the banking sector.

What could happen in three years? (horizon June 2025+3)

| Scenario | Description |

|---|---|

| Best | Strong economic recovery leads to increased profitability and share price growth. |

| Base | Stability in loan loss provisions; moderate growth and steady dividends. |

| Worse | Economic downturn leads to rising defaults and decreased share price. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Economic conditions and interest rate changes

- Loan default rates and provisions

- Regulatory changes impacting the banking sector

- Competitive landscape among Canadian banks

- Share buybacks and dividend policies

Conclusion

In summary, Royal Bank of Canada stands at a critical juncture as it maneuvers through economic uncertainties and seeks to strengthen its market position amidst challenging conditions. The recent decisions to repurchase shares and adjust provisions reflect a proactive approach toward sustaining profitability and maintaining investor confidence. Moving forward, the trajectory of RBC will be heavily influenced by external economic factors and internal strategic decisions. Stakeholders will need to remain vigilant about the evolving landscape and the bank’s responses to both opportunities and challenges.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.