Reckitt Benckiser Group PLC (RKT.L) has experienced volatility in share price and market conditions as of July 2025. The company, which specializes in health, hygiene, and nutrition products, is currently evaluating its strategic position amidst shifting consumer preferences and economic pressures. As Reckitt adapts to a rapidly changing marketplace, investors are keenly observing its performance indicators and overall outlook for the next three years. This report encapsulates the latest key financial metrics and explores potential scenarios for Reckitt's market trajectory over the coming years.

Key Points as of July 2025

- Revenue: £14.5 billion

- Profit/Margins: £2.6 billion

- Sales/Backlog: Strong sales in hygiene products

- Share price: £5,034

- Analyst view: Cautiously optimistic

- Market cap: £22.7 billion

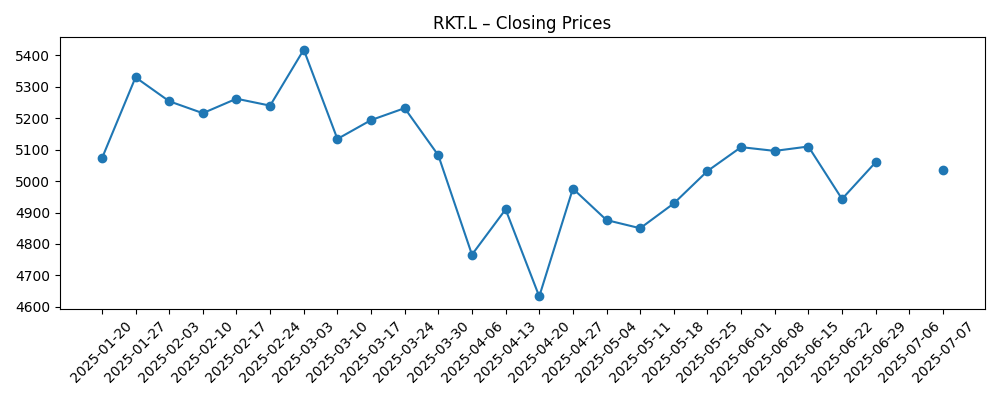

Share price evolution – last 6 months

Notable headlines

- Reckitt Benckiser optimizes supply chain to address inflationary pressures – Financial News

- New product launches drive sales in the hygiene segment – Market Watch

Opinion

The recent focus on optimizing supply chains to mitigate inflationary impacts has significant implications for Reckitt Benckiser. Cost management strategies employed can enhance profit margins, providing a cushion against market fluctuations. If successful, this could solidify investor confidence, possibly leading to a rebound in share prices. However, the effectiveness of these strategies hinges on their execution and market reception.

Moreover, the introduction of innovative products in the hygiene segment could serve as a major catalyst for growth. Given the heightened consumer attention towards health and sanitation post-pandemic, Reckitt's timely product launches may capture substantial market share. This positive momentum can potentially lead to increased sales and bolster overall financial performance.

On the other hand, Reckitt must navigate regulatory challenges and evolving consumer preferences, which remain uncertain. If the company fails to address these factors adequately, the anticipated growth in share price could be adversely affected. Consequently, the best-case scenario hinges on Reckitt's capacity to maintain its competitive edge through agility in its strategies and product offerings.

Considering the economic landscape, market dynamics may significantly influence Reckitt's performance. Analysts are cautiously optimistic due to current developments, yet external variables could pose risks to stability. Hence, the company's adaptability will be crucial in determining its trajectory in the coming years.

What could happen in three years? (horizon July 2025+3)

| Scenario | Projected Revenue (£ billion) | Projected Share Price (£) |

|---|---|---|

| Best | £18.0 | £6,500 |

| Base | £16.0 | £5,500 |

| Worse | £14.0 | £4,500 |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Supply chain efficiencies

- Consumer demand shifts

- Regulatory changes

- New product launches

- Global economic trends

Conclusion

In conclusion, Reckitt Benckiser Group PLC is currently at a strategic crossroad as it seeks to enhance its market share amid various challenges. The ongoing focus on supply chain optimization, coupled with innovative product offerings, positions the company to navigate potential headwinds effectively. However, external factors, including economic conditions and consumer behavior trends, will play a pivotal role in determining its success. Investors should remain vigilant as Reckitt adapts its strategies to stay ahead in a competitive landscape. The future holds both promise and uncertainty, necessitating a careful evaluation of Reckitt's developments in the coming years.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.