NVIDIA enters August 2025 with record scale and profitability. Over the last twelve months, revenue reached $165.22B and net income $86.6B, supported by a 60.84% operating margin and 52.41% profit margin. Quarterly revenue and earnings growth remain brisk at 55.60% and 59.20% year over year, while cash of $56.79B and a 4.21 current ratio underpin flexibility. Shares have been volatile but strong, climbing 61.28% over 52 weeks, within a range of $86.62–$184.48, and recently closing near $174.18. Management projects $54B in Q3 revenue despite H2O chip export restrictions to China, and analysts such as Oppenheimer maintain an Outperform view amid accelerating hyperscaler capex. This three‑year outlook assesses how AI demand, product cadence, supply constraints, and policy risks could shape NVIDIA’s fundamentals and share price through August 2028.

Key Points as of August 2025

- Revenue – Trailing 12‑month revenue stands at $165.22B; quarterly revenue growth (yoy) is 55.60%. Management projects $54B for Q3 (per company guidance reported in headlines).

- Profit/Margins – Profit margin 52.41%; operating margin 60.84%; gross profit $115.4B; EBITDA $98.28B; ROE 109.42%; ROA 53.09%.

- Cash & Balance Sheet – Total cash $56.79B vs. total debt $10.6B; current ratio 4.21; operating cash flow $77.04B; levered free cash flow $52.44B; dividend yield 0.02% (payout ratio 1.14%); last split 10:1 on 6/10/2024.

- Sales/Backlog – AI accelerator demand remains elevated; hyperscaler capex is accelerating (Oppenheimer). Export restrictions on H2O chips to China could shift regional mix.

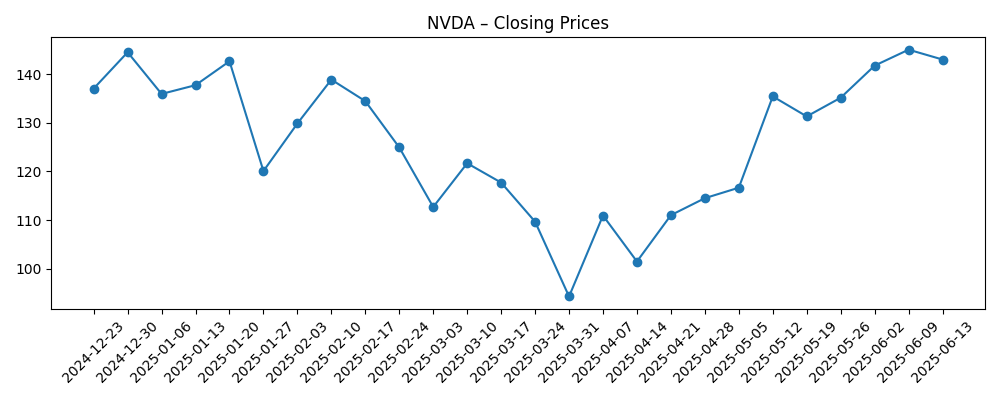

- Share price – 52‑week range $86.62–$184.48; 50‑day MA $170.52, 200‑day MA $138.75; beta 2.14. Weekly closes show a trough near $94.31 (week of 2025‑03‑31) and recovery to $182.70 (week of 2025‑08‑04).

- Analyst/Ownership – Oppenheimer maintains Outperform; institutions hold 68.97%. Short interest is modest at 0.88% of float (short ratio 1.3).

- Market cap – Approximately $4.24 trillion, based on ~24.35B shares outstanding and a recent close near $174.18.

- Trading/liquidity – Average 3‑month volume ~175.02M (10‑day ~193.69M); float 23.32B; insiders hold 4.33%.

Share price evolution – last 12 months

Notable headlines

- Oppenheimer Maintains Outperform on Nvidia (NVDA) as Hyperscaler Capex Accelerates

- NVIDIA (NVDA) Projects $54 Billion Q3 Revenue Despite H2O Chip Export Restrictions to China

- Nvidia Stock Is Falling Hard for No Real Reason. Should You Buy the Dip in NVDA Here?

- ‘It’s Not Going to Slow Down’: The Tech Stock Everyone Is Watching This Week

- Did Nvidia Just Pop an AI Bubble? Here’s What the Market Says

- Nvidia Warning: With Reports of Rubin Delays, How Should You Play NVDA Stock Here?

- J.W. Cole Advisors Boosts NVIDIA Corporation (NVDA) Stake by 73%

Opinion

NVIDIA’s near‑term setup is defined by powerful demand signals and disciplined execution. The company’s projection of $54B for Q3, despite export restrictions on H2O chips to China, underscores the breadth of AI accelerator uptake across hyperscalers and enterprises. Ongoing commentary that hyperscaler capex is accelerating aligns with reported backlog‑like order visibility, even if no formal backlog figure is disclosed. The key question for a three‑year outlook is not whether demand exists, but how elastic it is to pricing, power constraints, and customer diversification. If software stacks and networking remain tightly integrated with NVIDIA’s silicon, switching costs stay high, sustaining pricing and margins. That said, the rate of growth is likely to normalize from today’s exceptional comps as capacity expands and customers scrutinize total cost of ownership.

Execution on the product roadmap is a second critical pillar. Reports discussing potential Rubin delays highlight schedule risk in an industry where node transitions, advanced packaging, and platform software must align. Sustained leadership requires timely, generational performance gains and availability at scale; any slippage opens windows for rivals or custom silicon. Over the next three years, we expect competitive intensity to rise, including from internal accelerators and alternative architectures. NVIDIA’s advantage lies in its end‑to‑end platform—GPUs, networking, systems, and CUDA‑level software—which historically amplifies each hardware cycle. Maintaining that flywheel will likely matter more than any single chip’s spec sheet, particularly as buyers evaluate vendor lock‑in versus ecosystem maturity.

Policy and supply are the wild cards. Export controls aimed at China have already forced product segmentation; the guidance implies demand outside restricted markets is sufficient to absorb capacity, but the mix may evolve. Additional controls or licensing requirements could shift revenue timing and gross margin mix. On supply, the industry remains constrained by advanced node capacity and high‑end packaging. While NVIDIA’s scale and prepayments historically secured priority, the balance of supply versus demand will shape pricing power and delivery intervals through 2028. Investors should monitor lead times, customer inventory behavior, and node/packaging roadmaps as coincident indicators of how quickly the ecosystem can translate orders into recognized revenue.

Finally, the equity story is married to sentiment and volatility. The stock’s 52‑week change of 61.28% and sharp swings—from a spring trough to summer highs—show how macro risk, headline sensitivity, and positioning drive multiple compression/expansion. With margins already exceptional and the dividend minimal, future returns hinge on sustaining revenue growth, platform breadth, and capital efficiency rather than financial engineering. A durable case for outperformance through 2028 rests on continued hyperscaler and enterprise adoption, software lock‑in, and execution on successive product cycles. Conversely, a moderation in AI spending, intensifying competition, or extended regulatory drag could translate into slower top‑line growth and multiple contraction, even if fundamentals remain solid.

What could happen in three years? (horizon August 2025+3)

| Scenario | Narrative | Indicators to watch |

|---|---|---|

| Best | AI accelerator demand stays robust as hyperscaler and enterprise adoption broadens; product cadence remains on track with strong platform pull‑through in networking and software. Margins remain elevated, and policy headwinds are manageable. | Node and packaging ramps; deployment of new GPU platforms; sustained customer spend intentions; software adoption and recurring revenue mix. |

| Base | Growth normalizes from exceptional levels as capacity expands and competition rises. Pricing stays rational; margins ease but remain strong. Regional mix shifts due to export controls but is offset by ex‑China demand. | Order lead times; pricing discipline; utilization at major customers; inventory trends; regulatory updates. |

| Worse | Roadmap slips and tighter export controls intersect with a capex pause. Competitive alternatives gain share, pressuring pricing and gross margins; deliveries lag due to supply bottlenecks. | Project delays; hyperscaler budget revisions; stricter policy actions; evidence of accelerated customer diversification away from the platform. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Hyperscaler and enterprise AI capex cycles, including deployment velocity of new workloads.

- Roadmap execution (e.g., cadence of next‑gen platforms) and strength of the CUDA and networking ecosystems.

- Export controls and geopolitical policy affecting product availability and regional mix.

- Supply chain capacity and costs at advanced nodes and high‑end packaging, influencing lead times and pricing power.

- Competitive responses (custom accelerators, CPU/GPU alternatives) and any resulting pricing pressure.

- Valuation and market sentiment amid high beta and heavy trading volumes.

Conclusion

NVIDIA’s three‑year outlook pivots on whether its platform advantage can translate today’s extraordinary demand into durable, compounding cash flows. The company enters this period with exceptional profitability, a strong balance sheet, and a product‑plus‑software stack that raises switching costs. Guidance pointing to $54B in Q3, alongside accelerating hyperscaler capex, suggests demand depth extends beyond specific geographies impacted by export controls. Still, the slope of growth should moderate as supply expands and customers optimize total cost of ownership, making roadmap execution and software differentiation critical to sustain margins. Policy and supply remain the key exogenous variables to track, while competition will likely intensify. Given high beta and a substantial 52‑week advance, investors should expect continued volatility. Over a horizon to August 2028, steady execution and ecosystem breadth argue for resilience; misses on product timing or policy shocks would be the main threats to the bull case.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.